Which States Have The Lowest Property Taxes Hubpages

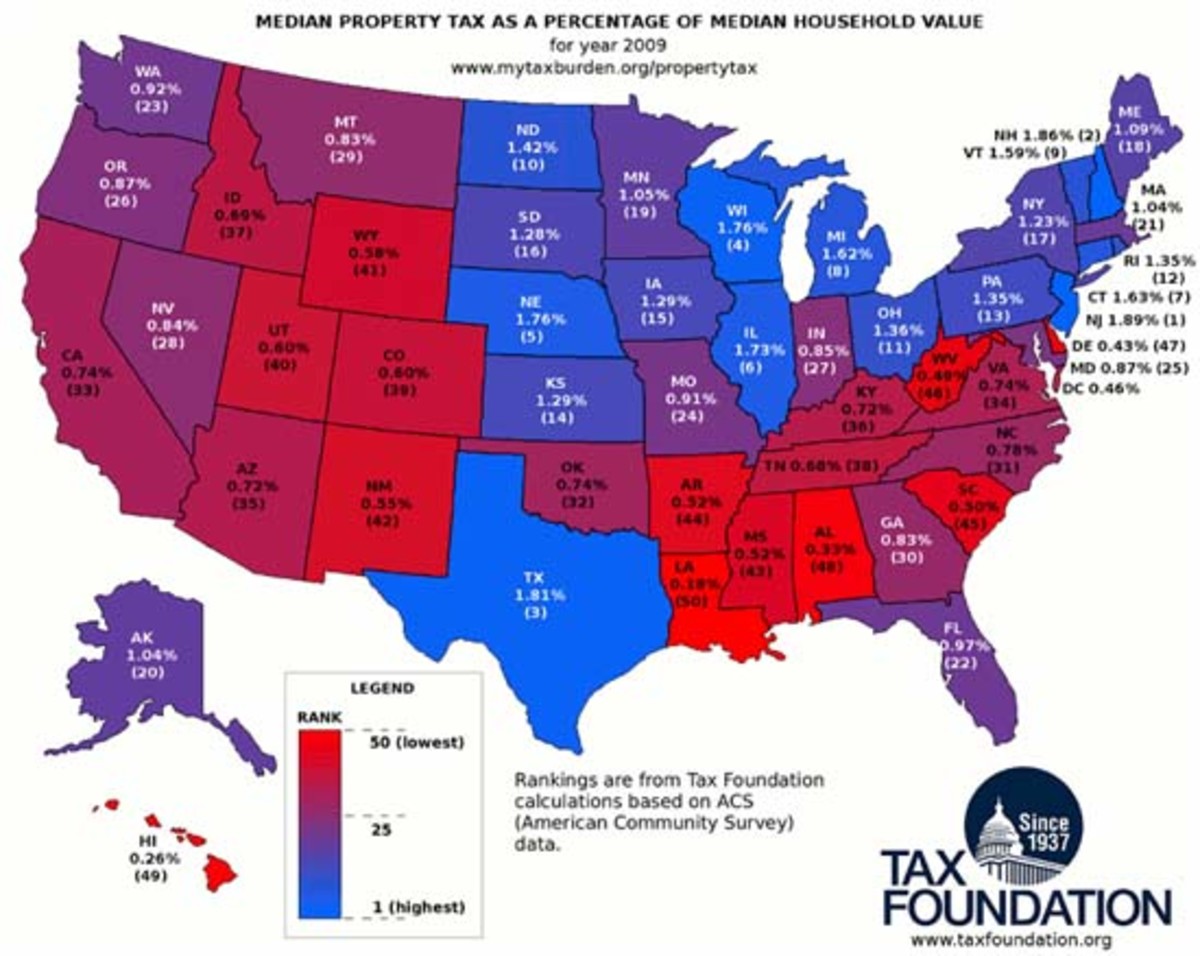

Which States Have The Lowest Property Taxes Hubpages These taxes are local governments’ primary tool for funding a variety of services associated with residency and property ownership. in fiscal 2021, they represented 72.5% of local tax. Hawaii has the lowest property tax rate in the u.s. at 0.29%. the aloha state has a home median value of $662,100. for a comparison with new jersey, the state with the highest effective property tax rate in the nation at 2.47%, hawaii’s home median value is just over twice the home median value of the garden state ($355,700).

Which States Have The Lowest Property Taxes Hubpages The three counties in new york with the highest effective property tax rates are allegany county (3.23%), monroe county (2.99%), and orleans county (2.94%). the new york counties with the lowest. Median property tax rate: 0.74%. median property tax total: $796. median home value: $107,700. out of the 10 states with the lowest median property tax payment, oklahoma has the highest tax rate at 0.74%. however, the low median property value for the state, $107,700, helps keep the median property tax payment at $796. Here is a list of states in order of lowest ranking property tax to highest: rank. state. effective tax rate. median home value or list price. average annual property tax. 1. hawaii. 0.32%. For a long time now, hawaii has consistently ranked at or near no. 1 as the state with the lowest property tax rate. whether using its median property tax rate — 0.286% — or its mean (average.

Comments are closed.