What Credit Score Does Santander Use Creditguide360 Com

What Does My Credit Score Mean Santander Bank It can take up to 30 days for the reporting agencies to update a credit report. the contact information for each credit bureau agency is as follows: experian. (888) 397 3742. experian.com. transunion. (800) 916 8800. transunion.com. equifax. What credit score does synchrony use? in this insightful video, we delve into the world of credit scores and how they impact your financial journey. discover.

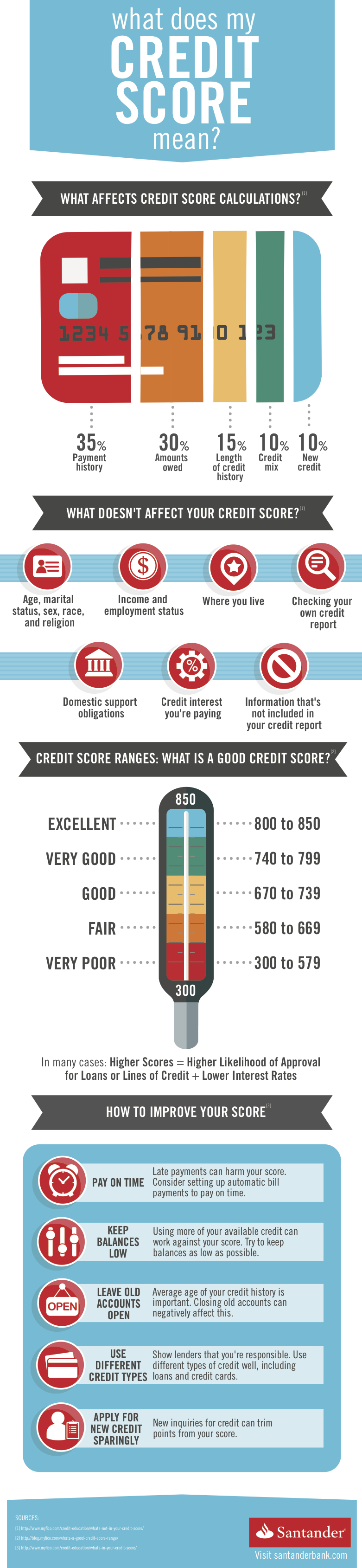

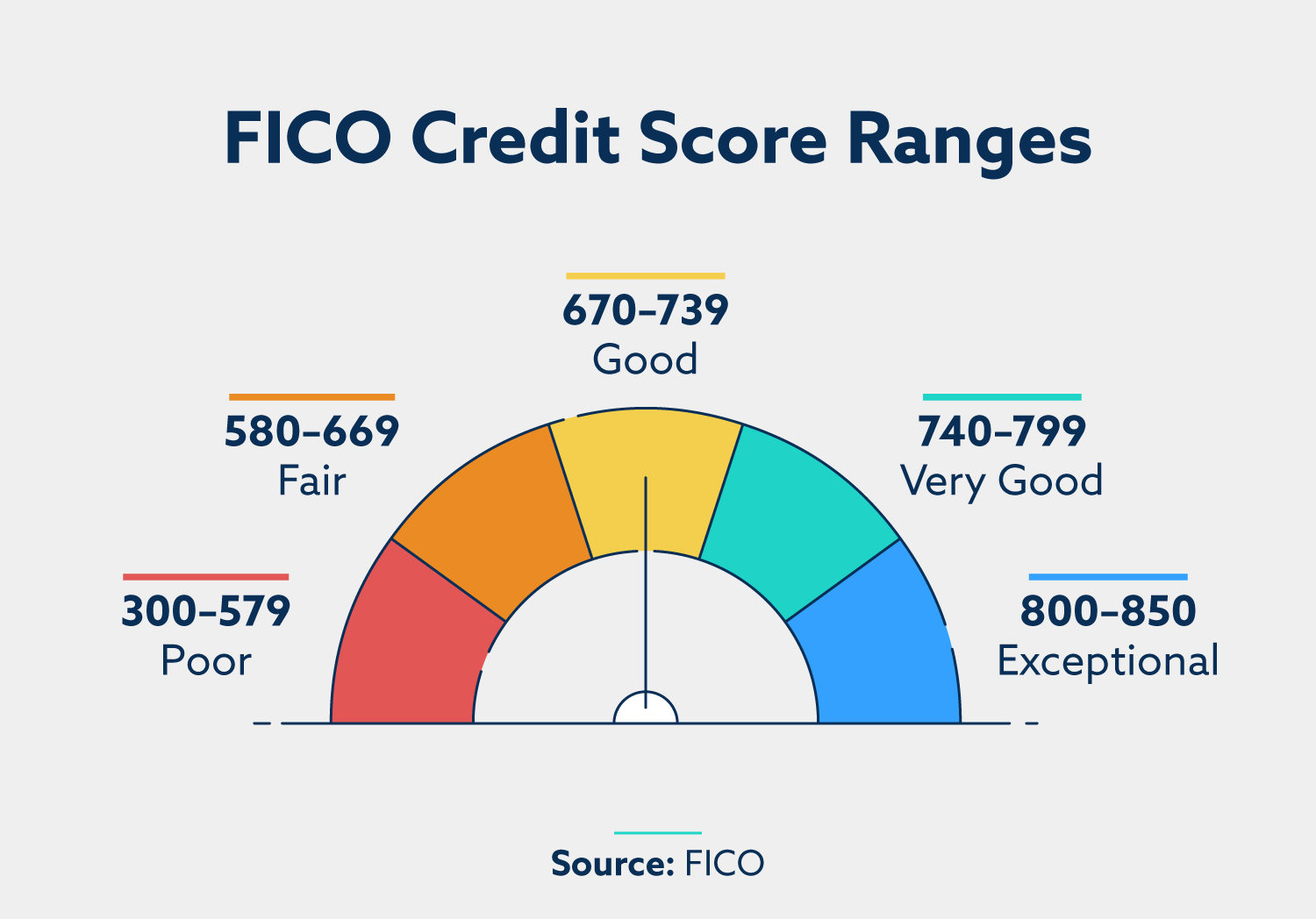

Credit Score Ranges What They Mean And Why They Matter Everyone is entitled to one free credit report per year from each of the three major credit bureaus (equifax, experian and transunion).*. this said, the term “regularly” means different things to different people. for many, requesting one, or all three, of their free, annual reports is enough. others choose to do it more often. It should be no surprise. what you need to know about credit when financing a vehicle is that lenders generally provide more financing to borrowers with higher credit scores. almost half the money loaned goes to so called super prime borrowers – those with credit scores of 720 or above – based on data from the consumer financial protection. Fair credit. bad credit. no credit. you need a credit score of at least 750 for a santander bank credit card. that means you must have good credit to be considered eligible, but other financial factors (like your current income or existing debts) will also be taken into consideration when the issuer looks at your application. Your credit score is a three digit number, ranging from 300 to 850, that reflects how responsible you are when it comes to managing credit and debt. when lenders consider your application for new credit, whether for a car loan or a mortgage, your credit score is one factor that affects approval decisions. it may also influence the interest.

Credit Score Rating Scale Chart Fair credit. bad credit. no credit. you need a credit score of at least 750 for a santander bank credit card. that means you must have good credit to be considered eligible, but other financial factors (like your current income or existing debts) will also be taken into consideration when the issuer looks at your application. Your credit score is a three digit number, ranging from 300 to 850, that reflects how responsible you are when it comes to managing credit and debt. when lenders consider your application for new credit, whether for a car loan or a mortgage, your credit score is one factor that affects approval decisions. it may also influence the interest. If you have all your information ready to go, you can complete our online personal loan application in approximately 10 15 minutes. if you would feel more comfortable having someone assist you with the application, you can also make an appointment to apply at your local branch, or call a specialist at 833 san loan, monday to friday between 8:00. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

What Does My Credit Score Mean Santander Bank If you have all your information ready to go, you can complete our online personal loan application in approximately 10 15 minutes. if you would feel more comfortable having someone assist you with the application, you can also make an appointment to apply at your local branch, or call a specialist at 833 san loan, monday to friday between 8:00. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

Comments are closed.