What Is The Difference Between A Bank And Credit Union Explained

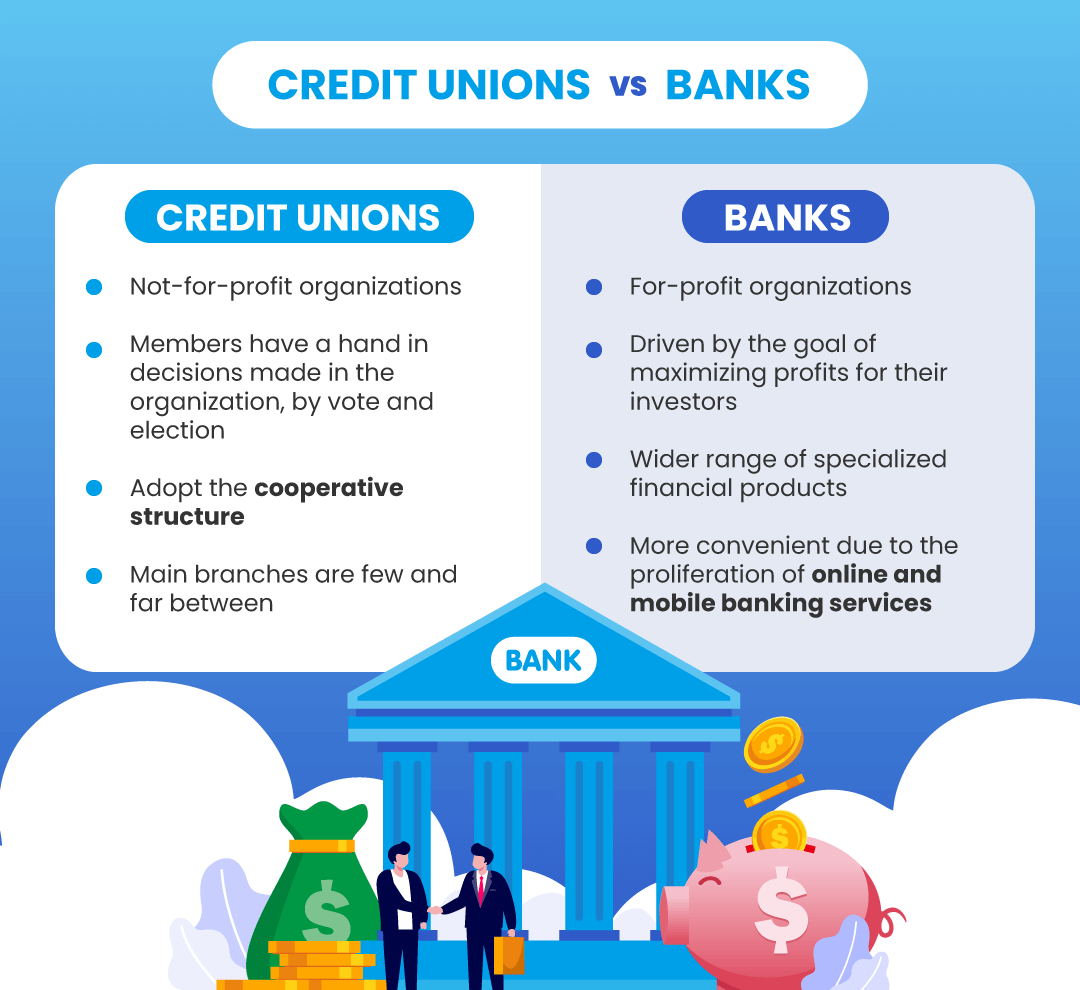

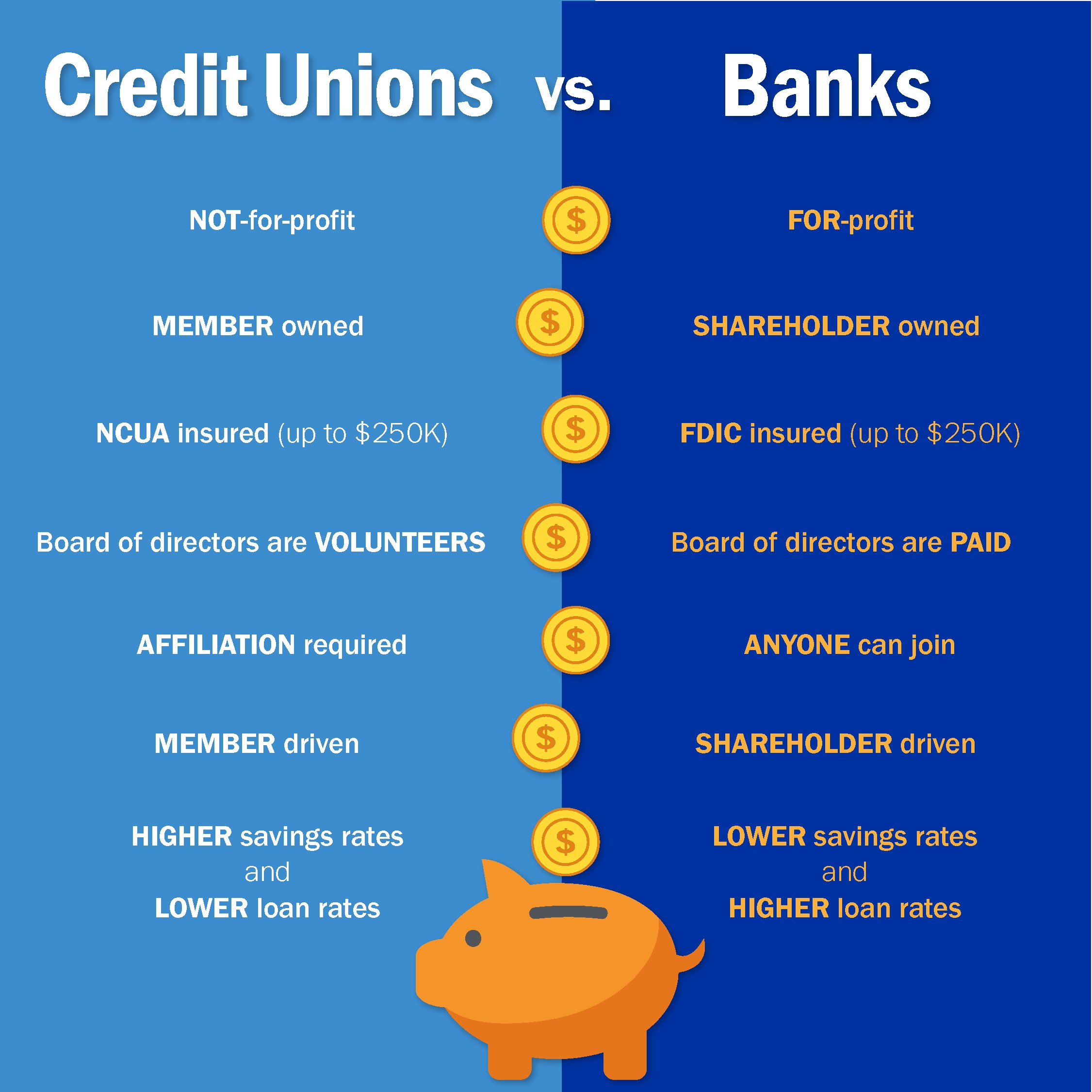

Credit Union Vs Bank What Are The Differences Azeus Convene Better rates on savings accounts and loans: credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want. higher interest rates on bank. The main difference between a credit union and a bank is that credit unions are not for profit, whereas banks are for profit enterprises. knowing about the other differences will affect which home.

