The Basics Of Real Estate Supply Demand Cycle

The Four Phases Of The Real Estate Cycle Crowdstreet The influencing factors and how they affect your business. by diccon hyatt. updated on september 13, 2022. fact checked by yasmin ghahremani. view all. photo: cavan getty images. real estate supply and demand are impacted by factors ranging from interest rates to supply chain snags. understanding them can help your business prepare and respond. The commercial real estate cycle generally follows a pattern of recovery, expansion, hypersupply and recession. “but there’s no set duration for each phase,” felsot said. “the length of each phase depends on economic conditions, government policies and other market factors, with expansion and recession being fairly short in duration.”. 1.

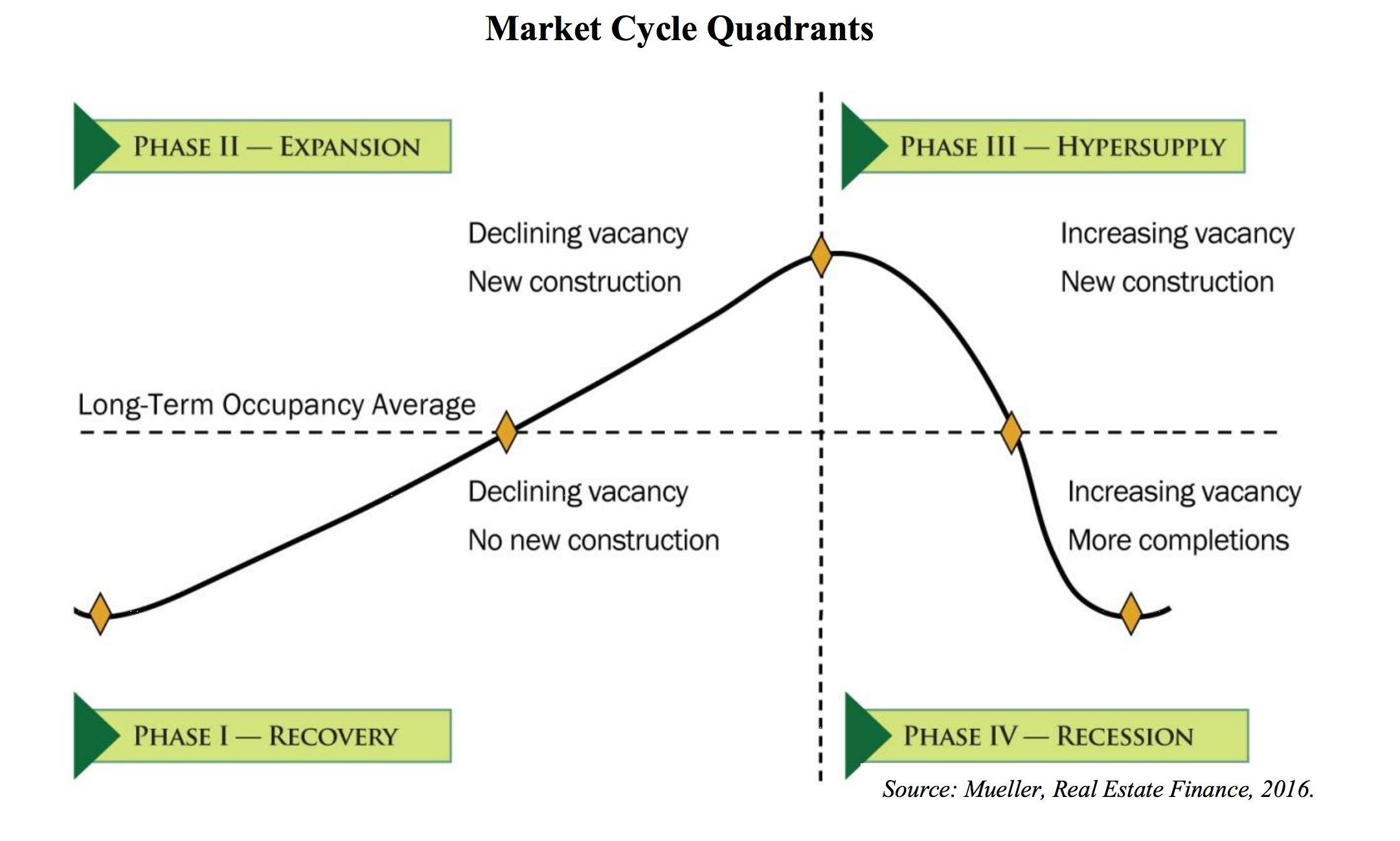

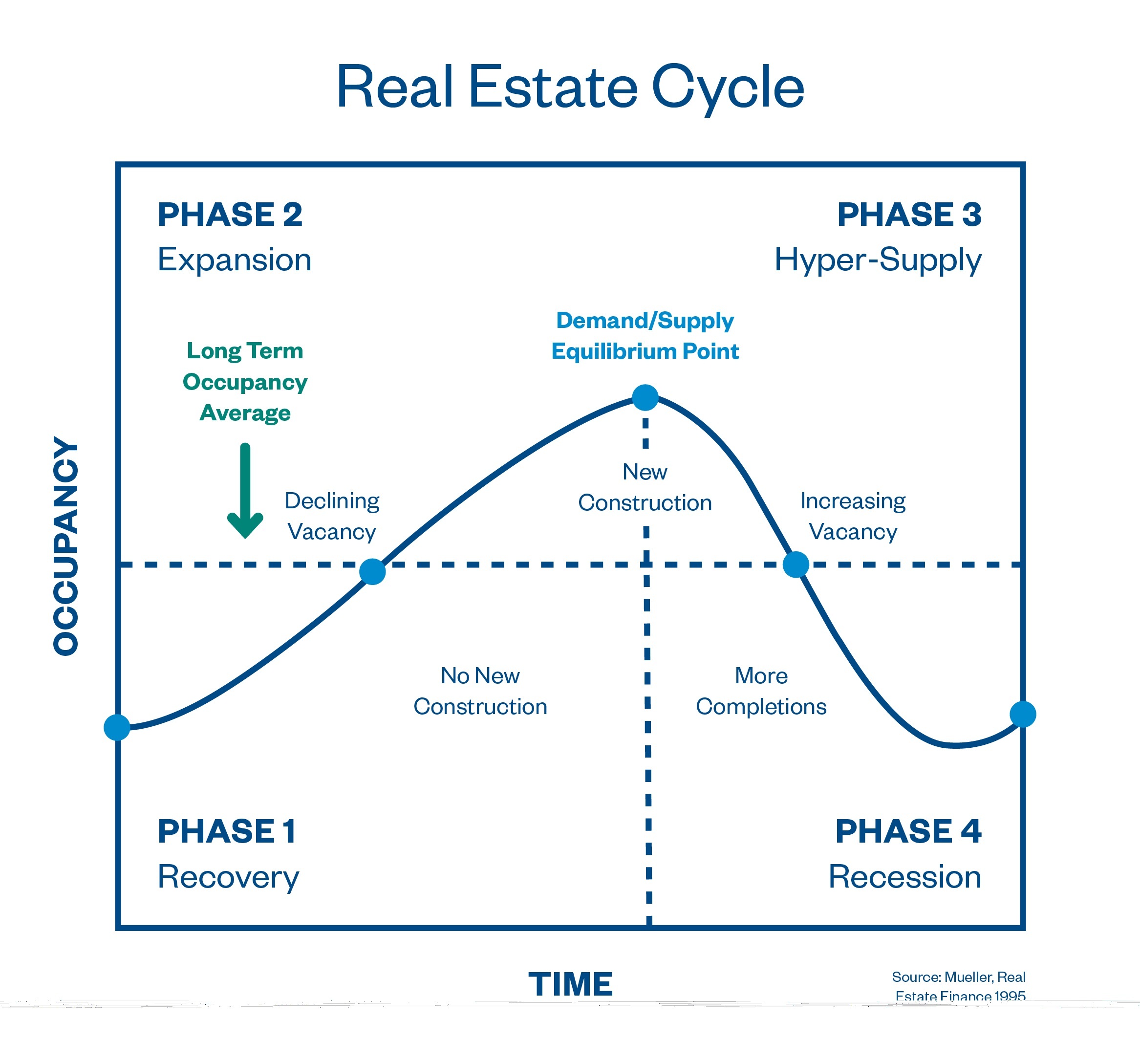

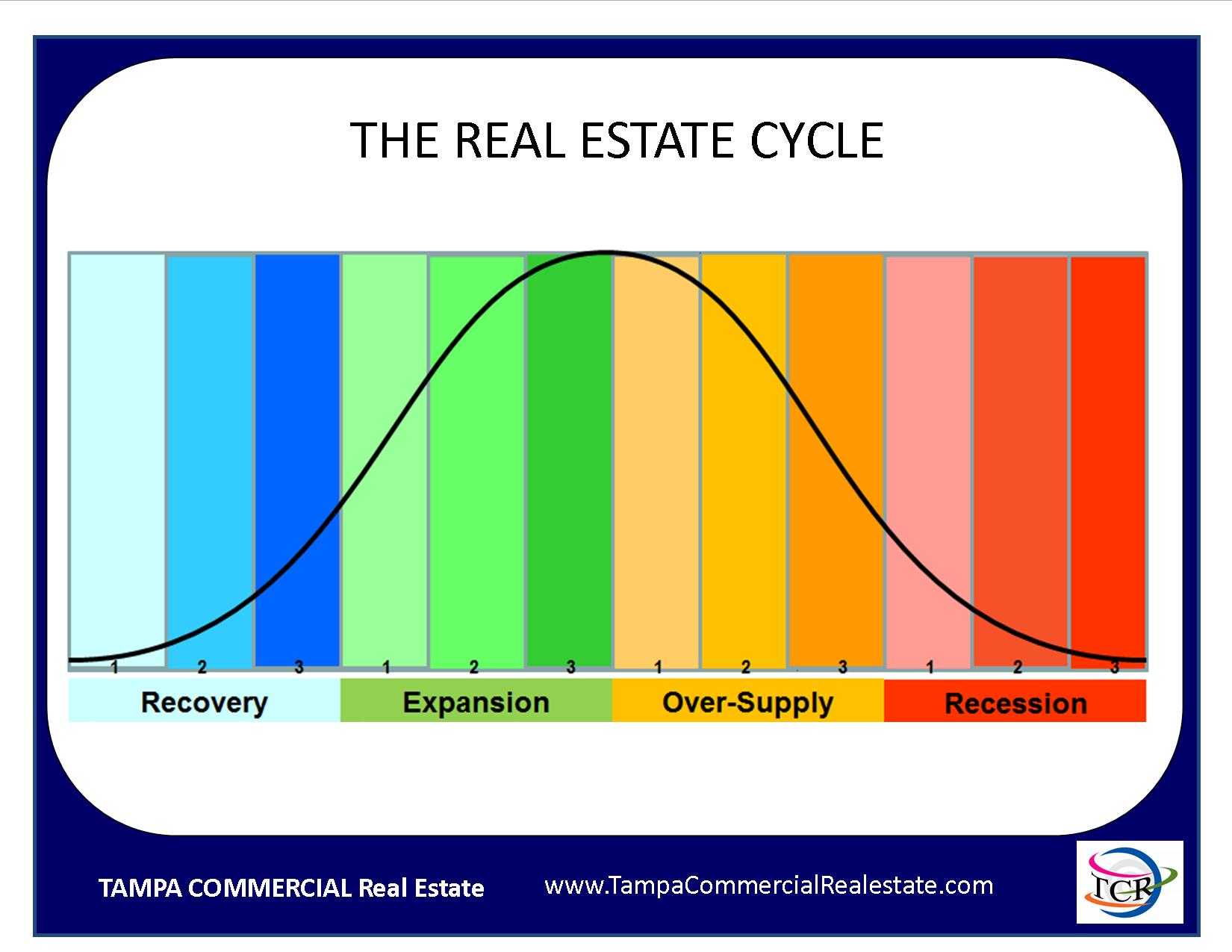

Understanding Real Estate Cycles The real estate cycle is a four phase series that reports on the status of both commercial and residential real estate markets. the four phases are recovery, expansion, hyper supply, and recession. the origin of the term dates back almost one hundred years, as analysts first began to study trends within the housing market. The basics. there are four phases in the cycle