Repair And Improve Your Fico Credit Score Fast Elika New York

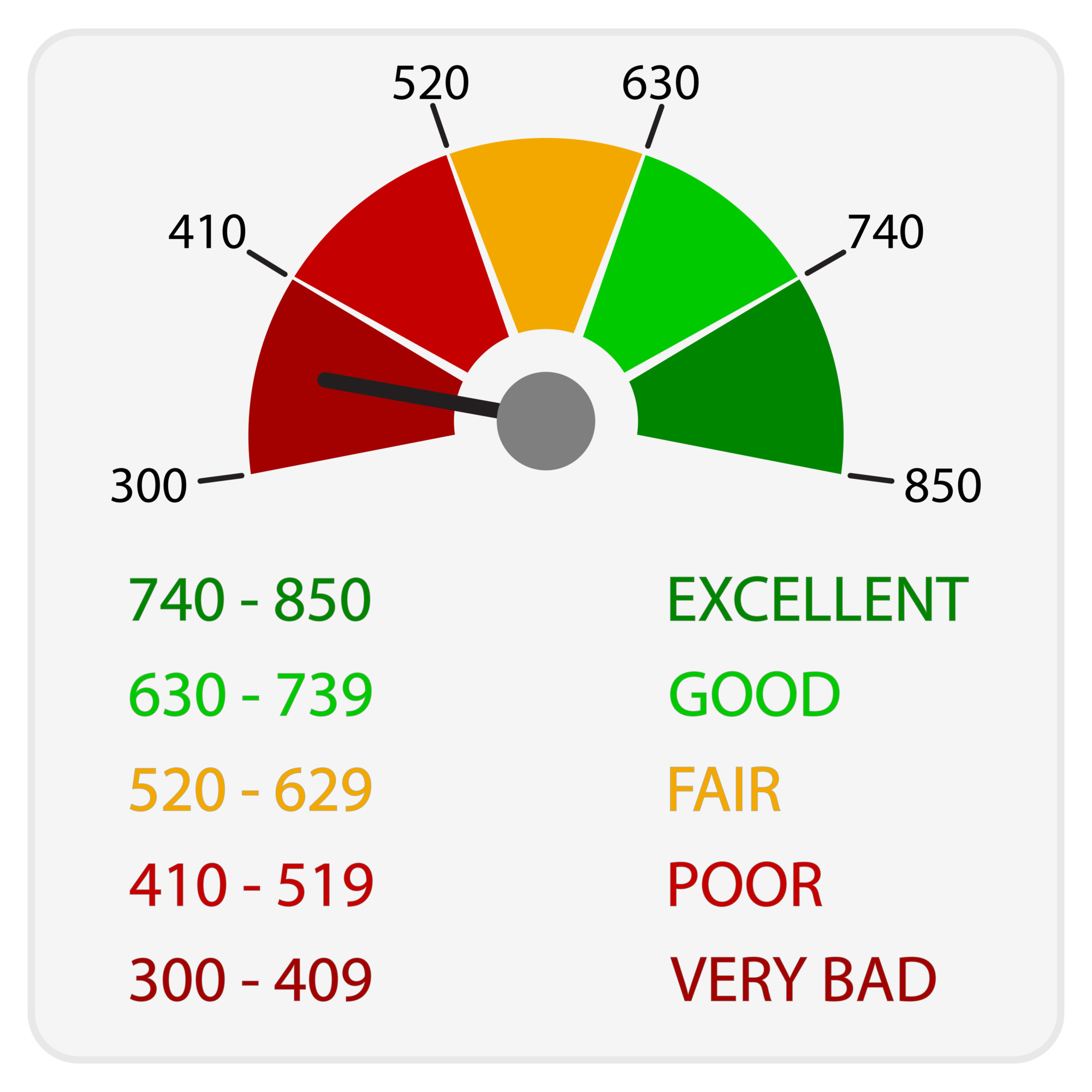

Repair And Improve Your Fico Credit Score Fast Elika New York The brand of credit score used in more than 90 percent of consumer credit decisions, the fico score, typically ranges from a low of 350 to a high of 850; good scores begin in the mid to high 600s. Card details. 1. pay all your bills on time. on time payment history is the most important factor when building credit. your payment history, which is one factor that makes up your fico score.

Repair And Improve Your Fico Credit Score Fast Elika New York Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. in fact, owing the same amount but having fewer open accounts. Diversify the types of credit you have. 5. limit new credit applications. 6. dispute inaccurate information on your credit report. 7. become an authorized user. there are several ways you can improve your credit score, including making on time payments, paying down balances, avoiding unnecessary debt and more. Just be sure you have the money in your account to cover them. 2. keep your balances and overall credit card debt low. ideally, the amount you borrow should be less than 30% of your available credit limit. this is called your credit utilization rate. so, if you have a card with a $5,000 limit, 30% of that is $1,500. Improving your fico credit score – step by step. 1. check your credit reports for accuracy. trying to improve your credit without checking your credit report is like embarking on a road trip.

Repair And Improve Your Fico Credit Score Fast Elika New York Just be sure you have the money in your account to cover them. 2. keep your balances and overall credit card debt low. ideally, the amount you borrow should be less than 30% of your available credit limit. this is called your credit utilization rate. so, if you have a card with a $5,000 limit, 30% of that is $1,500. Improving your fico credit score – step by step. 1. check your credit reports for accuracy. trying to improve your credit without checking your credit report is like embarking on a road trip. Below are some strategies to quickly improve your credit. selecting a few options that make sense for your current circumstances is a great way to build credit fast. 1. pay credit card balances. 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest.

How To Improve Your Credit Score Credit Below are some strategies to quickly improve your credit. selecting a few options that make sense for your current circumstances is a great way to build credit fast. 1. pay credit card balances. 5. get a credit card if you don’t have one. irresponsible use of a credit card can be a negative for your credit score and your finances. but used wisely, a credit card can be one of the fastest.

Comments are closed.