What Is The Vix Volatility Index And How Does It Work Money

What Is The Vix Volatility Index And How Does It Work Money The cboe volatility index, or vix, is a real time market index representing the market’s expectations for volatility over the coming 30 days. investors use the vix to measure the level of risk. The vix index is specifically measuring expected volatility for another index, the s&p 500. true to its name, the s&p 500 index is composed of 500 of the largest publicly traded companies in the u.s.

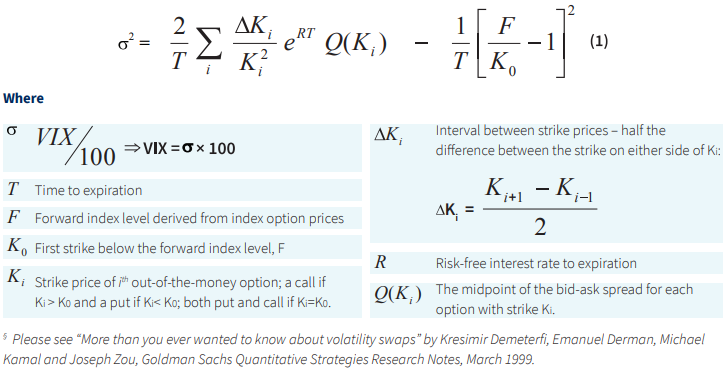

What Is The Vix Volatility Index And How Does It Work Money What is the vix? the vix, formally known as the chicago board options exchange (cboe) volatility index, measures how much volatility professional investors think the s&p 500 index will experience. The vix is expressed as a percentage and represents the expected annualized volatility over the next 30 days. the vix is calculated based on the prices of options on the s&p 500 index. it uses a. The vix index is generated from the implied volatilities extracted from prices of index options on the s&p 500, and is intended to reflect the market's expectation of 30 day volatility. keeping an. The vix is calculated using a "formula to derive expected volatility by averaging the weighted prices of out of the money puts and calls.” using options that expire in 16 and 44 days.

What Is The Vix Index Forex Glossary The vix index is generated from the implied volatilities extracted from prices of index options on the s&p 500, and is intended to reflect the market's expectation of 30 day volatility. keeping an. The vix is calculated using a "formula to derive expected volatility by averaging the weighted prices of out of the money puts and calls.” using options that expire in 16 and 44 days. The vix index is a real time calculation designed to measure expected volatility in the u.s. stock market. one of the most recognized barometers of fluctuations in financial markets, the vix measures how much volatility investing experts expect to see in the market over the next 30 days. this measurement reflects real time quotes of s&p 500. How does the cboe volatility index (vix) work? the cboe volatility index is used to track the expected volatility of the stock market based on changes in the price of s&p 500 options. using a complicated formula, the vix rises when stock market volatility is expected to increase, and drops when volatility is expected to drop.

What Is India Vix Volatility Index How Vix Works Yadnya The vix index is a real time calculation designed to measure expected volatility in the u.s. stock market. one of the most recognized barometers of fluctuations in financial markets, the vix measures how much volatility investing experts expect to see in the market over the next 30 days. this measurement reflects real time quotes of s&p 500. How does the cboe volatility index (vix) work? the cboe volatility index is used to track the expected volatility of the stock market based on changes in the price of s&p 500 options. using a complicated formula, the vix rises when stock market volatility is expected to increase, and drops when volatility is expected to drop.

Comments are closed.