What Constitutes A Consumer Reporting Agency Under The Fcra

Know Your Rights Under The Fair Credit Reporting Act Credit Recovery A summary of your rights under the fair credit reporting act. the federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell. Lations fcrafair credit reporting act1the fair credit reporting act (fc. a)2 became effective on april 25, 1971. the fcra is a part of a group of acts contained in the federal consumer credit protection act3 such as the truth in lending act and. the fair debt collection practices act.congress substantively amended the fcra upon the passage of.

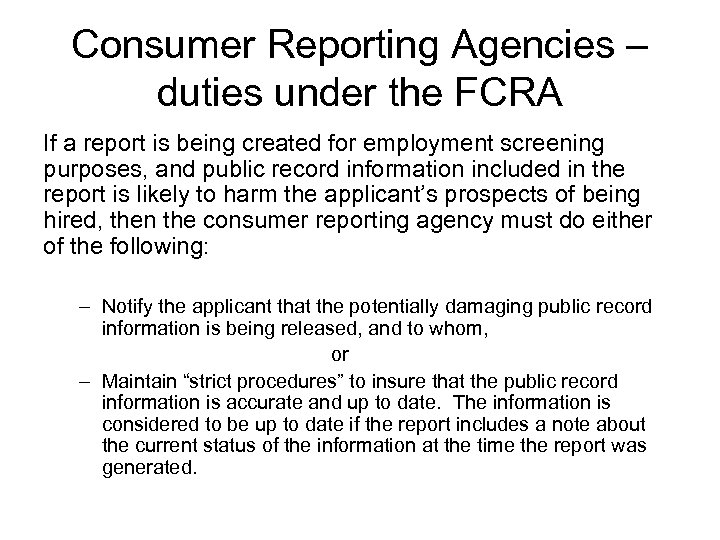

Employment Screening Cori And Private Background Checks Presented For the purposes of the fair credit reporting act (fcra), a “credit reporting agency” is any legal entity—such as a company or a person—who reports or collects your credit information. this can include: credit bureaus, like equifax, experian, and transunion. the person or company that furnishes credit information for employment. Consumer financial protection bureau, 1700 g street n.w., washington, dc 20552. a summary of your rights under the fair credit reporting act. the federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of. Under the federal fair credit reporting act (fcra), all consumer reporting companies are required to provide you a copy of the information in your report if you request it. you are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—equifax, transunion, and experian. The fair credit reporting act (fcra) (15 u.s.c. §§ 1681 and following) is a federal law that governs how credit reporting agencies handle your credit information. this law protects the integrity and privacy of your credit data. the fcra requires these agencies and the entities that report your credit data to them and others to ensure that.

What Is The Fcra How Does It Protect Consumers Under the federal fair credit reporting act (fcra), all consumer reporting companies are required to provide you a copy of the information in your report if you request it. you are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies—equifax, transunion, and experian. The fair credit reporting act (fcra) (15 u.s.c. §§ 1681 and following) is a federal law that governs how credit reporting agencies handle your credit information. this law protects the integrity and privacy of your credit data. the fcra requires these agencies and the entities that report your credit data to them and others to ensure that. Cfpb bulletin 2014 01: the fcra’s requirement that furnishers conduct investigations of disputed information. cfpb bulletin 2013 09: the fcra’s requirement to investigate disputes and review “all relevant” information provided by consumer reporting agencies about the dispute. cfpb bulletin 2012 09: the fcra’s “streamlined process. A summary of your rights under the fair credit reporting act. the fair credit reporting act (fcra) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. the law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your.

What Constitutes A Consumer Reporting Agency Under The Fcra Cfpb bulletin 2014 01: the fcra’s requirement that furnishers conduct investigations of disputed information. cfpb bulletin 2013 09: the fcra’s requirement to investigate disputes and review “all relevant” information provided by consumer reporting agencies about the dispute. cfpb bulletin 2012 09: the fcra’s “streamlined process. A summary of your rights under the fair credit reporting act. the fair credit reporting act (fcra) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. the law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your.

Understanding The Fair Credit Reporting Act Fintopi

Comments are closed.