Three Steps To A Va Loan Military

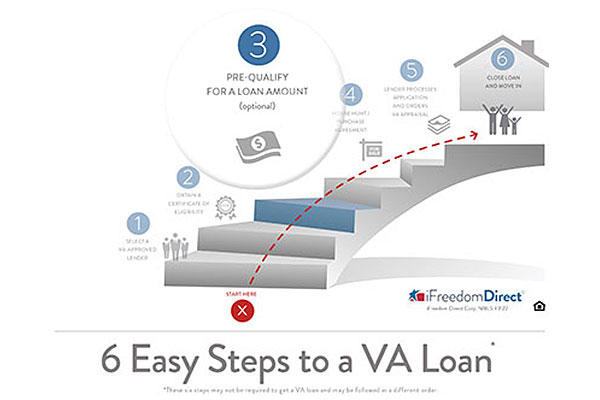

Step By Step To A Va Loan 3 Prequalifying Military The many advantages the va loan offers include a va guaranty for loans with little or no down payment, guaranteed loan limits of over $450,000 (or even higher, depending on your location), and. Military . published august 07, 2014. for many borrowers, applying for any kind of mortgage may seem daunting. but, when broken down, this rundown of 6 steps to getting a va loan is easy to.

Three Steps To A Va Loan Military Step 6: va appraisal. the va appraisal is a mandatory step in the va loan process. it ensures the home you’re interested in is worth its value and meets the va’s property standards. partner with your va lender to navigate this step smoothly. they’ll guide you, ensuring the property is a solid investment for your future. Following 6 easy steps to a va home loan can help make the process go more smoothly. learn the do’s and don’ts of the optional third step: prequalifying. The va loan process timeline typically takes 30 45 days from contract to closing. while va streamline refinancing can be faster, often closing in half the time, both va purchase and refinance timelines are comparable to conventional mortgages. if you're a first time homebuyer, the va loan process can feel daunting, but the first step is simple. For homebuyers, the va loan has five basic steps: preapproval, house hunting, getting under contract, underwriting and closing. this process typically results in a stronger financial future, using arguably the most powerful mortgage product on the market. here we detail the step by step process of getting a va loan and how veterans can get the.

Step By Step Guide To The Va Loan Process Military The va loan process timeline typically takes 30 45 days from contract to closing. while va streamline refinancing can be faster, often closing in half the time, both va purchase and refinance timelines are comparable to conventional mortgages. if you're a first time homebuyer, the va loan process can feel daunting, but the first step is simple. For homebuyers, the va loan has five basic steps: preapproval, house hunting, getting under contract, underwriting and closing. this process typically results in a stronger financial future, using arguably the most powerful mortgage product on the market. here we detail the step by step process of getting a va loan and how veterans can get the. Many lenders charge veterans using va backed home loans a 1% flat fee (sometimes called a “loan origination fee”). lenders may also charge you additional fees. if you don’t know what a fee is for, ask the lender. in some cases, lender fees are negotiable. to learn more: read about the va funding fee and other closing costs. If you have any questions during the process that the lender can't answer to your satisfaction, please contact va at your regional loan center by calling 1 877 827 3702, with hours of operation from 8am to 6pm est. return to top. apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member.

Comments are closed.