The Accounting Equation And Transaction Analysis The Accounting

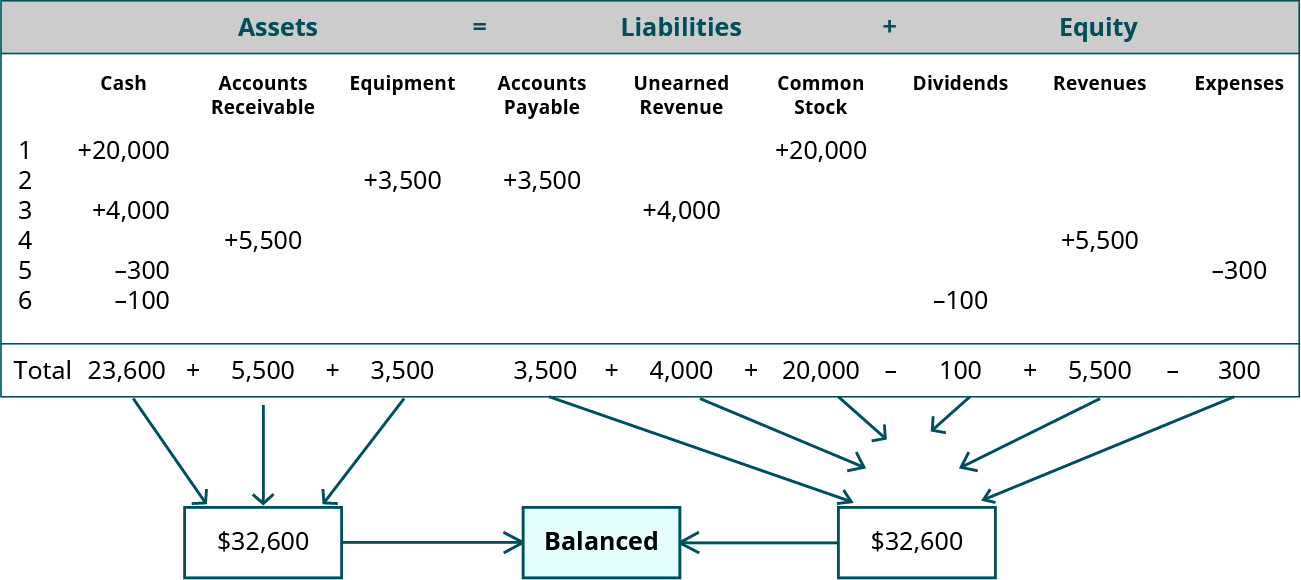

Accounting Equation Accounting Corner Transaction 1: issues $20,000 shares of common stock for cash. analysis: looking at the accounting equation, we know cash is an asset and common stock is stockholder’s equity. when a company collects cash, this will increase assets because cash is coming into the business. when a company issues common stock, this will increase a stockholder. Assets = liabilities shareholder’s equity. this equation sets the foundation of double entry accounting, also known as double entry bookkeeping, and highlights the structure of the balance sheet. double entry accounting is a system where every transaction affects at least two accounts. for example, an increase in an asset account can be.

