Taxes And Elastcity

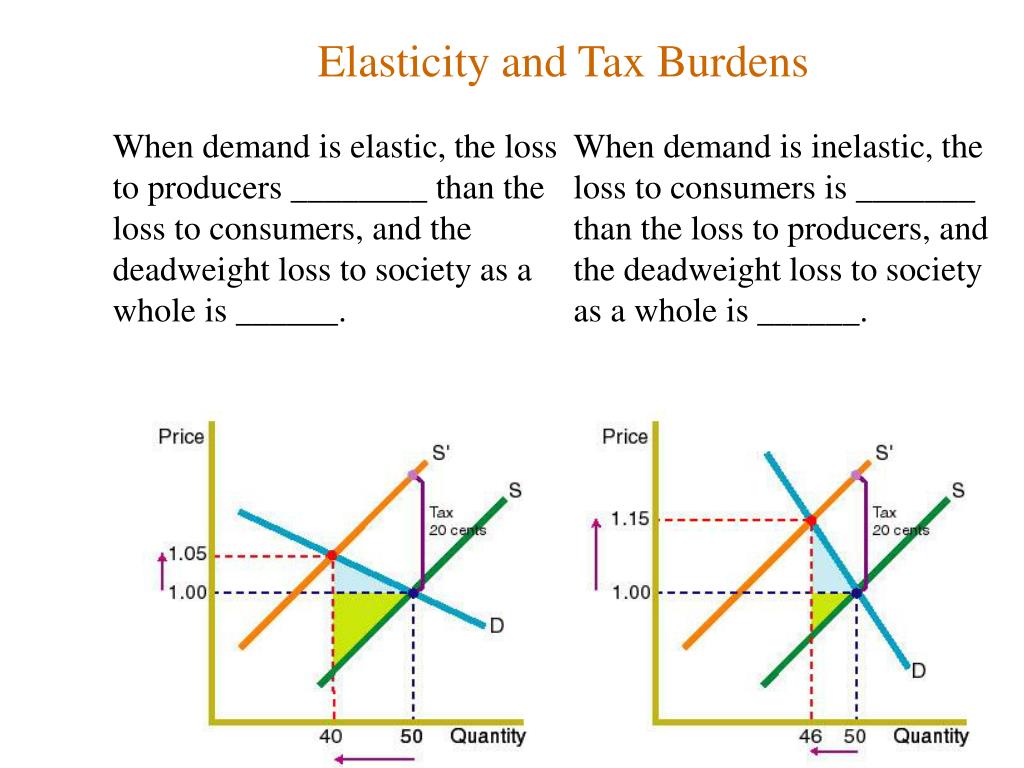

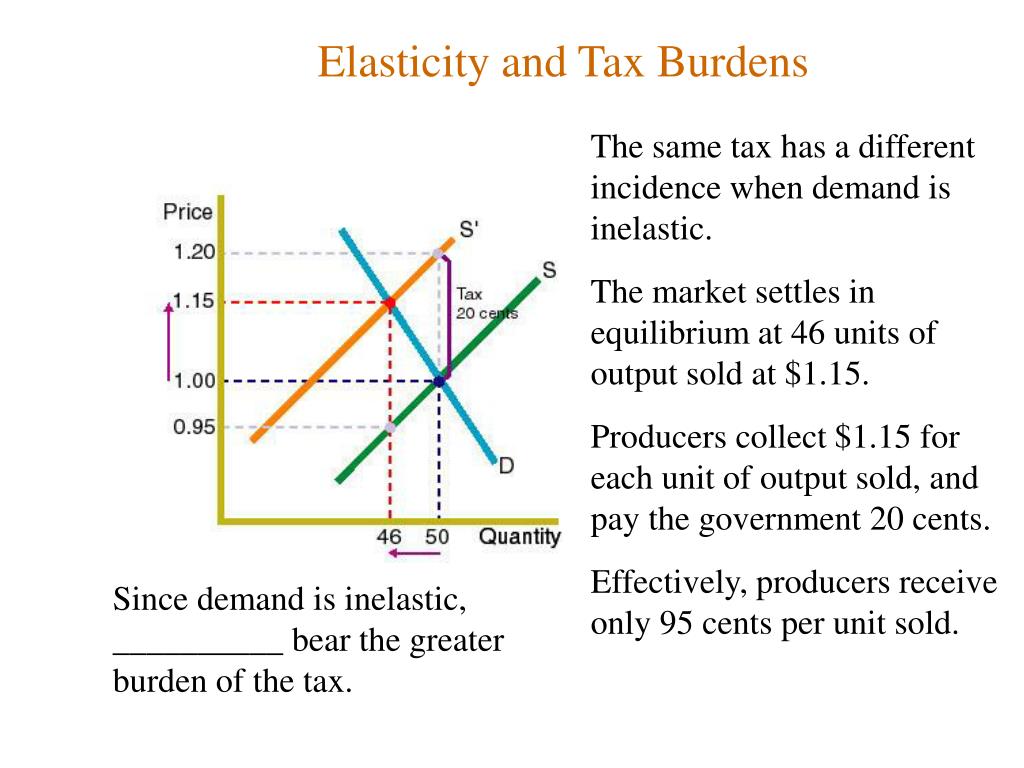

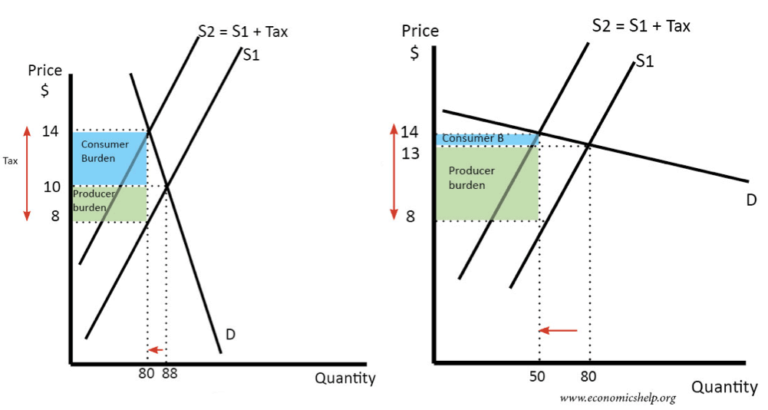

Ppt Elasticity Powerpoint Presentation Free Download Id 6537721 Placing a tax on a good, shifts the supply curve to the left. it leads to a fall in demand and higher price. however, the impact of a tax depends on the elasticity of demand. if demand is inelastic, a higher tax will cause only a small fall in demand. most of the tax will be passed onto consumers. when demand is inelastic, governments will see. The answer is that the relative burden of a tax on consumers versus producers corresponds to the relative price. economists sometimes refer to this as the "whoever can run from a tax will" principle. when supply is more elastic than demand, consumers will bear more of the burden of a tax than producers will. for example, if supply is twice as.

