Understanding Credit

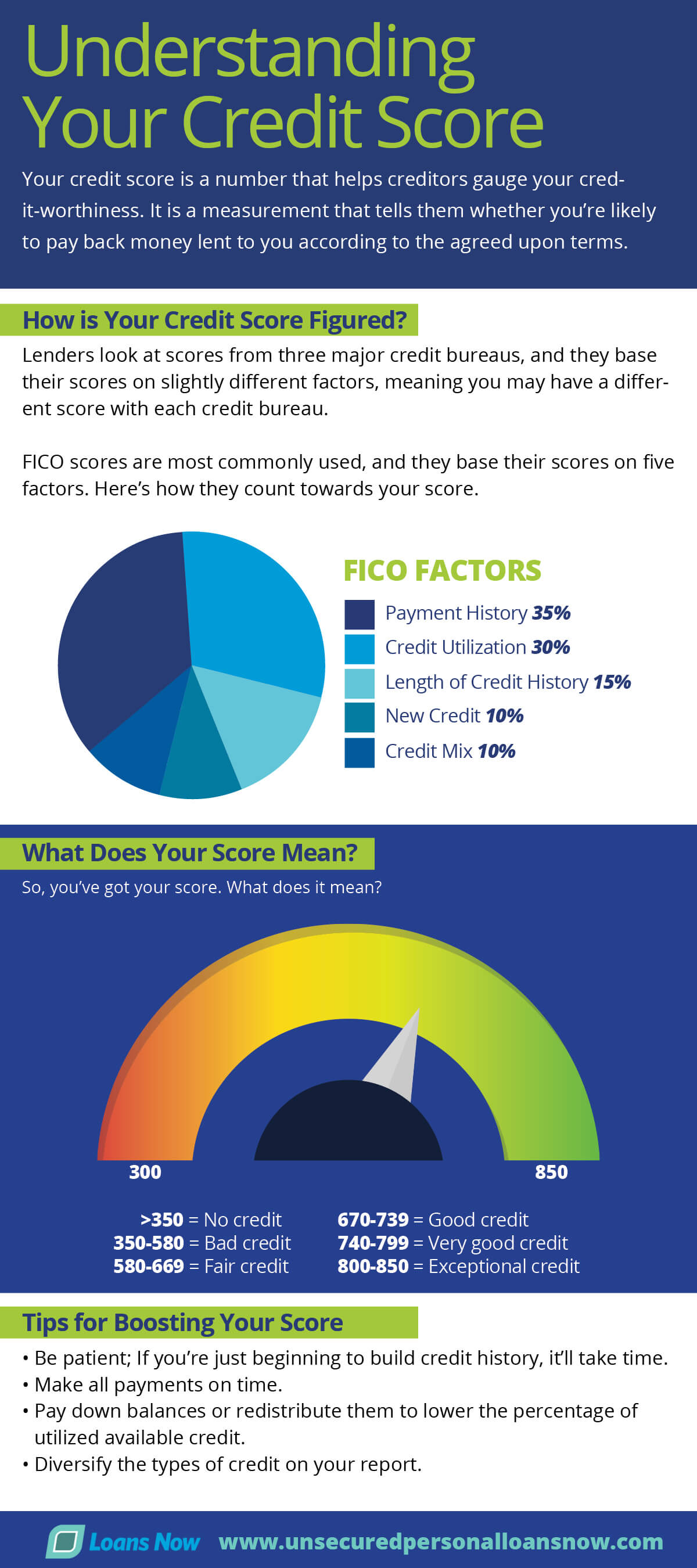

Understanding Your Credit Score Some financial advisors suggest staggering your requests over a 12 month period to help keep an eye on your reports and make sure they have accurate information. the best way to get your free credit report is to. go to annualcreditreport or. call annual credit report at 1 877 322 8228. Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently.

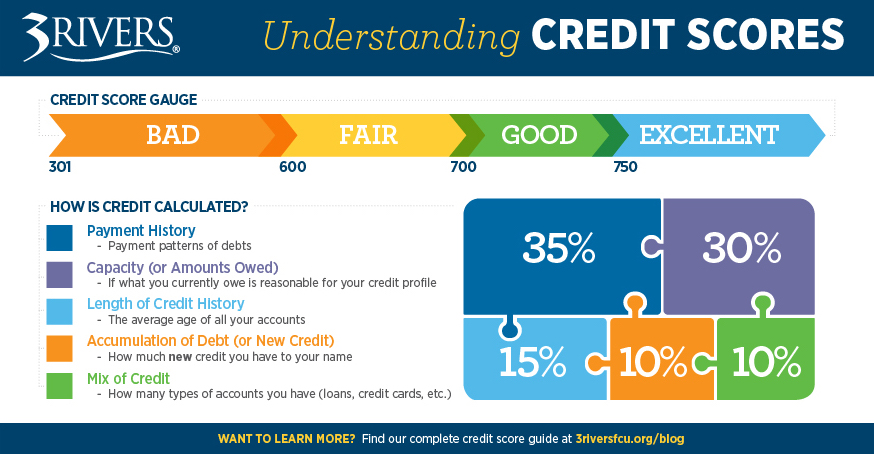

Understanding Credit Scores The ability to borrow money with the promise that you'll repay it in the future, often with interest. you might need credit to purchase a product or use a service that you can’t pay for. See 4 important steps that can help you build a solid credit history. understanding your credit limit—and what you should use—can help you build a better credit score. here’s how. a damaged credit rating can raise the interest rates you pay and limit your ability to qualify for new credit. learn 6 steps you can take to rebuild your credit. Understanding your credit scores is an important part of getting a better understanding of your credit reports. a credit score is a three digit number, typically between 300 and 850, which is designed to represent your credit risk, or the likelihood you will pay your bills on time. in general, a higher credit score represents a higher. Understanding how the two facets of credit interact can help you make the most of your financial plan. what are the types of credit accounts? there are several different types of loans and credit cards you can use to accomplish your financial goals, but they all generally fall under two umbrellas: installment credit and revolving credit.

Comments are closed.