The Relationship Between Taxation And The Elasticity Of Pptx

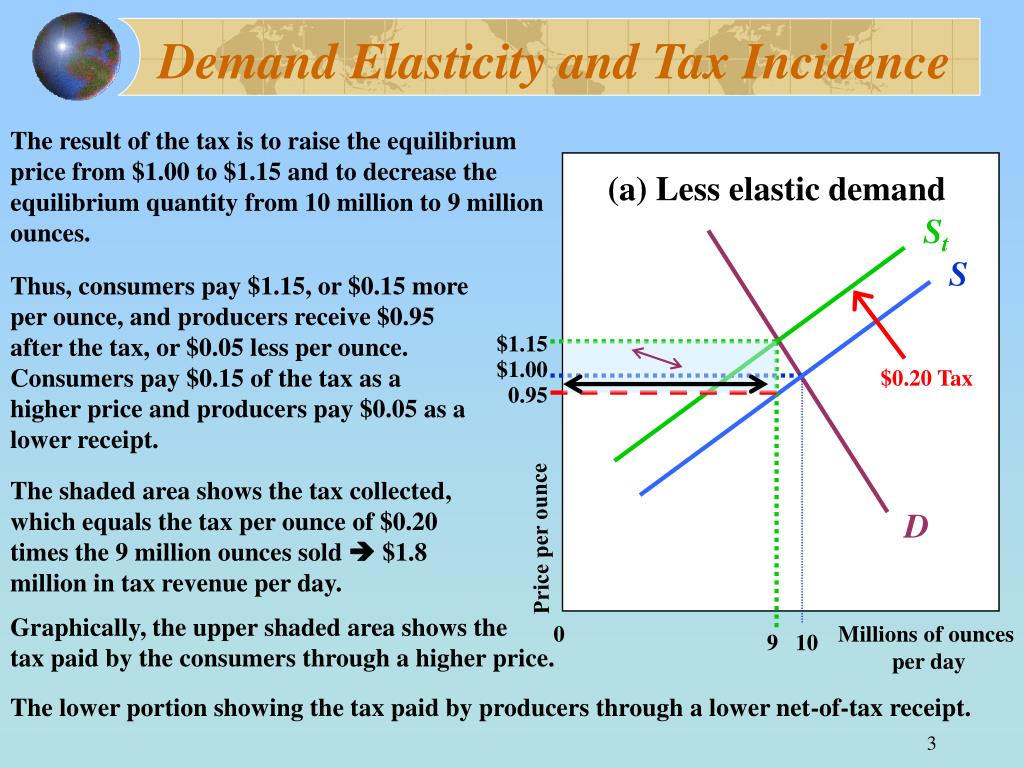

Ppt Price Elasticity And Tax Incidence Powerpoint Presentation Free Placing a tax on a good, shifts the supply curve to the left. it leads to a fall in demand and higher price. however, the impact of a tax depends on the elasticity of demand. if demand is inelastic, a higher tax will cause only a small fall in demand. most of the tax will be passed onto consumers. when demand is inelastic, governments will see. Figure 3.16 – elastic demand and inelastic supply. the tax revenue is given by the shaded area, which is obtained by multiplying the tax per unit by the total quantity sold qt. the tax incidence on the consumers is given by the difference between the price paid pc and the initial equilibrium price pe. the tax incidence on the sellers is given.