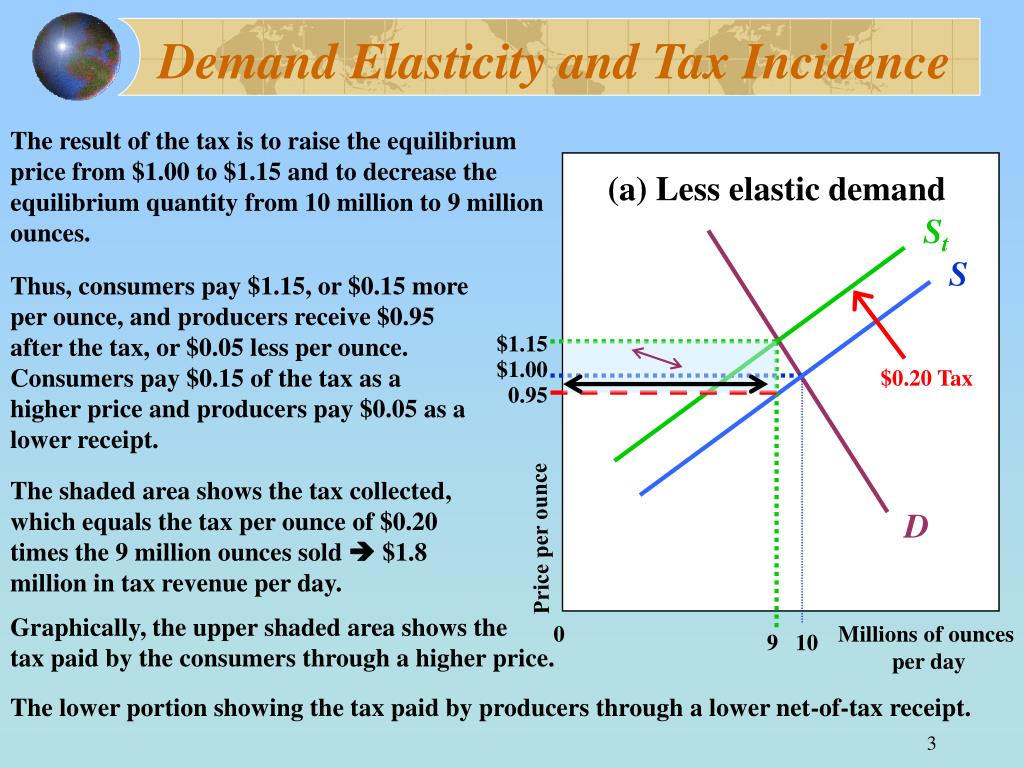

Ppt Price Elasticity And Tax Incidence Powerpoint Presentation Free Figure 3.16 – elastic demand and inelastic supply. the tax revenue is given by the shaded area, which is obtained by multiplying the tax per unit by the total quantity sold qt. the tax incidence on the consumers is given by the difference between the price paid pc and the initial equilibrium price pe. the tax incidence on the sellers is given. The supplier faces a lower supply price, and bears a higher share of the tax. figure 4.9 tax incidence with inelastic supply. the imposition of a specific tax of $4 shifts the supply curve vertically by $4. the final price at b (pt) increases by $2 over the no tax price at a. at the new quantity traded, qt, the supplier gets $3 per unit (), the. Governments tax cigarettes at the state and national levels. as of 2021, state taxes ranged from a low of 17 cents per pack in missouri to $4.35 per pack in connecticut and new york. the average state cigarette tax is $1.76 per pack. the 2021 federal tax rate on cigarettes was $1.01 per pack. Economists use the term tax incidence to indicate how the burden of a tax is actually shared between buyers and sellers. when a tax is imposed, the government can make either the buyer or the seller legally responsible for payment of the tax. the legal assignment is called the statutory incidence of the tax. however, the person who writes the.

Ppt Elasticity Powerpoint Presentation Free Download Id 6537721 Governments tax cigarettes at the state and national levels. as of 2021, state taxes ranged from a low of 17 cents per pack in missouri to $4.35 per pack in connecticut and new york. the average state cigarette tax is $1.76 per pack. the 2021 federal tax rate on cigarettes was $1.01 per pack. Economists use the term tax incidence to indicate how the burden of a tax is actually shared between buyers and sellers. when a tax is imposed, the government can make either the buyer or the seller legally responsible for payment of the tax. the legal assignment is called the statutory incidence of the tax. however, the person who writes the. The imposition of the tax causes the equilibrium. s. quantity to fall by ∆q, and the price to consumers increases ∆pd. p by ∆pd while the price to sellers falls by ∆ps. the incidence ∆ps of the tax measures the shares of the tax that fall on consumers and sellers. since ∆pd ∆ps = t, it is clear that ∆ pd ∆ the consumers. 5. multiple choice. suppose that a unit tax of $2 is imposed on producers with initial equilibrium of $10. if the demand curve is vertical and the supply curve is upward sloping, what will be the price faced by consumers after the tax? 285. 3. learn elasticity and taxes with free step by step video explanations and practice problems by.

Effect Of Tax Depending On Elasticity Economics Help The imposition of the tax causes the equilibrium. s. quantity to fall by ∆q, and the price to consumers increases ∆pd. p by ∆pd while the price to sellers falls by ∆ps. the incidence ∆ps of the tax measures the shares of the tax that fall on consumers and sellers. since ∆pd ∆ps = t, it is clear that ∆ pd ∆ the consumers. 5. multiple choice. suppose that a unit tax of $2 is imposed on producers with initial equilibrium of $10. if the demand curve is vertical and the supply curve is upward sloping, what will be the price faced by consumers after the tax? 285. 3. learn elasticity and taxes with free step by step video explanations and practice problems by.

Comments are closed.