Tax Incidence Price Inelastic Demand

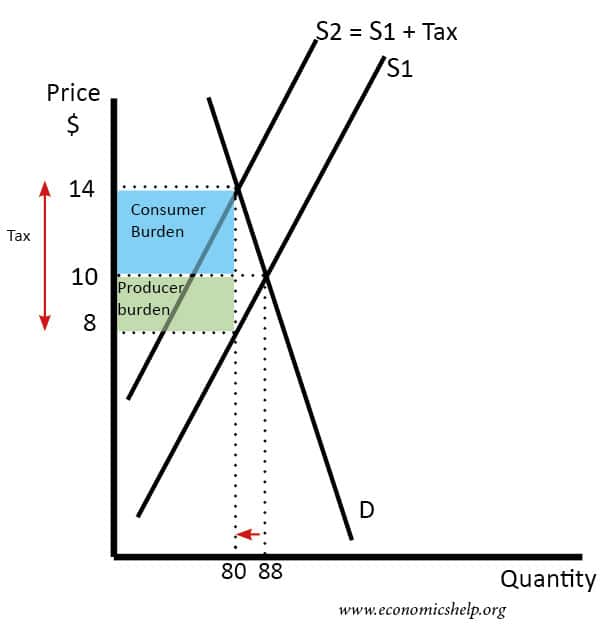

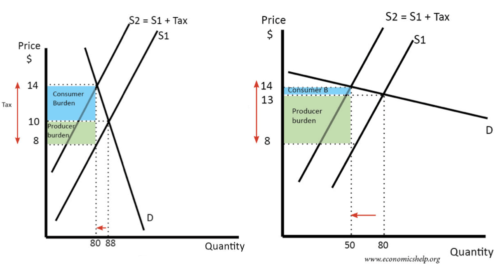

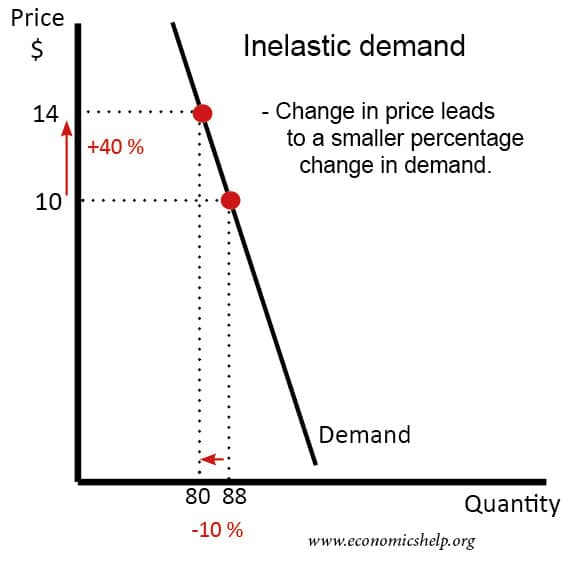

Inelastic Demand Economics Help In the diagram on the left, demand is price inelastic. a tax of £6 causes the price to rise from £10 to £14. the consumer burden is 80 x £4 = £320; the producer burden is £10 £8 = £2 x 80 = £160; elastic demand. the diagram on the right, demand is price elastic. there is only a small rise in price and a bigger percentage fall in demand. Tax incidence can also be related to the price elasticity of supply and demand. is an element that helps determine tax incidence. inelastic goods are those that consumers will continue to buy.

Tax Incidence Economics Help The analysis, or manner, of how a tax burden is divided between consumers and producers is called tax incidence. tax incidence depends on the price elasticities of supply and demand. the example of cigarette taxes introduced previously demonstrated that because demand is inelastic, taxes are not effective at reducing the equilibrium quantity of. Where the tax incidence falls depends (in the short run) on the price elasticity of demand and price elasticity of supply. tax incidence falls mostly upon the group that responds least to price (the group that has the most inelastic price quantity curve). The assessed tax shifts the supply curve upward, from s to s t, the price increases from p to p t, and the quantity declines from q to q t. but how the tax incidence, or tax burden, is shared between buyer and seller depends on the elasticity of both demand and supply. the buyer bears a greater portion of the tax burden when either demand is. The supplier faces a lower supply price, and bears a higher share of the tax. figure 4.9 tax incidence with inelastic supply. the imposition of a specific tax of $4 shifts the supply curve vertically by $4. the final price at b (pt) increases by $2 over the no tax price at a. at the new quantity traded, qt, the supplier gets $3 per unit (), the.

Inelastic Demand Economics Help The assessed tax shifts the supply curve upward, from s to s t, the price increases from p to p t, and the quantity declines from q to q t. but how the tax incidence, or tax burden, is shared between buyer and seller depends on the elasticity of both demand and supply. the buyer bears a greater portion of the tax burden when either demand is. The supplier faces a lower supply price, and bears a higher share of the tax. figure 4.9 tax incidence with inelastic supply. the imposition of a specific tax of $4 shifts the supply curve vertically by $4. the final price at b (pt) increases by $2 over the no tax price at a. at the new quantity traded, qt, the supplier gets $3 per unit (), the. Tax incidence. demand for good x is d(q) decreases with q = p t. supply for good x is s(p) increases with p. equilibrium condition: q = s(p) = d(p t) start from t = 0 and s(p) = d(p). we want to characterize dp dt: effect of a small tax increase on price, which determines who bears effective burden of tax:. Figure 3.16 – elastic demand and inelastic supply. the tax revenue is given by the shaded area, which is obtained by multiplying the tax per unit by the total quantity sold qt. the tax incidence on the consumers is given by the difference between the price paid pc and the initial equilibrium price pe. the tax incidence on the sellers is given.

Tax Incidence Price Inelastic Demand Youtube Tax incidence. demand for good x is d(q) decreases with q = p t. supply for good x is s(p) increases with p. equilibrium condition: q = s(p) = d(p t) start from t = 0 and s(p) = d(p). we want to characterize dp dt: effect of a small tax increase on price, which determines who bears effective burden of tax:. Figure 3.16 – elastic demand and inelastic supply. the tax revenue is given by the shaded area, which is obtained by multiplying the tax per unit by the total quantity sold qt. the tax incidence on the consumers is given by the difference between the price paid pc and the initial equilibrium price pe. the tax incidence on the sellers is given.

Tax Incidence Definition Formula Calculation Video Lesson

Comments are closed.