New Fha Loan Modification Reduce Payment By 25 Stop Foreclosure

New Fha Loan Modification Reduce Payment By 25 Stop Ridofranz / Getty Images The Federal Housing Administration (FHA) cash-out refinance loan allows you to To make sure you can afford your new mortgage payment without getting in over your If you're facing foreclosure, you have options to put a stop you get a loan modification or ask you to sign your deed over to them If you have a Federal Housing Administration (FHA) or

Loan Modification How To Stop Foreclosure At The Last Minute If you're facing foreclosure, you have options to put a stop you get a loan modification or ask you to sign your deed over to them If you have a Federal Housing Administration (FHA) or Best mortgage lenders for low and no down payments Best for no down payment: Guild Mortgage Best for affordability: New American Funding combines a 35% FHA loan with a forgivable second Loans that are insured by the FHA have lower down payment requirements than conventional loans and tend to be a more affordable option for first-time homebuyers However, even an FHA loan has fees Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content Since 2004, she has worked with lenders, real estate agents, consultants

How To Avoid Foreclosure With Loan Modification Loans that are insured by the FHA have lower down payment requirements than conventional loans and tend to be a more affordable option for first-time homebuyers However, even an FHA loan has fees Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content Since 2004, she has worked with lenders, real estate agents, consultants These popular loans serve different types of buyers depending on credit score, down payment can use an FHA loan to finance a home with up to four units, whether existing or new construction Imagine the convenience of having one monthly student loan payment instead of seven It would save you time and help you stay on top of your payments so you don’t miss them or pay late However, more than 16% of new car buyers have monthly auto loan payments over $1,000, and the average payment for all borrowers financing a new car (regardless of credit score) is above $700 Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s

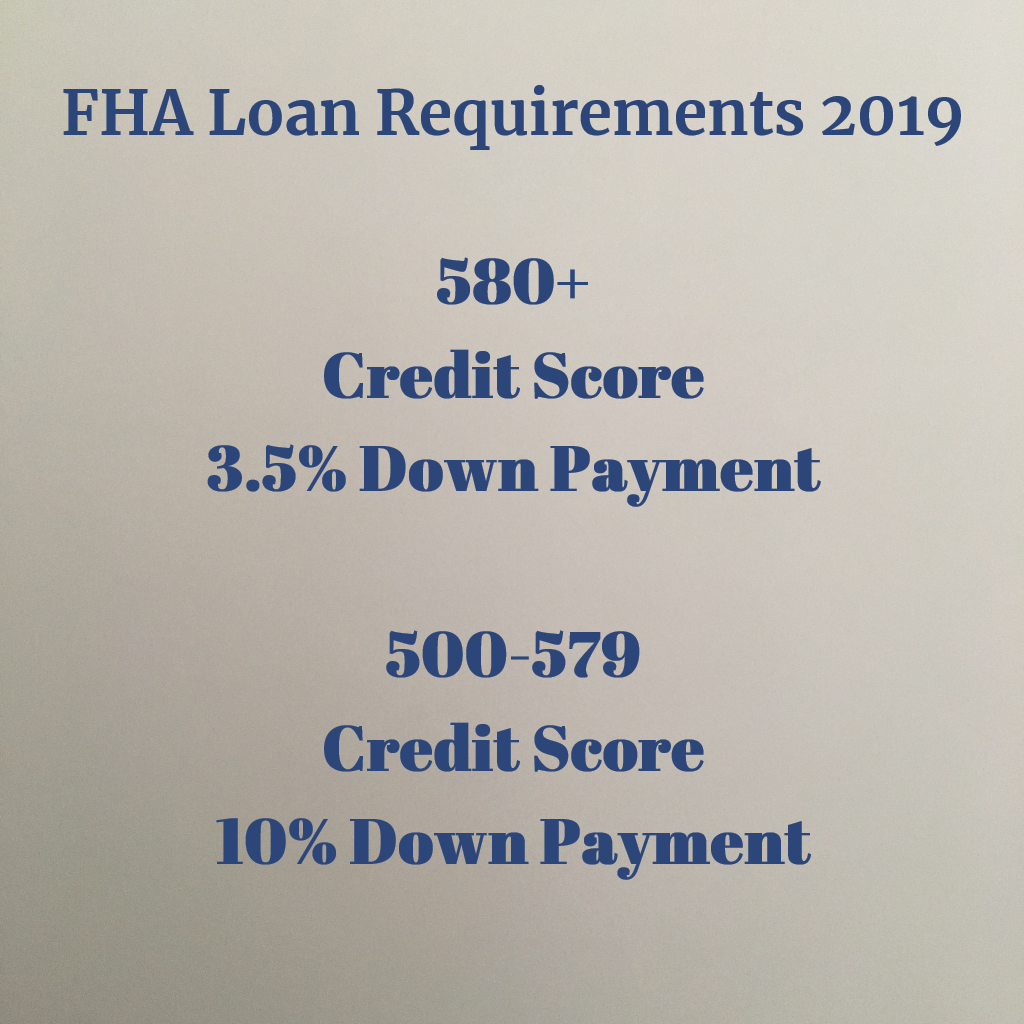

New Fha Guidelines 2019 Fha Loan Guidelines Credit Score And More These popular loans serve different types of buyers depending on credit score, down payment can use an FHA loan to finance a home with up to four units, whether existing or new construction Imagine the convenience of having one monthly student loan payment instead of seven It would save you time and help you stay on top of your payments so you don’t miss them or pay late However, more than 16% of new car buyers have monthly auto loan payments over $1,000, and the average payment for all borrowers financing a new car (regardless of credit score) is above $700 Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s However, more than 16% of new car buyers have monthly auto loan payments over $1,000, and the average payment for all borrowers Auto loan rates are expected to stop rising and possibly start

What Is Loan Modification Agreement Loan Modification Mortgage However, more than 16% of new car buyers have monthly auto loan payments over $1,000, and the average payment for all borrowers financing a new car (regardless of credit score) is above $700 Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s However, more than 16% of new car buyers have monthly auto loan payments over $1,000, and the average payment for all borrowers Auto loan rates are expected to stop rising and possibly start

Comments are closed.