Understanding Credit Scores And How To Improve It

7 Quick Ways To Improve Your Credit Score Whatever the reason, here are seven things you can do to bring that score up—and keep it there. 1. pay your bills on time. late payments or missing payments can lower your score more than any other factor. making regular, on time payments is one of the best ways to bring it back up. How to get your credit score. there are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection.

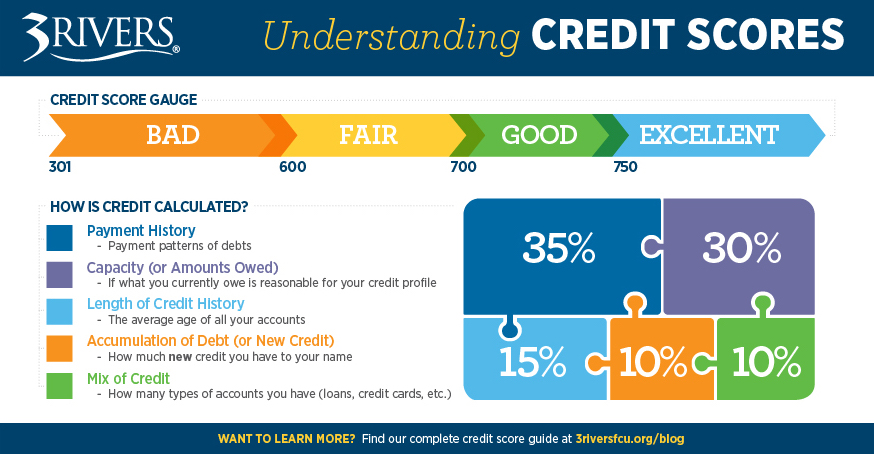

The Ultimate Guide To Understanding Your Credit Score And How To Fair: 601 to 660. good: 661 to 780. excellent: 781 to 850. if your lender is pulling your score from experian, they will see your fico credit score. you would need to score between 670 and 739 to. Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently. 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest. Get started and build your score. get started as an authorized user, or with a credit builder loan or secured credit card. you can track spending, seek higher limits and set up balance alerts to.

Understanding Credit Scores 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest. Get started and build your score. get started as an authorized user, or with a credit builder loan or secured credit card. you can track spending, seek higher limits and set up balance alerts to. Industry specific fico scores range from 250 to 900, but fico based scores and vantagescore versions 3.0 and 4.0 each range from 300 to 850. a credit score of 700 or higher is generally considered. Very good (740 to 799): a very good credit score is above average, and it illustrates a low level of risk. good (670 to 739): a good credit score is at or near the u.s. average, which is why most.

Comments are closed.