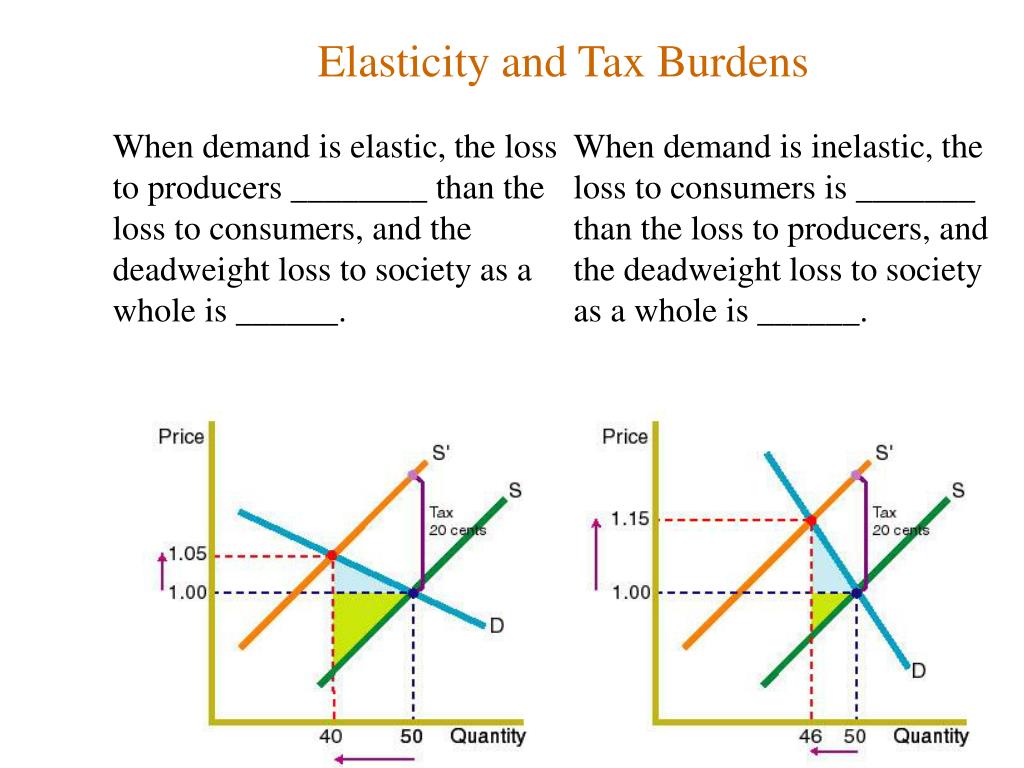

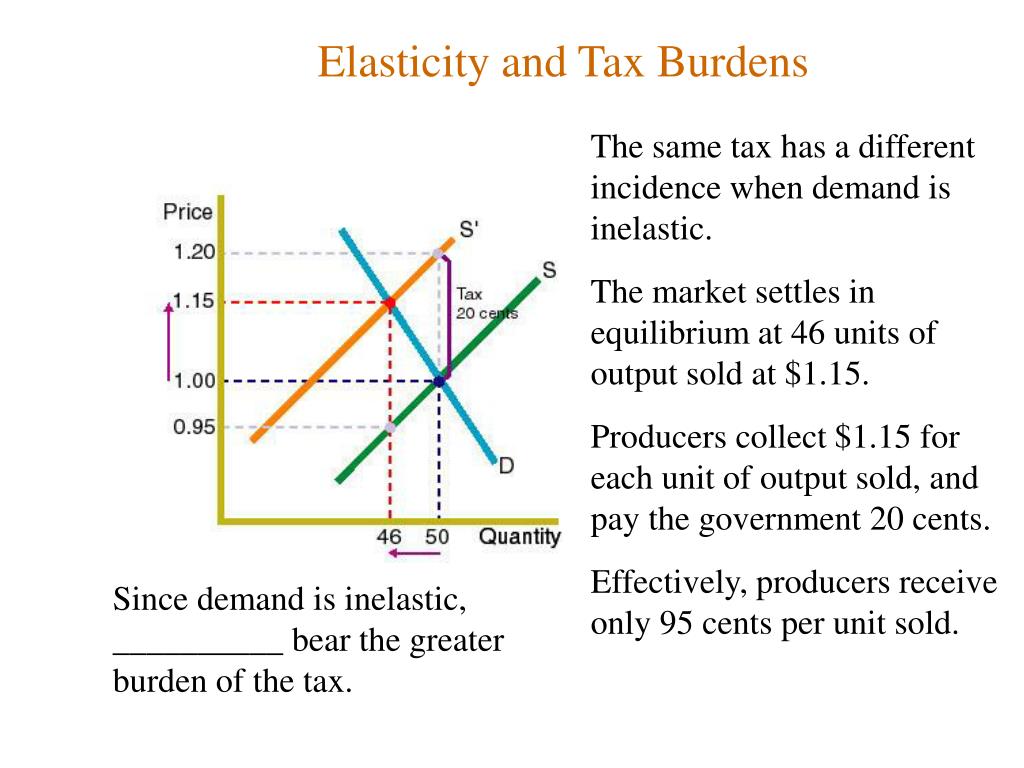

Ppt Elasticity Powerpoint Presentation Free Download Id 6537721 The answer is that the relative burden of a tax on consumers versus producers corresponds to the relative price. economists sometimes refer to this as the "whoever can run from a tax will" principle. when supply is more elastic than demand, consumers will bear more of the burden of a tax than producers will. for example, if supply is twice as. Figure 5.10 elasticity and tax incidence an excise tax introduces a wedge between the price paid by consumers (pc) and the price received by producers (pp). (a) when the demand is more elastic than supply, the tax incidence on consumers pc – pe is lower than the tax incidence on producers pe – pp. (b) when the supply is more elastic than. Due to the tax’s effect on the price, areas a and c are transferred from consumer and producer surplus to government revenue. consumers to government – area a – consumers originally paid $4 gallon for gas. now, they are paying $5 gallon. the $1 increase in price is the portion of the tax that consumers have to bear. Elasticity of demand.ppt. this document defines and explains different types of elasticity of demand including price elasticity, income elasticity, cross elasticity, and advertising elasticity. it discusses how elasticity is measured and factors that influence different types of elasticity. key types are defined such as perfectly inelastic.

Ppt Elasticity Powerpoint Presentation Free Download Id 6537721 Due to the tax’s effect on the price, areas a and c are transferred from consumer and producer surplus to government revenue. consumers to government – area a – consumers originally paid $4 gallon for gas. now, they are paying $5 gallon. the $1 increase in price is the portion of the tax that consumers have to bear. Elasticity of demand.ppt. this document defines and explains different types of elasticity of demand including price elasticity, income elasticity, cross elasticity, and advertising elasticity. it discusses how elasticity is measured and factors that influence different types of elasticity. key types are defined such as perfectly inelastic. The ramsey inverse elasticity rule an example • elasticity estimates for many goods are available and reasonably robust • using these, a ramsey optimal commodity tax structure can be calculated • since the inverse elasticity rule specifies proportional relationships between optimal tax rates, one rate must be chosen arbitrarily hale ramsey. The fall in total surplus (consumer surplus, producer surplus, and tax revenue) is called the deadweight loss (dwl) of the tax. a tax has a dwl because it causes consumers to buy less and producers to sell less, thus shrinking the market below the level that maximizes total surplus. 33. taxation: a welfare analysis.

Comments are closed.