Understanding Your Credit Score

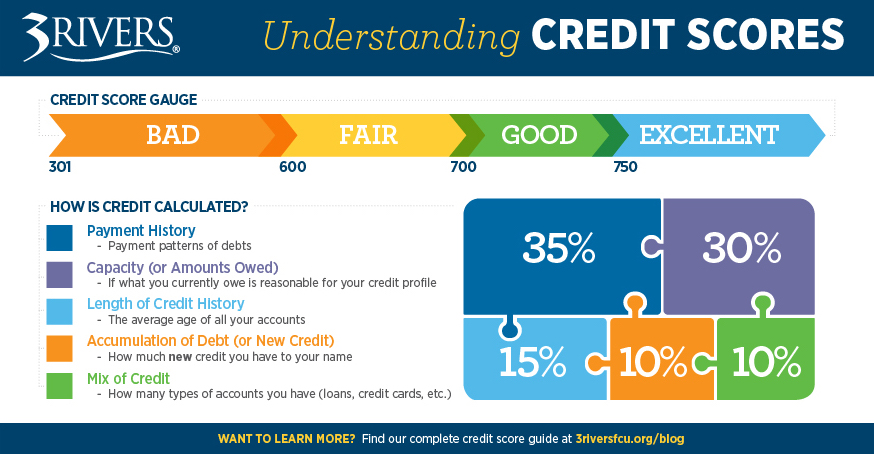

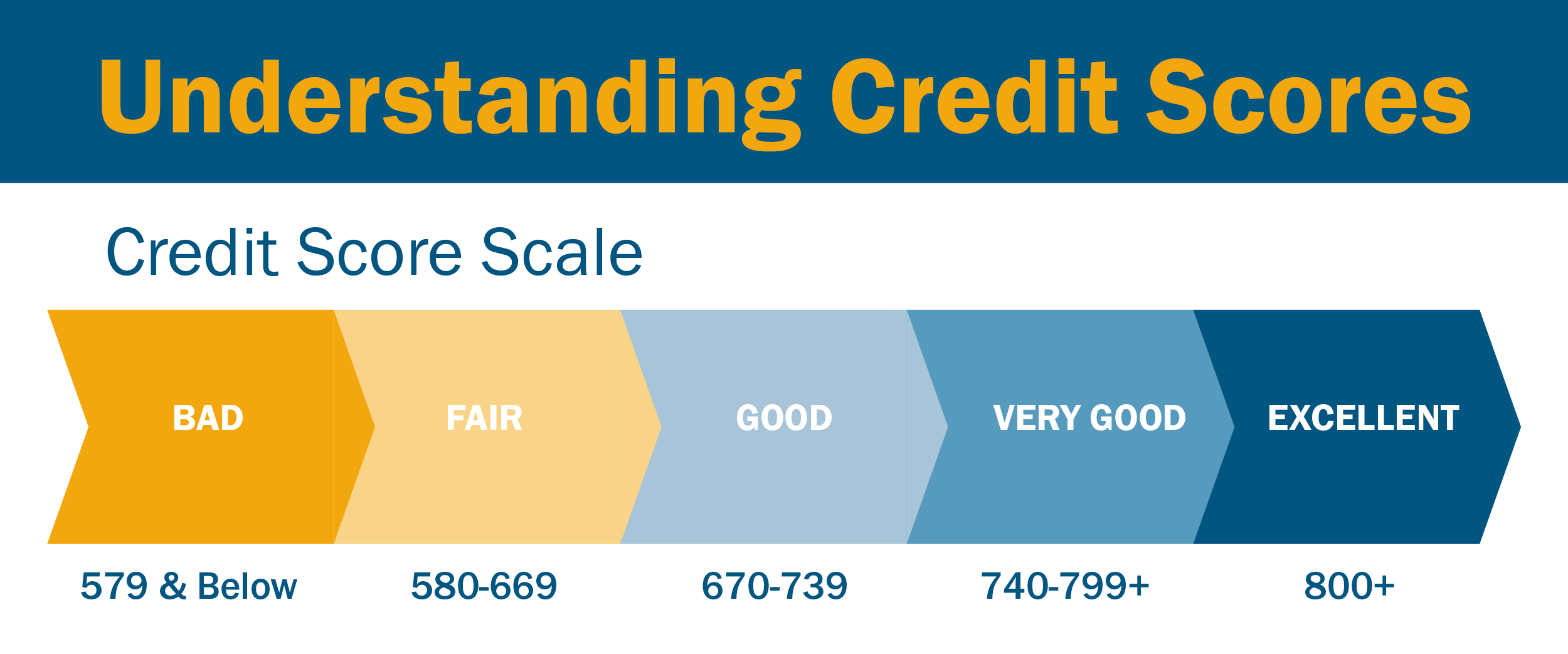

Understanding Your Credit Score Your credit score. your credit score is a three digit number that comes from the information in your credit report. it shows how well you manage credit and how risky it would be for a lender to lend you money. your credit score is calculated using a formula based on your credit report. note that you:. Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently.

Understanding Credit Scores In canada, credit scores range from 300 to 900, 900 being a perfect score and 300 the lowest. according to data from a 2022 survey, the average credit score in canada is 672, and 694 in british columbia. your credit score is used by lenders to determine what kind of borrower you are. it can affect your eligibility for certain loans or credit. With equifax complete tm premier, we monitor your credit report and score to help you spot signs of fraud. and if your identity is stolen, we'll help you recover. understanding credit scores is not as difficult as you may think. this guide from equifax canada tells you five things you need to know about credit scores. The score is a three digit number that lenders use to help them make decisions. lenders use scores to determine whether or not to grant credit, and if so, how much credit and at what rate. a higher score indicates that the individual is a lower credit risk.to calculate a score, numerical weights are placed on different aspects of your credit. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%. a low credit utilization is better for your credit score. there's no specific amount separating.

How To Understand Your Credit Scores The score is a three digit number that lenders use to help them make decisions. lenders use scores to determine whether or not to grant credit, and if so, how much credit and at what rate. a higher score indicates that the individual is a lower credit risk.to calculate a score, numerical weights are placed on different aspects of your credit. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%. a low credit utilization is better for your credit score. there's no specific amount separating. A credit score is a three digit number that's assigned to you by either one of the two canadian credit bureaus, equifax canada or transunion. your credit score is an assessment of your ability to fulfill the financial commitment of borrowing credit at a particular time based on your financial history as reported to the credit bureau. Simply put, your credit score is a numeric snapshot of your spending history. it captures important elements of your credit report, like payment and credit history, the amount of credit you use, and whether or not you’ve historically paid your bills in full and on time. your credit score is a three digit number calculated by canada’s two.

Read On To Understand What Is Credit Score How Is It Calculated A credit score is a three digit number that's assigned to you by either one of the two canadian credit bureaus, equifax canada or transunion. your credit score is an assessment of your ability to fulfill the financial commitment of borrowing credit at a particular time based on your financial history as reported to the credit bureau. Simply put, your credit score is a numeric snapshot of your spending history. it captures important elements of your credit report, like payment and credit history, the amount of credit you use, and whether or not you’ve historically paid your bills in full and on time. your credit score is a three digit number calculated by canada’s two.

Comments are closed.