Understanding Your Credit Score Public Service Credit Union

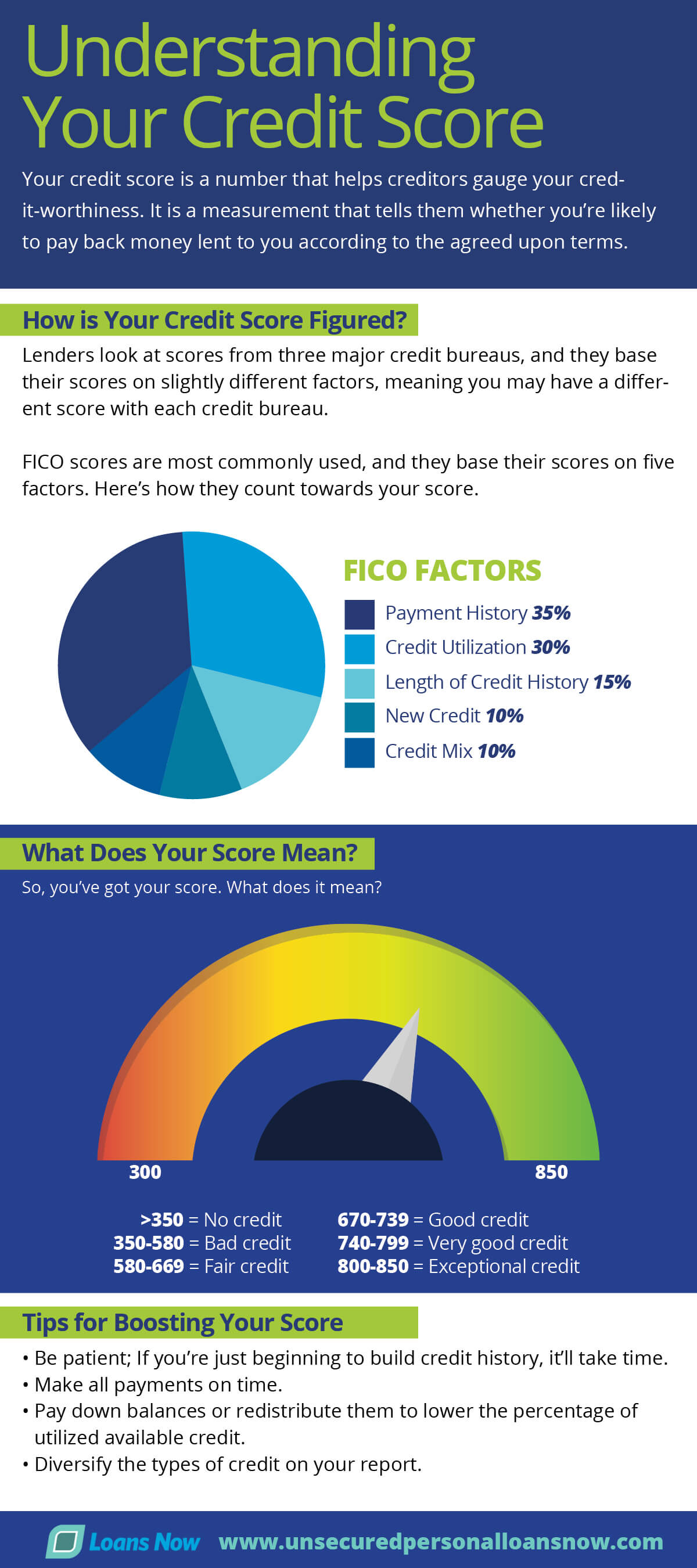

Understanding Your Credit Score Public Service Credit Union How credit scores are created. the three main credit bureaus – equifax, experian and transunion – create your credit reports, which credit scoring models like vantagescore uses to come up with a score that typically ranges from 300 850. the credit bureaus can also calculate scores for you based on their own proprietary models. A good fico score falls between 670 and 739, while an exceptional score measures 800 and above. a good vantagescore ranges from 700 to 749, while an excellent score is 750 and above. the higher the number, the lower the perceived credit risk. keep in mind, however, each lender has its own standards and approval process.

Vantage Credit Score Public Service Credit Union You may opt out with the nationwide credit bureaus at 1 888 567 8688 (888 5optout) you have a right to place a security freeze on your credit report which will prohibit a consumer reporting agency from releasing information in your credit report without your express authorization. Credit history (15%): this factor considers how long you’ve had credit accounts. credit mix (10%): the types of credit accounts you have, such as credit cards and loans. new credit (10%): recent inquiries for credit. your fico credit score can range from 300 to 850, with higher scores indicating better creditworthiness. This information includes: your bill paying history. current unpaid debt. the number and type of loan accounts you have. how long you have had your loans open. how much available credit you’re using. reviewing your credit reports regularly helps you identify any issues that could lower your credit score. by federal law, you are entitled to. The average fico score in the united states is currently 711, which positions it squarely in the "good" category. meanwhile, the average vantagescore stands at 688. as a group, individuals age 75 and older have the highest credit scores, with averages of 758 and 729 for fico and vantagescore, respectively.

Vantage Credit Score Public Service Credit Union This information includes: your bill paying history. current unpaid debt. the number and type of loan accounts you have. how long you have had your loans open. how much available credit you’re using. reviewing your credit reports regularly helps you identify any issues that could lower your credit score. by federal law, you are entitled to. The average fico score in the united states is currently 711, which positions it squarely in the "good" category. meanwhile, the average vantagescore stands at 688. as a group, individuals age 75 and older have the highest credit scores, with averages of 758 and 729 for fico and vantagescore, respectively. Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list. Your credit score is based on: your payment history – if you pay your loans and bills on time. how much of your available credit you use – also known as your credit utilization ratio. what types of credit you have – such as car loans, student loans and credit cards. how long you’ve had your credit – the age of your credit accounts.

Understanding Your Credit Score Know the data on your credit report. you know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data. use our list of credit reporting companies to request and review each of your reports. browse the list. Your credit score is based on: your payment history – if you pay your loans and bills on time. how much of your available credit you use – also known as your credit utilization ratio. what types of credit you have – such as car loans, student loans and credit cards. how long you’ve had your credit – the age of your credit accounts.

Understanding Your Credit Score

Comments are closed.