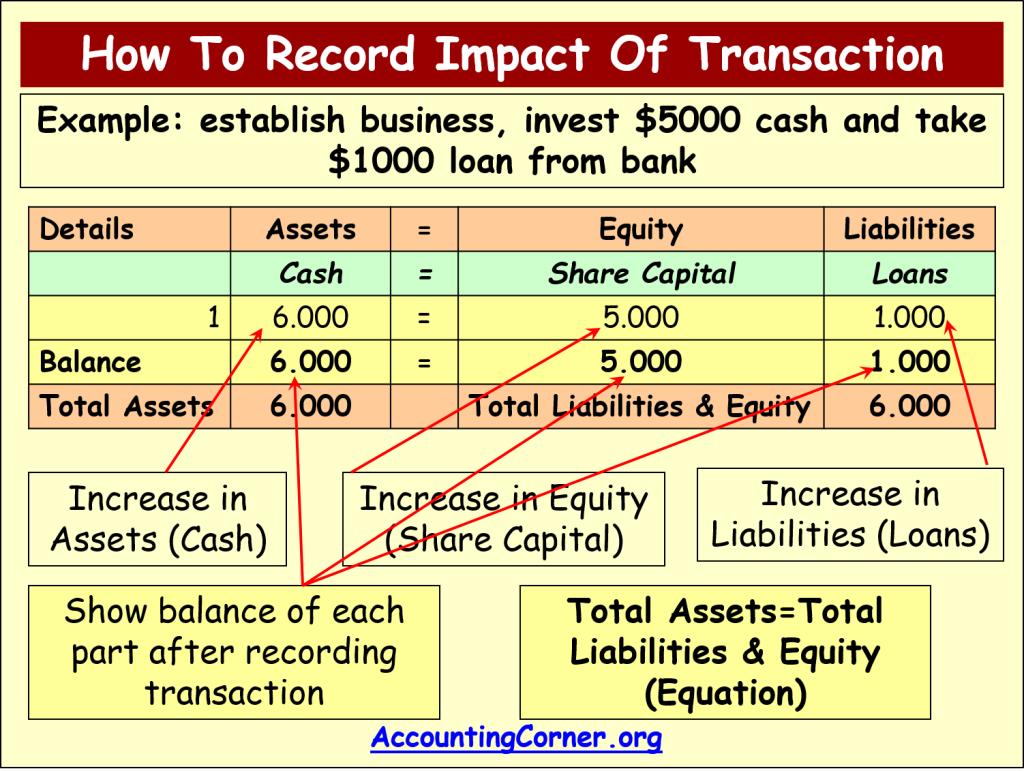

Accounting Equation Accounting Corner We now analyze each of these transactions, paying attention to how they impact the accounting equation and corresponding financial statements. transaction 1: issues $20,000 shares of common stock for cash. analysis: looking at the accounting equation, we know cash is an asset and common stock is stockholder’s equity. when a company collects. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. below are examples of items listed on. Click transaction analysis to see the full chart with all transactions. the final accounting equation would be: assets $88,100 (cash $66,800 accounts receivable $5,000 supplies $500 prepaid rent $1,800 equipment $5,500 truck $8,500) = liabilities $200 equity $87, 900 (common stock $30,000 net income $57,900 from revenue of $60,000. The impact of each of the above transactions has been outlined below, followed by a summary of the cumulative effect of these transactions on the accounting equation: 1. the cash (asset) of the business will increase by $5,000 as will the amount representing the investment from anushka as the owner of the business (capital).

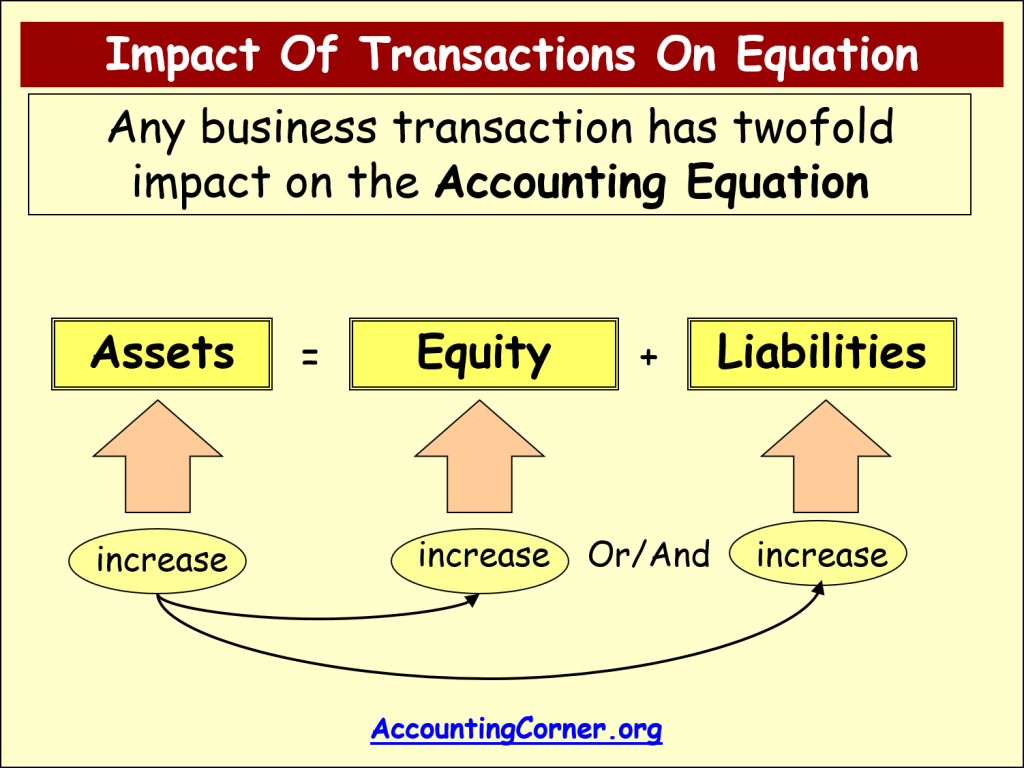

1 2 Transaction Analysis Accounting Equation Format вђ Financial And Click transaction analysis to see the full chart with all transactions. the final accounting equation would be: assets $88,100 (cash $66,800 accounts receivable $5,000 supplies $500 prepaid rent $1,800 equipment $5,500 truck $8,500) = liabilities $200 equity $87, 900 (common stock $30,000 net income $57,900 from revenue of $60,000. The impact of each of the above transactions has been outlined below, followed by a summary of the cumulative effect of these transactions on the accounting equation: 1. the cash (asset) of the business will increase by $5,000 as will the amount representing the investment from anushka as the owner of the business (capital). Impact of transactions on accounting equation. valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). every transaction impacts accounting equation in terms of dollar amounts but the equation as a whole always. Accounting equation illustration. assume the following transactions: mr. alex invested $20,000 to start a printing business, the company obtained a loan from a bank, $30,000, the company purchased printers and paid a total of $1,000. how will the transactions affect the accounting equation? let us take a look at transaction #1:.

Comments are closed.