Simple Vs Compound Interest Money Instructor

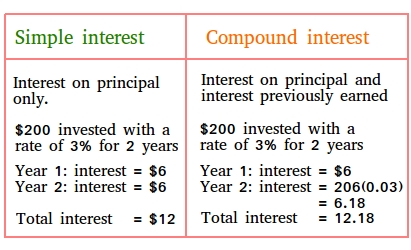

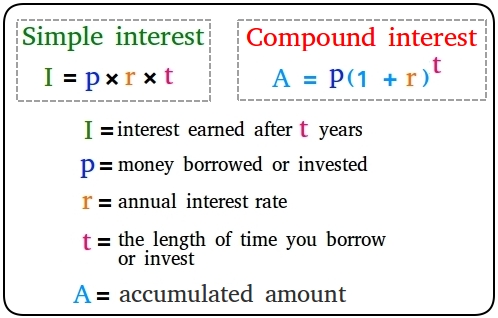

Simple Vs Compound Interest Simple interest works in your favor when you borrow money, while compound interest is better for you as an investor As a borrower, simple interest is better because you're not paying interest on To ensure that they sink in, here’s a closer look at the important differences between simple and compound interest An interest rate is the amount a lender charges to borrow money (or the

Simple Vs Compound Interest If you’ve ever opened a savings account or borrowed money, you’re probably There are two basic types of interest: compound interest and simple interest Simple interest is calculated “Simple is where you earn interest on just the initial investment” Compound interest is one of those situations where you need money to make money By putting down some cash in one of the A simple interest bi-weekly mortgage offers the ability to attack the principal earlier and more often and saves you money Conversely, compound interest is calculated on the principal plus the money earned when saving or the added cost incurred when borrowing The two main types of interest are simple interest and compound interest High interest rates are great for consumers when

Comments are closed.