Stablecoins On Bitcoin The Complete Guide To Stablecoins Rsk

Stablecoins On Bitcoin The Complete Guide To Stablecoins Rsk Stablecoins play an essential role in the defi ecosystem, enabling investors to use a price stable asset for trading, lending, yield farming, and more. bitcoin stablecoins are a specific type of stablecoin that have been designed to provide price stability in the bitcoin defi ecosystem, allowing users to deploy a range of yield earning strategies. There are several running and upcoming projects, and the stablecoins on rsk will enable users to access one of the most secure and efficient solutions in the market for defi. rsk is also the first bitcoin sidechain offering turing complete smart contracts that are compatible with ethereum and further secured by bitcoin merge mining. the.

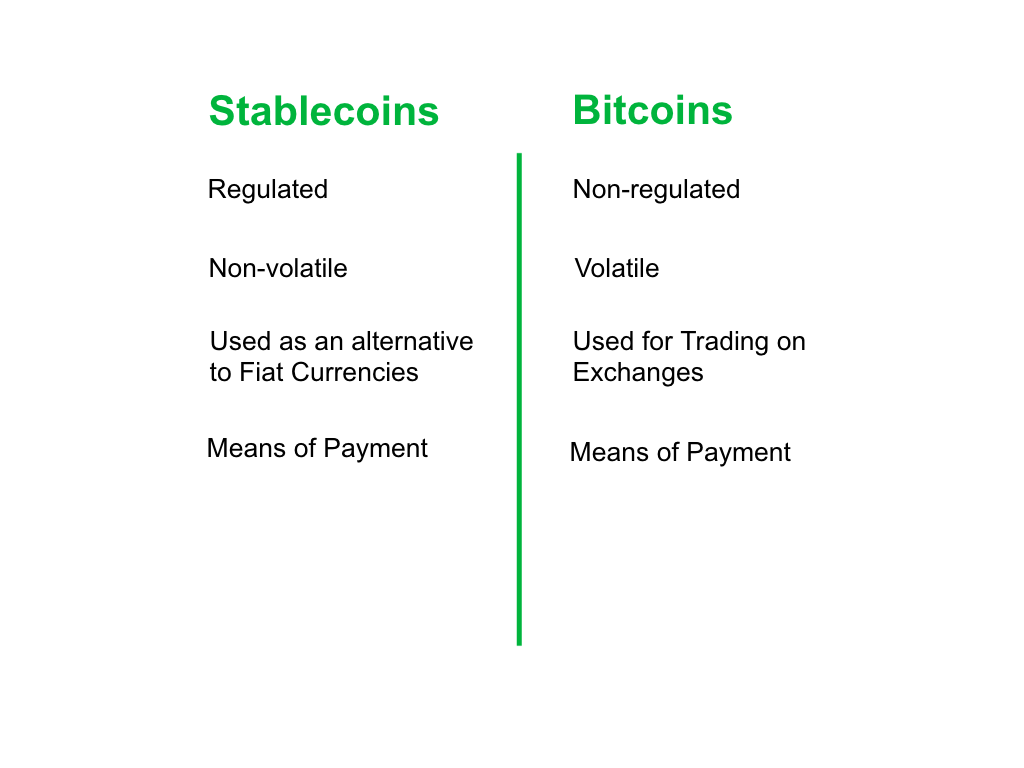

The Difference Between Stablecoins And Other Digital Assets The Bitcoin stablecoins are cryptocurrencies that operate within the bitcoin ecosystem that aim to provide a high degree of price stability. bitcoin stablecoins are either minted directly on the bitcoin blockchain or on layer 2 networks like stacks, rootstock, or the liquid network. layer 2 networks are built on top of bitcoin and are connected to. Cryptocurrency backed stablecoins, such as bitcoin stablecoins, are supported by reserves of another cryptocurrency. the stablecoin issuer holds reserves of the supporting cryptocurrency, which provides collateral for maintaining stability. this mechanism relies on the underlying cryptocurrency's value to secure the stablecoin's stability. Doc (dollar on chain) is a 100% bitcoin collateralized stablecoin with a 1:1 peg to the us dollar. the doc token falls into a collection of money on chain tokens, each providing different use cases on the rsk layer. a stablecoin like doc gives users viable means for daily transactions, and helps traders avoid volatility. The difference between stablecoins and other digital assets – the complete guide to stablecoins published on: 16 january, 2024 in this section, we will cover the difference between a stablecoin and other digital assets like bitcoins, fiat currency, fungible tokens, central bank digital currency (cbdcs), and altcoins.

Bitcoin Stablecoins A Complete Beginner S Guide Doc (dollar on chain) is a 100% bitcoin collateralized stablecoin with a 1:1 peg to the us dollar. the doc token falls into a collection of money on chain tokens, each providing different use cases on the rsk layer. a stablecoin like doc gives users viable means for daily transactions, and helps traders avoid volatility. The difference between stablecoins and other digital assets – the complete guide to stablecoins published on: 16 january, 2024 in this section, we will cover the difference between a stablecoin and other digital assets like bitcoins, fiat currency, fungible tokens, central bank digital currency (cbdcs), and altcoins. Stablecoins vs bitcoin – quick summary. the global cryptocurrency market cap is $1.23 trillion. that would put it comfortably in the top 20 economies in the world. of that market, bitcoin is by far the largest cryptocurrency, with a market cap of almost $600bn, accounting for 48% of the entire market. stablecoins, which are a category of. Stablecoins are an attempt to create a cryptocurrency that isn’t volatile. a stablecoin’s value is pegged to a real world currency, also known as fiat currency. for example, the stablecoin known as tether, or usdt, is worth 1 us dollar and is expected to maintain this peg no matter what. that’s stablecoins in a nutshell.

Comments are closed.