Uk Banks Stay Confident As Financial Cyberattacks Surge

Uk Banks Stay Confident As Financial Cyberattacks Surge Since the beginning of the russia ukraine conflict, the banking sector has faced an 81% surge in cyberattacks. nevertheless, financial companies in the uk have demonstrated a high level of. The fca regulates over 50,000 organizations operating in the financial sector in the uk, with firms mandated to report any cyber incidents to the regulatory body. nearly one third (31%) of cyber incidents reported to the fca in 2023 were classified as ransomware attacks, compared to 11% in the first half of 2022.

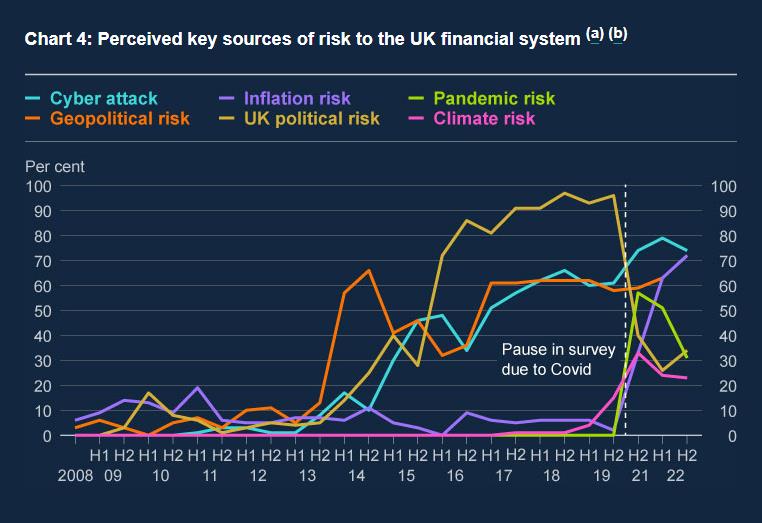

Ppt вђ Are Uk Banks Vulnerable To Cyber Attacks 1 Powerpoint Seven of the uk’s biggest banks including santander, royal bank of scotland and tesco bank were forced to reduce operations or shut down entire systems following a cyber attack last year using. The bank’s h2 systemic risk survey polled 65 executives in the uk financial sector, and shows that 74% of respondents deemed a cyberattack to be the highest risk to the financial sector in both the short and long term, followed closely by inflation or a geo political incident. however, while attacks are potentially very damaging if they do. As we show in a chapter of the april 2024 global financial stability report, the risk of extreme losses from cyber incidents is increasing. such losses could potentially cause funding problems for companies and even jeopardize their solvency. the size of these extreme losses has more than quadrupled since 2017 to $2.5 billion. In 2023, the number of ransomware attack s in the finance industry surged by 64 per cent, and was nearly double the 2021 level, according to sophos, a cyber security company. luke mcnamara, deputy.

Devastating Cyber Attacks On Banks Reasons Prevention As we show in a chapter of the april 2024 global financial stability report, the risk of extreme losses from cyber incidents is increasing. such losses could potentially cause funding problems for companies and even jeopardize their solvency. the size of these extreme losses has more than quadrupled since 2017 to $2.5 billion. In 2023, the number of ransomware attack s in the finance industry surged by 64 per cent, and was nearly double the 2021 level, according to sophos, a cyber security company. luke mcnamara, deputy. Here’s how it works. cyber security incidents targeting uk financial services providers increased by 52% in 2021, according to reports filed to the financial conduct authority (fca) and analysed by picus security. an foi filed by the cyber security company found that the majority (65%) of the incidents reported to the fca were cyber attacks. The bank of england and financial conduct authority have given uk financial services firms three months to produce backup plans explaining how they would respond to cyberattacks and avoid.

Cyber Incidents Targeting Uk Financial Services Providers Surged In Here’s how it works. cyber security incidents targeting uk financial services providers increased by 52% in 2021, according to reports filed to the financial conduct authority (fca) and analysed by picus security. an foi filed by the cyber security company found that the majority (65%) of the incidents reported to the fca were cyber attacks. The bank of england and financial conduct authority have given uk financial services firms three months to produce backup plans explaining how they would respond to cyberattacks and avoid.

Comments are closed.