Irs Form W4 Married Filing Jointly Mistake

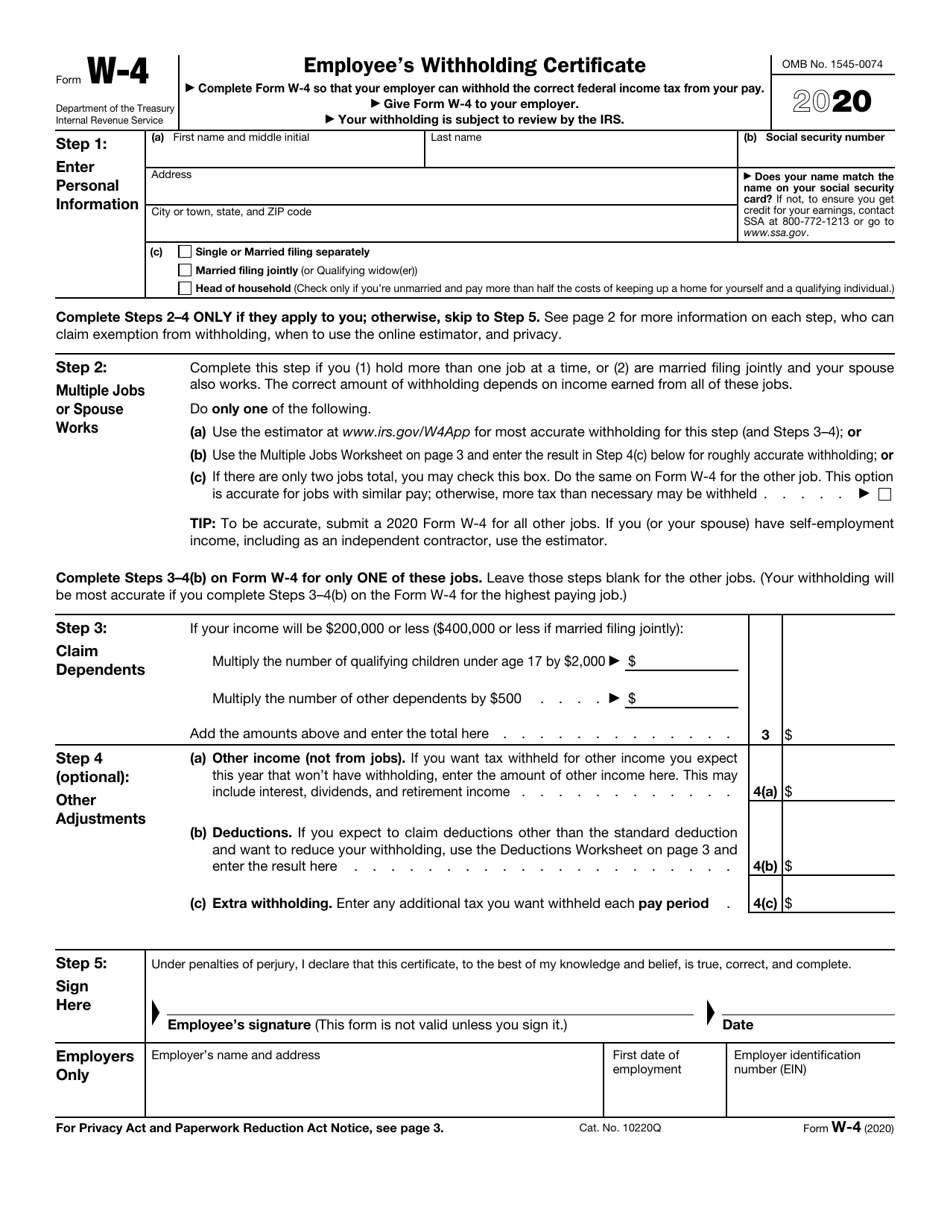

Irs Form W 4 2020 Fill Out Sign Online And Download Fillable Pdf 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

Free Printable W 4 Forms 2022 W4 Form Senior tax advisor. to fill out a w 4 when married filing jointly and both spouses work, both spouses fill out form w 4, both spouses check box 2 (c) in step 2, one spouse with the highest income claims any dependents in step 3, and each spouse fills out step 4 based on personal income. once complete, each spouse submits the w 4 to their employer. Your w 4 ($60k income): married filing jointly, $2,000 on line 3 for the child, $3,360 divided by your number of pay periods on line 4 (c). her w 4 ($35k income): married filing jointly, the rest blank. and add a direct deposit instruction to your pay to put $1,500 divided by your number of pay periods into a new savings account called "taxes". If you list your w 4 filing status as married (2019 version) or married filing jointly (2020 version), the irs is set up to assume that you are the sole breadwinner of your family. if both you and your spouse work, your household income is going to be a lot higher than your employer thinks, and you will not have enough withheld in taxes. If it doesn't, it could delay any tax refund. to update information, taxpayers should file form ss 5, application for a social security card. it is available on ssa.gov, by phone at 800 772 1213 or at a local ssa office. address – if marriage means a change of address, the irs and u.s. postal service need to know.

How To Fill Out Irs Form W4 Married Filing Jointly 20 Vrog If you list your w 4 filing status as married (2019 version) or married filing jointly (2020 version), the irs is set up to assume that you are the sole breadwinner of your family. if both you and your spouse work, your household income is going to be a lot higher than your employer thinks, and you will not have enough withheld in taxes. If it doesn't, it could delay any tax refund. to update information, taxpayers should file form ss 5, application for a social security card. it is available on ssa.gov, by phone at 800 772 1213 or at a local ssa office. address – if marriage means a change of address, the irs and u.s. postal service need to know. Step 1 – scroll down to page 4 of form w4 and find married filing jointly or qualifying surviving spouse table. step 2 – use the higher paying and lower paying job amounts to determine the appropriate amount and enter it on line 1 step 2 (b). step 3 – skip the three jobs section and go to line 3 of step 2 (b) to enter the number of pay. Step 2: account for multiple jobs. if you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding. for the highest paying job.

How To Fill Out Irs Form W4 Married Filing Jointly 20 Vrog Step 1 – scroll down to page 4 of form w4 and find married filing jointly or qualifying surviving spouse table. step 2 – use the higher paying and lower paying job amounts to determine the appropriate amount and enter it on line 1 step 2 (b). step 3 – skip the three jobs section and go to line 3 of step 2 (b) to enter the number of pay. Step 2: account for multiple jobs. if you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding. for the highest paying job.

How To Fill Out Irs Form W 4 2020 Married Filing Jointly в

Comments are closed.