Long Term Care Policy Guide вђ Long Term Care

Long Term Care Policy Guide вђ Long Term Care What does long term care in canada cost on average? here are some average costs to help you consider your future health needs and the type of care you want: $1,000 $6,000 month * for 24 7 care in an assisted living facility. $10 $200 hour * hourly rate for homemaking, personal care, and nursing care services. Long term care policy lab. the covid 19 pandemic has highlighted the ways people living in long term care (ltc) are vulnerable, and where care can be improved. as a result, many provinces and territories have been taking action to review their policies, processes and practices. to support the development and implementation of effective policies.

Nursing Policies And Procedures Manual For Long Term Care This article will a legal document that states how a person's property should be managed and distributed after death. provide a comprehensive guide to comparing different long term care policies, focusing on understanding the different types of policies, analyzing coverage options and benefits, reviewing elimination and benefit periods, and considering cost and affordability. 2. insurers cap your lifetime benefit. insurers used to offer unlimited benefits for long term care policies, but today, they usually limit payments to three to five years. you also pick the. A guide to the long term care homes act, 2007 and regulation 79 10 2 • residents’ councils; • family councils; • volunteers; • local health integration networks (lhins); and • community care access centres (ccacs). terminology in this guide, a “long term care home” will be referred to as a “home” for ease of reference. Once all the above questions have been answered, the policyholder and their family can make an informed decision about care options. when you are ready to file a claim for long term care insurance benefits, you will need to obtain and fill out an initial claim “packet” or claim initiation kit. each company’s insurance claim forms will be.

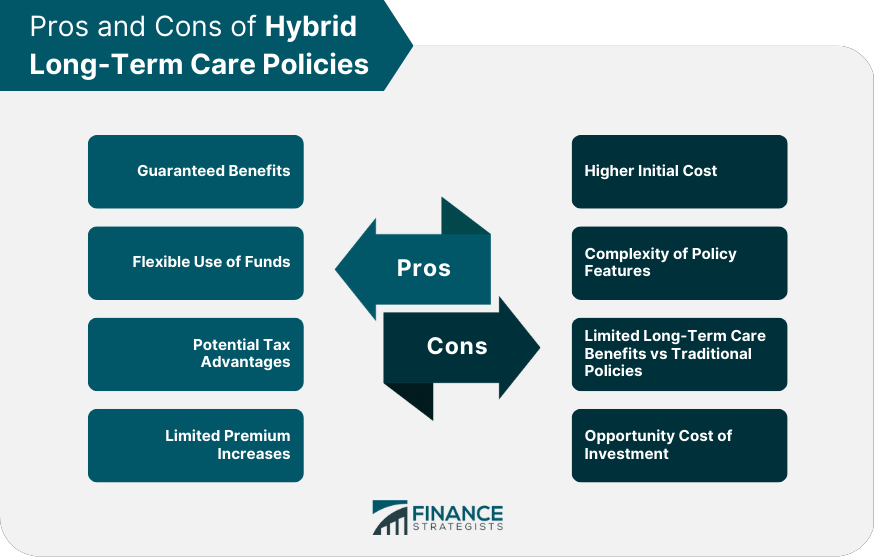

Hybrid Long Term Care Policies Meaning Types Pros Cons A guide to the long term care homes act, 2007 and regulation 79 10 2 • residents’ councils; • family councils; • volunteers; • local health integration networks (lhins); and • community care access centres (ccacs). terminology in this guide, a “long term care home” will be referred to as a “home” for ease of reference. Once all the above questions have been answered, the policyholder and their family can make an informed decision about care options. when you are ready to file a claim for long term care insurance benefits, you will need to obtain and fill out an initial claim “packet” or claim initiation kit. each company’s insurance claim forms will be. Ong term care. when the time comes for you to move to long term care, your case manager will guide you through the process, making sure you and your family know what to expect. each stage. if you don’t have a case manager, you can self refer by calling the community access intake centre for y. location. According to the american association for long term care insurance (aalci), in 2023 the average cost of long term care insurance is $900 a year for a 55 year old man for $165,000 of coverage. women pay significantly more in premiums. the average long term care insurance cost for a 55 year old woman is $1,500 a year for the same coverage. 2.

Comments are closed.