W4 Tax Form Irs W 4 Tax Form How To Fill Out W4ођ

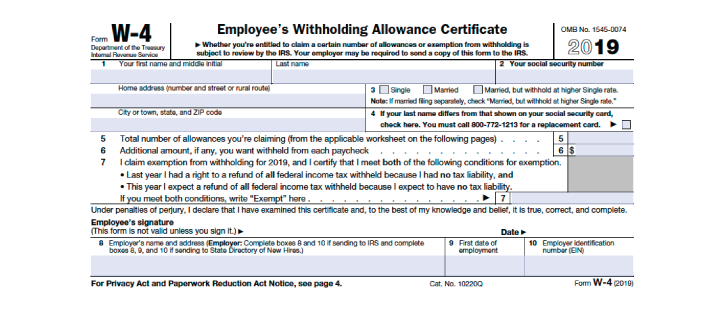

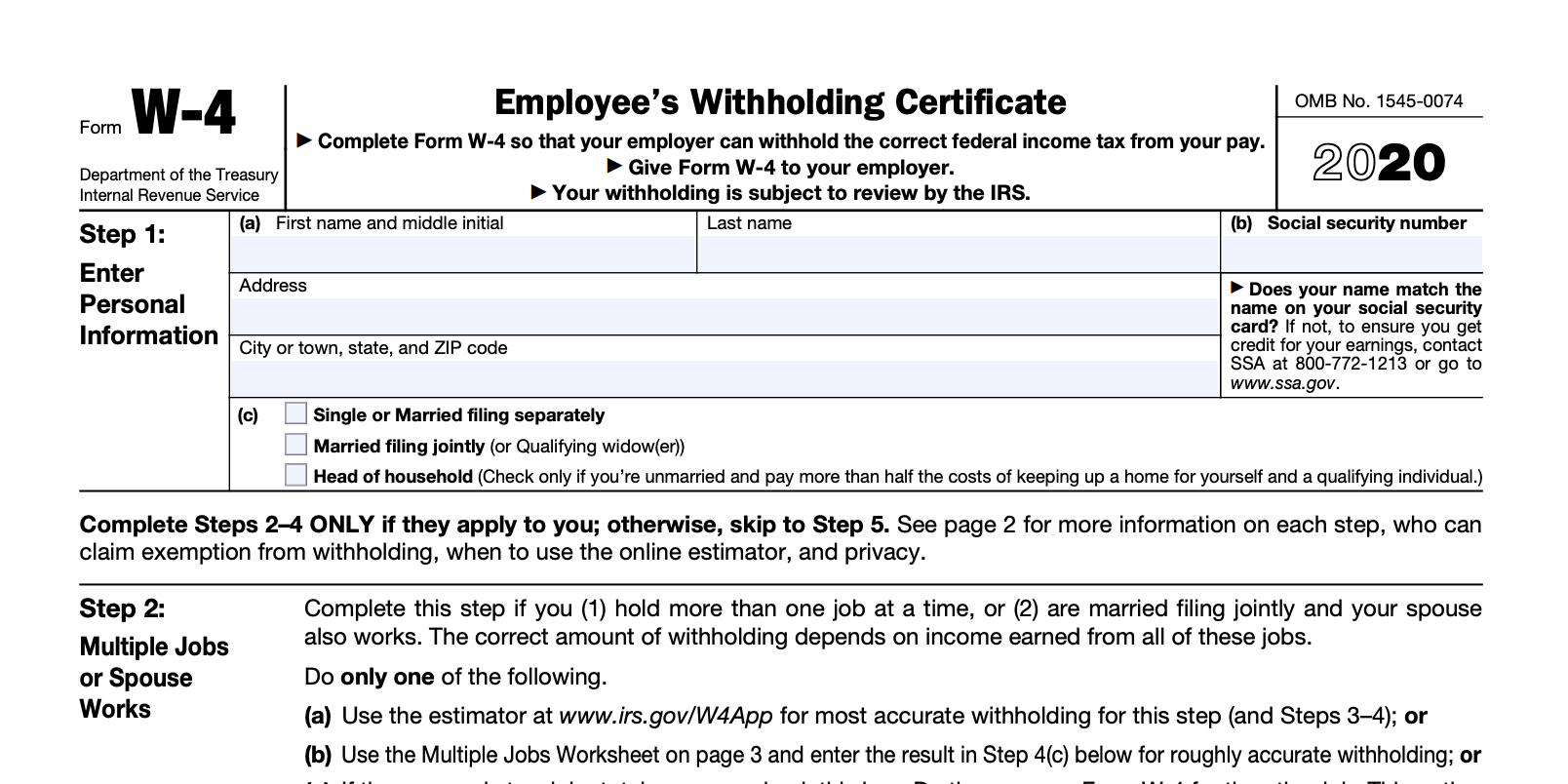

W 4 Form Irs How To Fill It Out Definitive Guide 2018 Smartasset 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay.

How To Do Deductions On W4 A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount.

How To Fill Out A W 4 Form For 2021 Millennial Money How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount. Complete steps 3–4(b) on form w 4 for only one of these jobs. leave those steps blank for the other jobs. (your withholding will be most accurate if you complete steps 3–4(b) on the form w 4 for the highest paying job.) step 3: claim dependents . if your total income will be $200,000 or less ($400,000 or less if married filing jointly):. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents.

Free Printable W 4 Forms 2022 W4 Form Complete steps 3–4(b) on form w 4 for only one of these jobs. leave those steps blank for the other jobs. (your withholding will be most accurate if you complete steps 3–4(b) on the form w 4 for the highest paying job.) step 3: claim dependents . if your total income will be $200,000 or less ($400,000 or less if married filing jointly):. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents.

Comments are closed.