Pros And Cons Of Consolidating Student Loans Nerdwallet

Pros And Cons Of Student Loan Consolidation For Federal Loans Pro: you’ll have more time to pay off your debt. the amount of time you have to pay back your federally consolidated loan will depend on how much you owe: loan amount. term length. $7,499 and. 1. enter which loans you do — and do not — want to consolidate. 2. choose a repayment plan. you can either get a repayment timeline based on your loan balance or pick one that ties payments to.

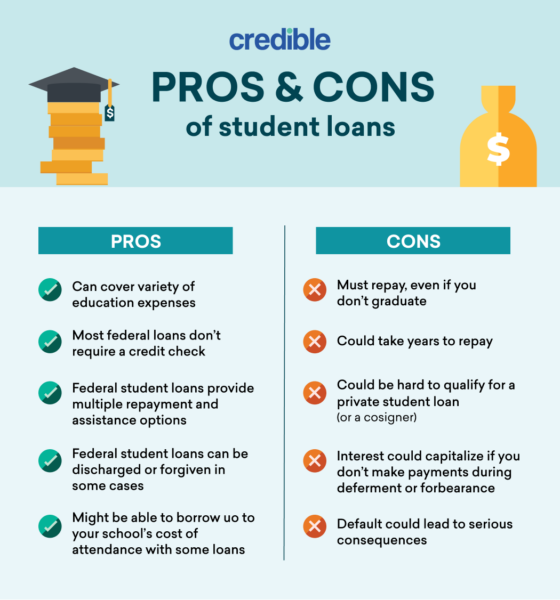

The Pros And Cons Of Student Loans Credible Consolidation is best as a strategic move. it bundles multiple federal loans into a new federal loan to let you make a single payment or qualify for government programs. student loan refinancing. Learn how consolidation works along with pros and cons. student loan consolidation refers to the process of combining multiple federal student loans into one new loan. while consolidation can’t. Here are the biggest pros: makes payment easy: the single, consolidated loan simplifies your student loan repayment with just one monthly bill — a perk for those dealing with different student. Step 1: determine if you have private or federal loans. if you’ve decided consolidation is right for you, the first step is determining if you have private or federal student loans. there are.

Comments are closed.