The Risk Of Deflation San Francisco Fed

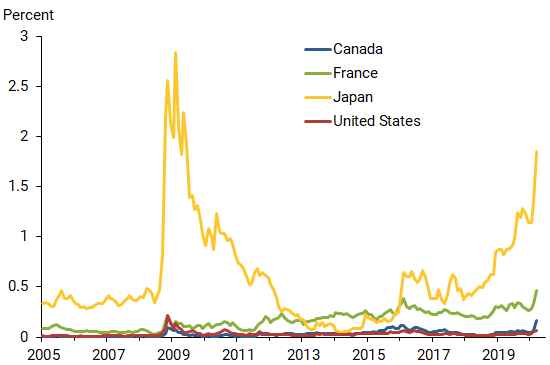

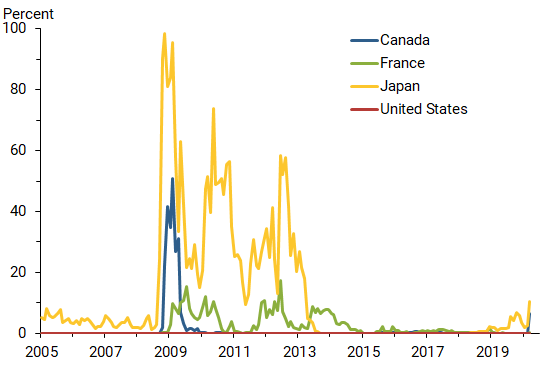

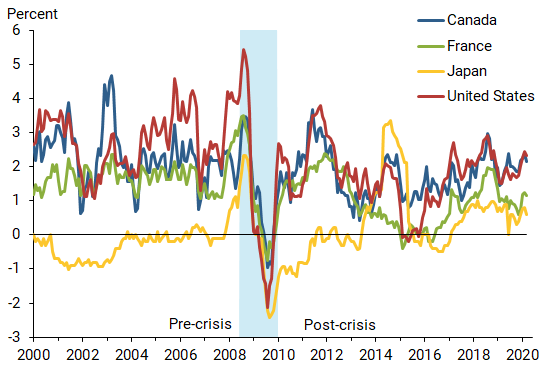

Coronavirus And The Risk Of Deflation San Francisco Fed The risk of deflation. the worsening global recession has heightened concerns that the united states and other economies could enter a sustained period of deflation, as did japan in the 1990s and the united states during the great depression. indeed, a popular version of the well known phillips curve model of inflation predicts that we are on. In this letter, we assess the downside risk to the inflation outlook caused by the unprecedented negative economic shock following the rapid spread of covid 19. analysis of the forward looking information in nominal and real government bond yields shows that the perceived risk of an outright decline in the price level, or deflation, over the.

Coronavirus And The Risk Of Deflation San Francisco Fed The low level of inflation and the sluggish pace of economic recovery have raised concerns about sustained deflation—an inflation rate below zero with a general fall in prices. however, the relative prices of inflation indexed and non indexed treasury bonds, which historically have proven to be good measures of inflation expectations, suggest that financial market participants consider the. 7 ways governments fight deflation. governments and central banks generally target an annual inflation rate of 2 3% in order to maintain economic stability and growth. if inflation "overheats" and. Jens h. e. christensen & james m. gamble & simon zhu, 2020. " coronavirus and the risk of deflation ," frbsf economic letter, federal reserve bank of san francisco, vol. 2020 (11), pages 1 5, may. downloadable! the pandemic caused by covid 19 represents an unprecedented negative shock to the global economy that is likely to severely depress. The risk of deflation. s. gerlach. published 2009. economics. introduction: the onset of financial instability in august 2007, which quickly spread across the world, raises a number of questions for policy makers.

Coronavirus And The Risk Of Deflation San Francisco Fed Jens h. e. christensen & james m. gamble & simon zhu, 2020. " coronavirus and the risk of deflation ," frbsf economic letter, federal reserve bank of san francisco, vol. 2020 (11), pages 1 5, may. downloadable! the pandemic caused by covid 19 represents an unprecedented negative shock to the global economy that is likely to severely depress. The risk of deflation. s. gerlach. published 2009. economics. introduction: the onset of financial instability in august 2007, which quickly spread across the world, raises a number of questions for policy makers. Diversity is critical to the federal reserve, and we are firmly committed to fostering a diverse and inclusive culture throughout the federal reserve system. collections within fraser contain historical language, content, and descriptions that reflect the time period within which they were created and the views of their creators. Federal reserve bank of san francisco. "frbsf economic letter: the risk of deflation." federal reserve history. "the great depression: 1929 1941." bank for international settlements.

Comments are closed.