W 4 Form Instructions Tax Withholding Form

W 4 Form Irs How To Fill It Out Definitive Guide 2018 Smartasset 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay.

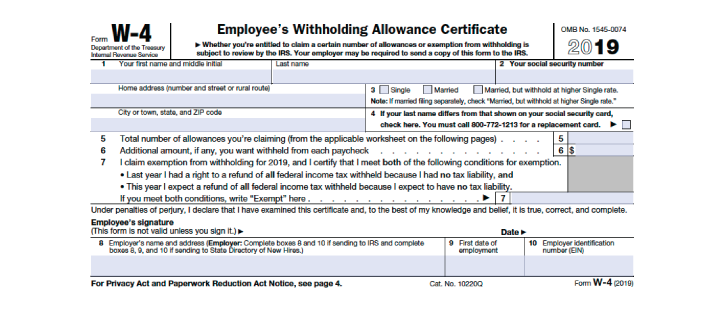

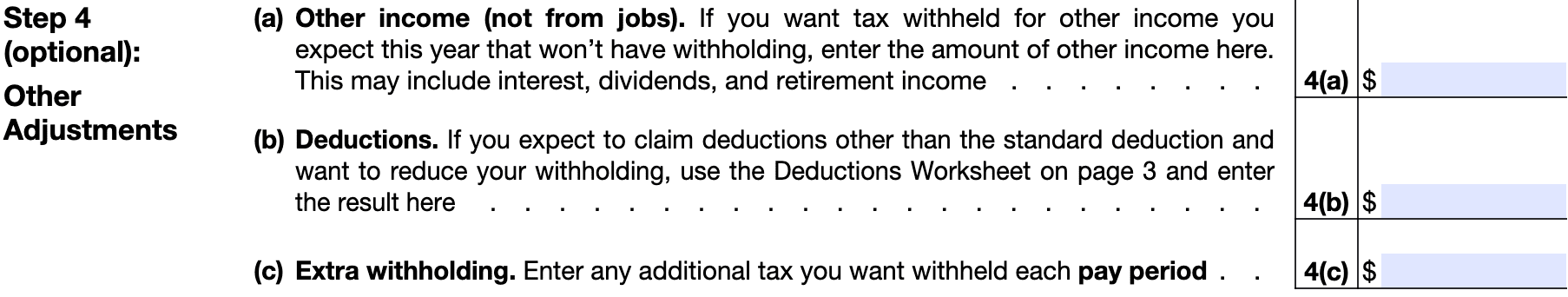

W 4 Form Instructions Tax Withholding Form A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Learn about the changes made to the w 4, including whether you can still claim 1 or 0. the balance is part of the dotdash meredith publishing family. the irs significantly updated the w 4 form to make it easier to fill out and give you more control over your withholding. learn how to complete it. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount.

Georgia Withholding Tax Forms 2022 Withholdingform Learn about the changes made to the w 4, including whether you can still claim 1 or 0. the balance is part of the dotdash meredith publishing family. the irs significantly updated the w 4 form to make it easier to fill out and give you more control over your withholding. learn how to complete it. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount. Taxpayers complete irs form w 4p, withholding certificate for periodic pension or annuity payments to give their payer instructions on tax withholding for regular pension or annuity payments. watch this brief educational video to learn more irs form w 4p. use irs form w 4p to withhold taxes from your pension or annuity. Employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. 2023. step 1: enter personal information. first name and middle initial. last name.

Comments are closed.