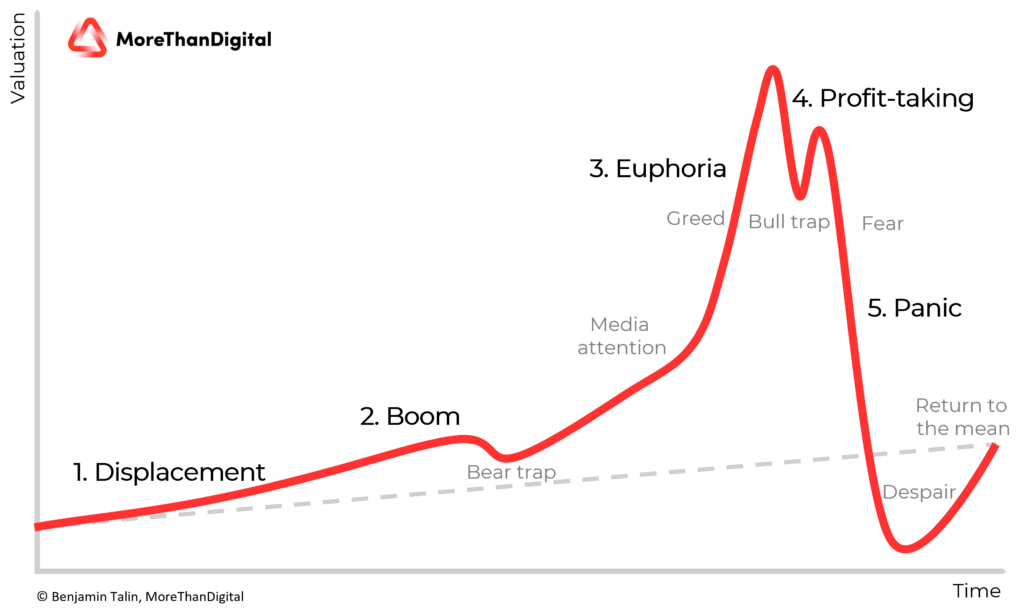

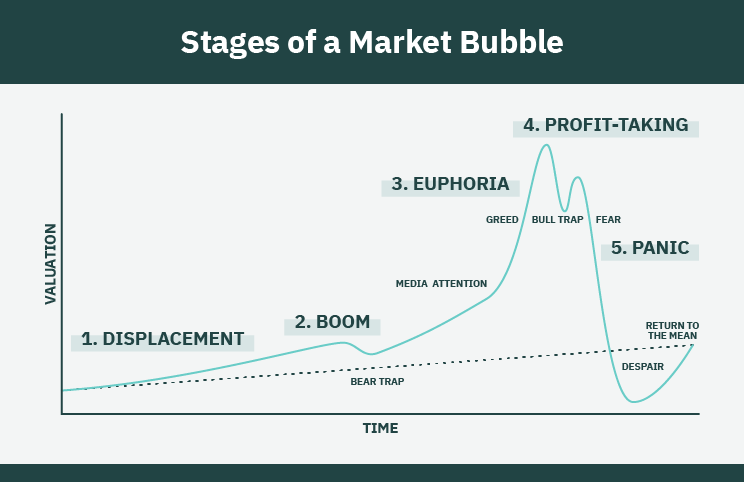

The 5 Stages Of Financial Bubbles Explained

Economic Bubbles And Financial Bubbles Explained вђ Definition Types 5 stages of a bubble . economist hyman p. minsky was one of the first to explain the development of financial instability and the relationship it has with the economy. Five steps of a bubble. minsky identified five stages in a typical credit cycle displacement, boom, euphoria, profit taking and panic. although there are various interpretations of the cycle, the.

Stock Market Bubbles Explained 2023 Complete Investor S Guide 5 stages of an asset bubble economist hyman p. minsky was one of the first to explain the development of financial instability and the relationship it has with the economy. in his book stabilizing an unstable economy (1986), he identified five stages in a typical credit cycle that was then extended to other financial bubbles. A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. this fast inflation is followed by a quick decrease in value, or a. Using the example of one of the earliest known financial bubbles, tulip mania, here are the five stages of a financial bubble, from the moment it begins to form until it bursts. 1. excitement. this is the stage where people fall in love with a new product or technology. it is also very often a time of major change in the economy. Phase one: displacement. an event or innovation occurs that sharply changes expectations. this phase is typically grounded in reality and good intentions. phase two: expansion. this is the stage where the narrative takes hold and people begin bidding up asset prices. phase three: euphoria.

Comments are closed.