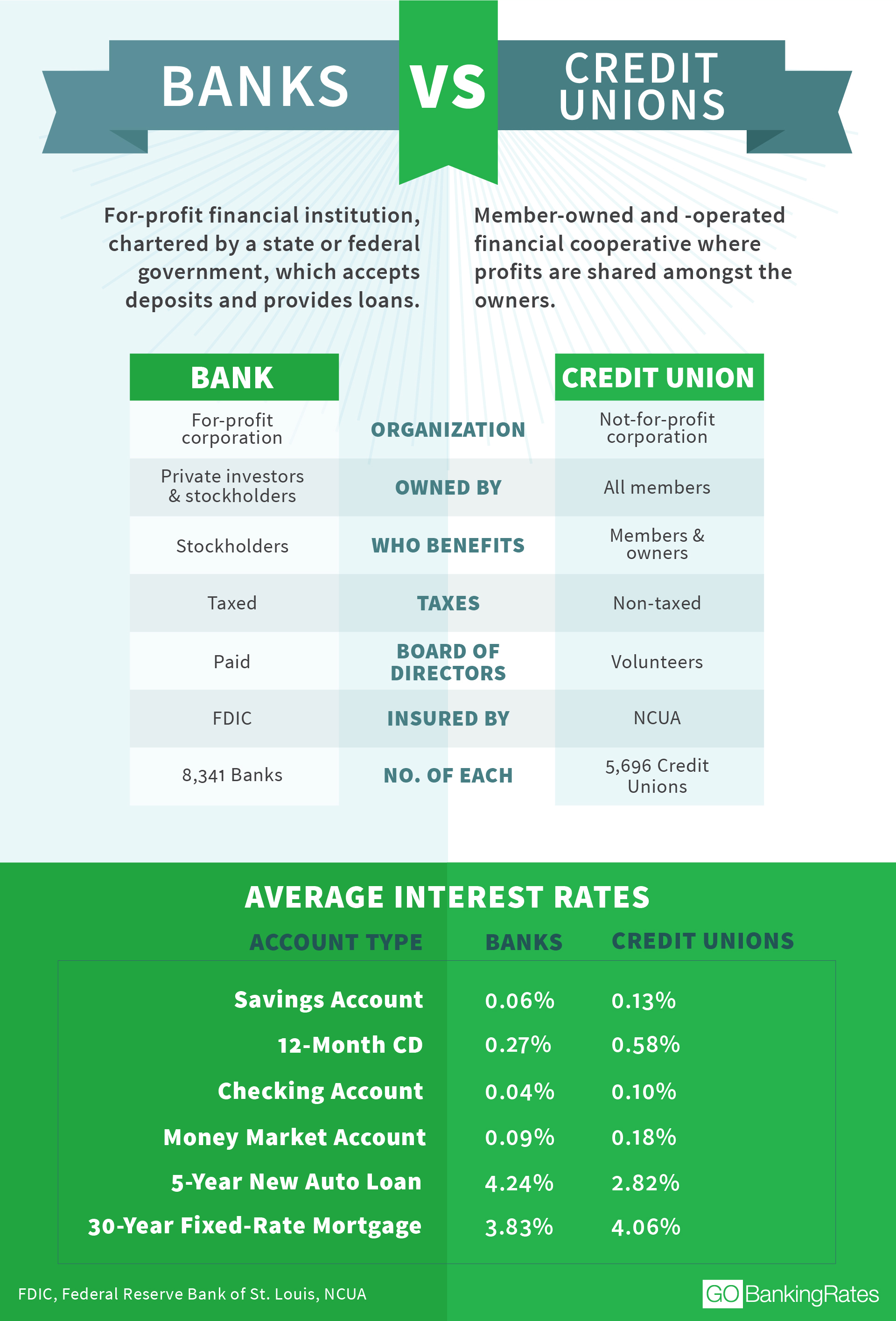

Credit Unions And Banks The Differences According to ncua data as of march 31, 2023, the national average rate for five year certificates of deposit (cds) offered by credit unions was 2.66%, compared to an average rate of 1.83% offered. Average credit union vs. bank fees; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151: $1,361. Bank vs. credit union ownership . the key difference between banks and credit unions is in ownership. credit unions are not for profit organizations. they're owned and controlled by their customers, known as "members." the primary goal of credit unions is to promote the financial welfare of their members and to return profits to them. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Credit Unions Vs Banks What S The Difference Bank vs. credit union ownership . the key difference between banks and credit unions is in ownership. credit unions are not for profit organizations. they're owned and controlled by their customers, known as "members." the primary goal of credit unions is to promote the financial welfare of their members and to return profits to them. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022. The safety of your money is critical when deciding between a credit union and a bank. years ago, many people believed banks were safer than credit unions. thankfully, there's not much difference between a credit union and a bank when it comes to security. both institutions are likely to offer industry standard encrypted security measures for. What is a. credit union? a credit union is a not for profit financial institution that accepts deposits, make loans, and provides a wide array of other financial services and products. deposits are insured by the national credit union share insurance fund, which is managed by the national credit union administration, commonly referred to as ncua.

What S The Difference Between Banks And Credit Unions Gobankingrates The safety of your money is critical when deciding between a credit union and a bank. years ago, many people believed banks were safer than credit unions. thankfully, there's not much difference between a credit union and a bank when it comes to security. both institutions are likely to offer industry standard encrypted security measures for. What is a. credit union? a credit union is a not for profit financial institution that accepts deposits, make loans, and provides a wide array of other financial services and products. deposits are insured by the national credit union share insurance fund, which is managed by the national credit union administration, commonly referred to as ncua.

Comments are closed.