of real estate, and they look like this: phase 1: recovery. recovery is typically the most difficult phase to identify. when a real estate market is. Understanding the principles behind the real estate supply and demand cycle is essential for any real estate investor to stay ahead of emerging trends. vogue property managers’ experts have created this quick, easy to understand guide to help you with the basics. the property cycle real estate. Real estate markets have historically moved through 18 year cycles. the four phases of the real estate cycle are recovery, expansion, hypersupply, and recession. factors affecting the real estate market cycle include interest rates, demographic trends, and government intervention. by understanding market trends, investors can identify potential.

Understanding Real Estate Basics Supply Demand And Elasticity Understanding the principles behind the real estate supply and demand cycle is essential for any real estate investor to stay ahead of emerging trends. vogue property managers’ experts have created this quick, easy to understand guide to help you with the basics. the property cycle real estate. Real estate markets have historically moved through 18 year cycles. the four phases of the real estate cycle are recovery, expansion, hypersupply, and recession. factors affecting the real estate market cycle include interest rates, demographic trends, and government intervention. by understanding market trends, investors can identify potential. The principle of supply in any market is that when there is an increase in the supply or amount of goods or services, prices will drop. the same is true of property: when there is an increased. Many researchers believe that real estate cycles last anywhere from 10 18 years. the four phases include recovery, expansion, hyper supply and recession. jobs lead to an increase in real estate prices and demand for residential rental units. however, another factor affects things like this and its population growth.

The Basics Of Real Estate Supply Demand Cycle The principle of supply in any market is that when there is an increase in the supply or amount of goods or services, prices will drop. the same is true of property: when there is an increased. Many researchers believe that real estate cycles last anywhere from 10 18 years. the four phases include recovery, expansion, hyper supply and recession. jobs lead to an increase in real estate prices and demand for residential rental units. however, another factor affects things like this and its population growth.

Real Estate Cycles Tampa Commercial Real Estate

Comments are closed.