Payment Delay Reduced Underscore

How To Reduce Payment Delays In Employee Vendor Supplier And Partner 10. incorrect invoice sent: sending out an invoice with errors, whether in the billing amount, customer details, or service descriptions, can lead to delays in payment as the customer seeks clarification or correction of the invoice. impact of delayed payments. the impact of delayed payments on businesses of all sizes is significant and. Maintaining a steady cash flow is essential to running a business, but keeping a steady revenue stream is more challenging. according to a pymnts report, 93% of companies experience late payments. payment delays pressure the accounts receivable (ar) and accounts payable (ap) teams. delayed payment can mean straining vendor relationships.

5 Strategies To Avoid Payment Delays вђў Paymo A sample of 509 firms spanning 2018–2021 is used for panel regression analysis. contrary to expectations, the covid 19 pandemic did not lead to longer payment times or reduced compliance with payment terms, which we attribute to state funded business supports and corporate decisions to accelerate payment to vulnerable suppliers. Financial instability among clients is a primary catalyst for payment delays. in challenging economic times or poor financial management, firms need help meeting their payment obligations. a linkedin study states customers will likely delay or reduce payment frequency during a cash flow crunch. in parallel, suppliers demand faster payments or. Mitigating these delays involves implementing specific actions and strategies that could encourage early payments, reduce late receivables, and foster strong client relationships. the following are some of the most effective tactics. a proactive approach to preventing payment delays is often a blend of human touch and technology based practices. Yes, you read that correctly! we use the rtp network and fednow service to move your money super fast. receiving instant payments with forwardly only costs 1% plus $1 per transaction, with a maximum cap of $10. if your bank doesn’t support these networks, we process your payment as a same day ach free of cost.

Mechanism To Protect Micro And Small Enterprises From Delayed Payment Mitigating these delays involves implementing specific actions and strategies that could encourage early payments, reduce late receivables, and foster strong client relationships. the following are some of the most effective tactics. a proactive approach to preventing payment delays is often a blend of human touch and technology based practices. Yes, you read that correctly! we use the rtp network and fednow service to move your money super fast. receiving instant payments with forwardly only costs 1% plus $1 per transaction, with a maximum cap of $10. if your bank doesn’t support these networks, we process your payment as a same day ach free of cost. Ensure sufficient resources: companies should ensure that they have sufficient resources to process payments quickly and efficiently. offer alternative payment methods: offering alternative payment methods, such as credit cards and e wallets, can help reduce payment delays. set up payment reminders: setting up payment reminders can help ensure. Ir 2023 221, nov. 21, 2023 — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service today released notice 2023 74 announcing a delay of the new $600 form 1099 k reporting threshold for third party settlement organizations for calendar year 2023.

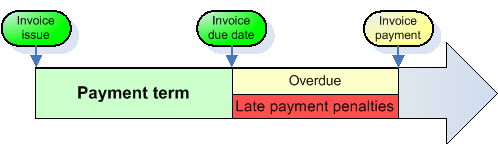

Late Payment Penalties How To Calculate And How To Apply Them Ensure sufficient resources: companies should ensure that they have sufficient resources to process payments quickly and efficiently. offer alternative payment methods: offering alternative payment methods, such as credit cards and e wallets, can help reduce payment delays. set up payment reminders: setting up payment reminders can help ensure. Ir 2023 221, nov. 21, 2023 — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service today released notice 2023 74 announcing a delay of the new $600 form 1099 k reporting threshold for third party settlement organizations for calendar year 2023.

Comments are closed.