Usda Loans How To Get 100 Financing In Nc Sc

North Carolina Usda Loan Limits This program helps lenders work with low and moderate income households living in rural areas to make homeownership a reality. providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. the section 502 guaranteed loan program assists approved. To determine if a property is located in an eligible rural area, click on one of the usda loan program links above and then select the property eligibility program link. when you select a rural development program, you will be directed to the appropriate property eligibility screen for the rural development loan program you selected. to assess.

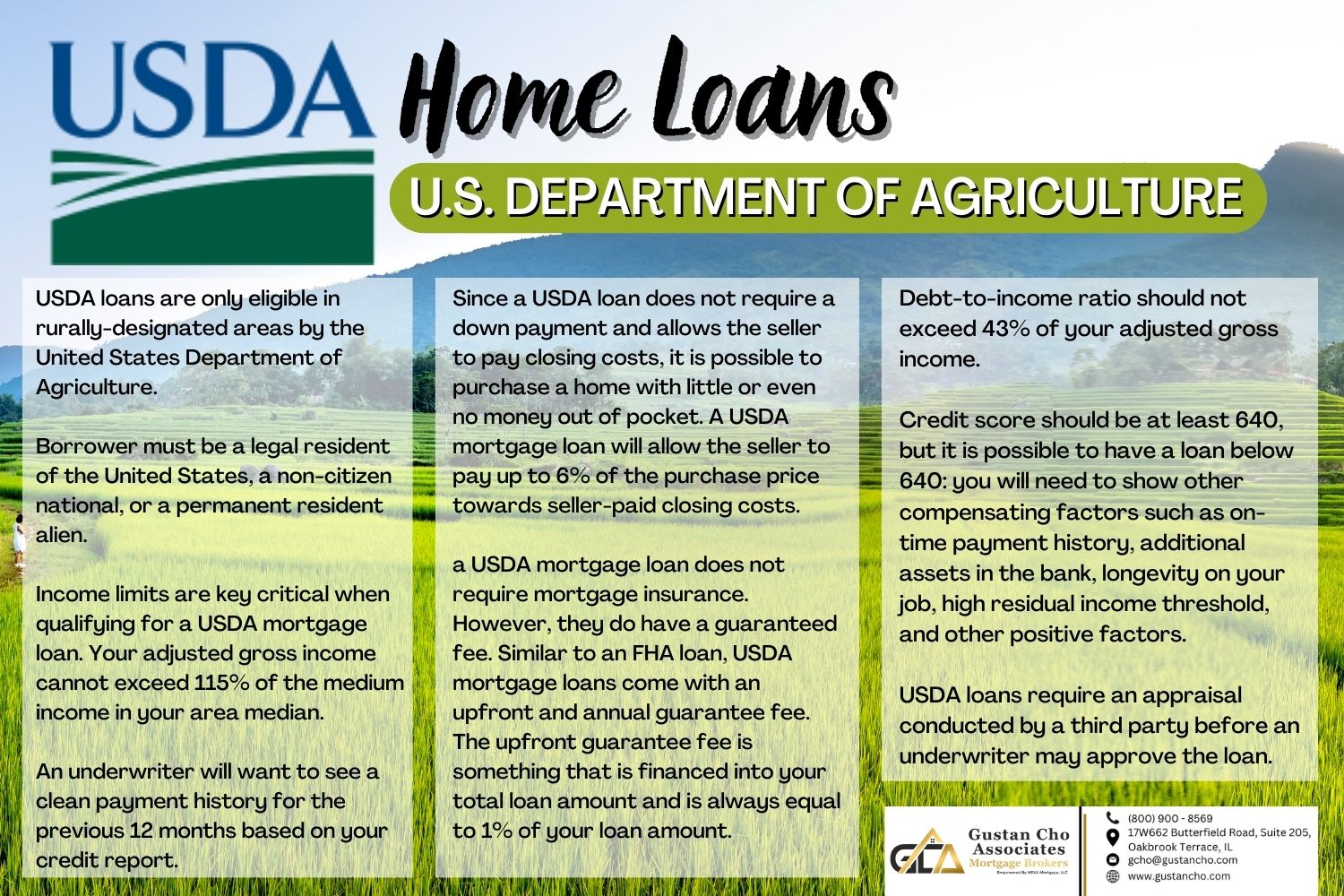

Usda Loans How To Get 100 Financing In Nc Sc Youtube In most counties in north carolina, the usda guaranteed income limits start at $112,450 for a household of 1–4 members in 2024. this income limit is even higher for larger families with 5 members in the household. charlotte and raleigh msa income limits are even greater. Effective september 1, 2024, the current interest rate for single family housing direct home loans is 4.75% for low income and very low income borrowers. fixed interest rate based on current market rates at loan approval or loan closing, whichever is lower. interest rate when modified by payment assistance, can be as low as 1%. In north carolina, there are a few basic requirements you must meet in order to be eligible for a usda loan. you must have u.s. citizenship or permanent residency. you must have a dependable income for a minimum of 24 months. you must be able to make a monthly payment — which includes principal, interest, insurance and taxes — that is 29. Loans are termed for 20 years. loan interest rate is fixed at 1%. full title service is required if the total outstanding balance on section 504 loans is greater than $25,000. grants have a lifetime limit of $10,000. grants must be repaid if the property is sold in less than 3 years.

Usda Home Loan Requirements In north carolina, there are a few basic requirements you must meet in order to be eligible for a usda loan. you must have u.s. citizenship or permanent residency. you must have a dependable income for a minimum of 24 months. you must be able to make a monthly payment — which includes principal, interest, insurance and taxes — that is 29. Loans are termed for 20 years. loan interest rate is fixed at 1%. full title service is required if the total outstanding balance on section 504 loans is greater than $25,000. grants have a lifetime limit of $10,000. grants must be repaid if the property is sold in less than 3 years. To qualify for a usda loan in nc or sc, you must meet the following: income limits: you must prove you have a stable income, but your income cannot be more than 15% over the median salary in the area you plan to buy into. united states citizenship: permanent residents may also qualify for usda home loans. Every effort is made to provide accurate and complete information regarding eligible and ineligible areas on this website, based on rural development rural area requirements. rural development, however, does not guarantee the accuracy, or completeness of any information, product, process, or determination provided by this system. final.

Comments are closed.