Payment Processing Basics What You Need To Know Storify Go

Payment Processing Basics What You Need To Know Storify Go Find the average number of transactions per month with 10,000 150, or about 67 monthly transactions. because the fee you pay for each transaction is 7¢, multiply .07 by 67 to find that you will pay about $5 in per transaction fees per month. then, add up all the scheduled monthly fees, and the annual fee of $170 12. Transaction authorization. the payment processor receives the transaction data from the payment gateway and validates the information. it then forwards the transaction details to the acquiring bank, which sends the information to the card network for validation and authorization. 4. issuing bank verification.

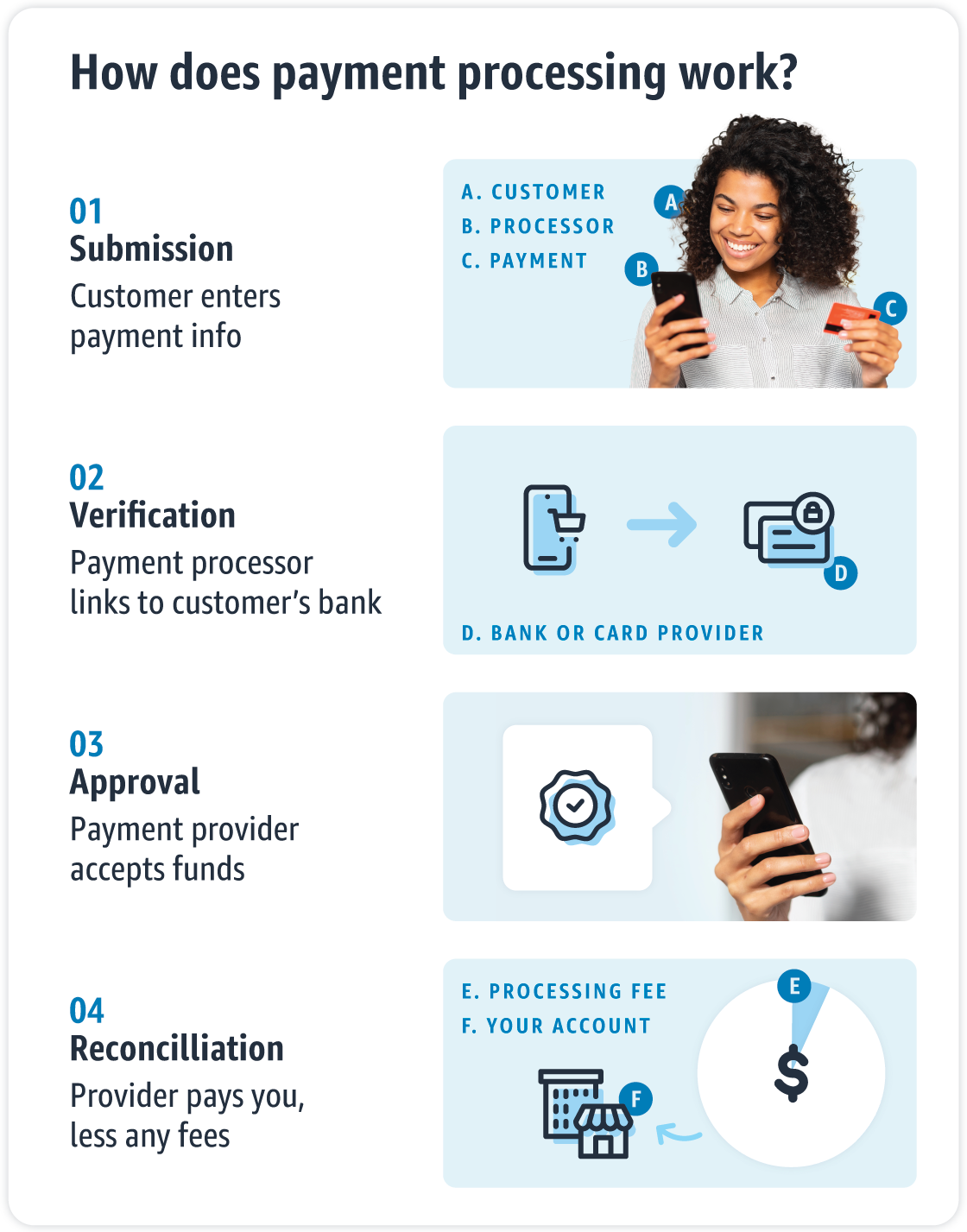

The Complete Guide To Payment Processing Amazon Pay The payment processing flow is a multi step process typically initiated by the customer making a payment using a debit or credit card, digital wallet or other payment method. here’s a breakdown of the flow: transaction initiation: the customer makes a purchase on the merchant’s website, chooses a payment method, and initiates the payment. Businesses are increasingly turning to online payment processing to meet growing customer demand. one recent study found that online payments are projected to reach $6.7 trillion globally by 2023. beyond accepting online payments, businesses should also provide exceptional customer experience, maximum flexibility, and strong security standards. Payment processing has a few different processes in between the order being placed and the store receiving the money. this includes a payment gateway and a payment processor, two seemingly similar but very different functions. these are the steps involved in payment processing: your customer submits their order. Payment processing is a really broad workflow that involves a bunch of different components working together effectively and efficiently to facilitate transactions between businesses and their customers. the payment processor (to be discussed shortly) is one of these components, but it is far from the only one.

Learn What Is Payment Processing How Does It Work How To Get One Payment processing has a few different processes in between the order being placed and the store receiving the money. this includes a payment gateway and a payment processor, two seemingly similar but very different functions. these are the steps involved in payment processing: your customer submits their order. Payment processing is a really broad workflow that involves a bunch of different components working together effectively and efficiently to facilitate transactions between businesses and their customers. the payment processor (to be discussed shortly) is one of these components, but it is far from the only one. Payment processing is how businesses complete card (debit and credit) transactions. it includes expedited card transactions and payment gateways securely transmitting data so money from a customer’s issuing bank can be easily and quickly transferred to the merchant’s account. all this happens in seconds. qn2. Let’s start with the basics. you may already know this, or are completely new to the topic. either way, the payment card industry covers the debit, credit, prepaid, e wallet, atm and pos cards associated with business. every payment method uses a very similar scheme, with small differences from one to another. once you make a payment, your.

Comments are closed.