How To Use A 529 Plan To Save For College

How To Maximize College Savings With A Savvy 529 Plan Withdraw funds only for qualified expenses. you can use funds from a 529 account for a wide range of qualified education related expenses. that includes tuition, fees, books, supplies, and. Montana montana offers the achieve montana 529 plan. nebraska nebraska offers the nest 529 plan and the td ameritrade 529 college savings plan. nevada nevada offers three 529 plans (including vanguard) and a prepaid tuition program. new hampshire new hampshire offers the unique college investing plan.

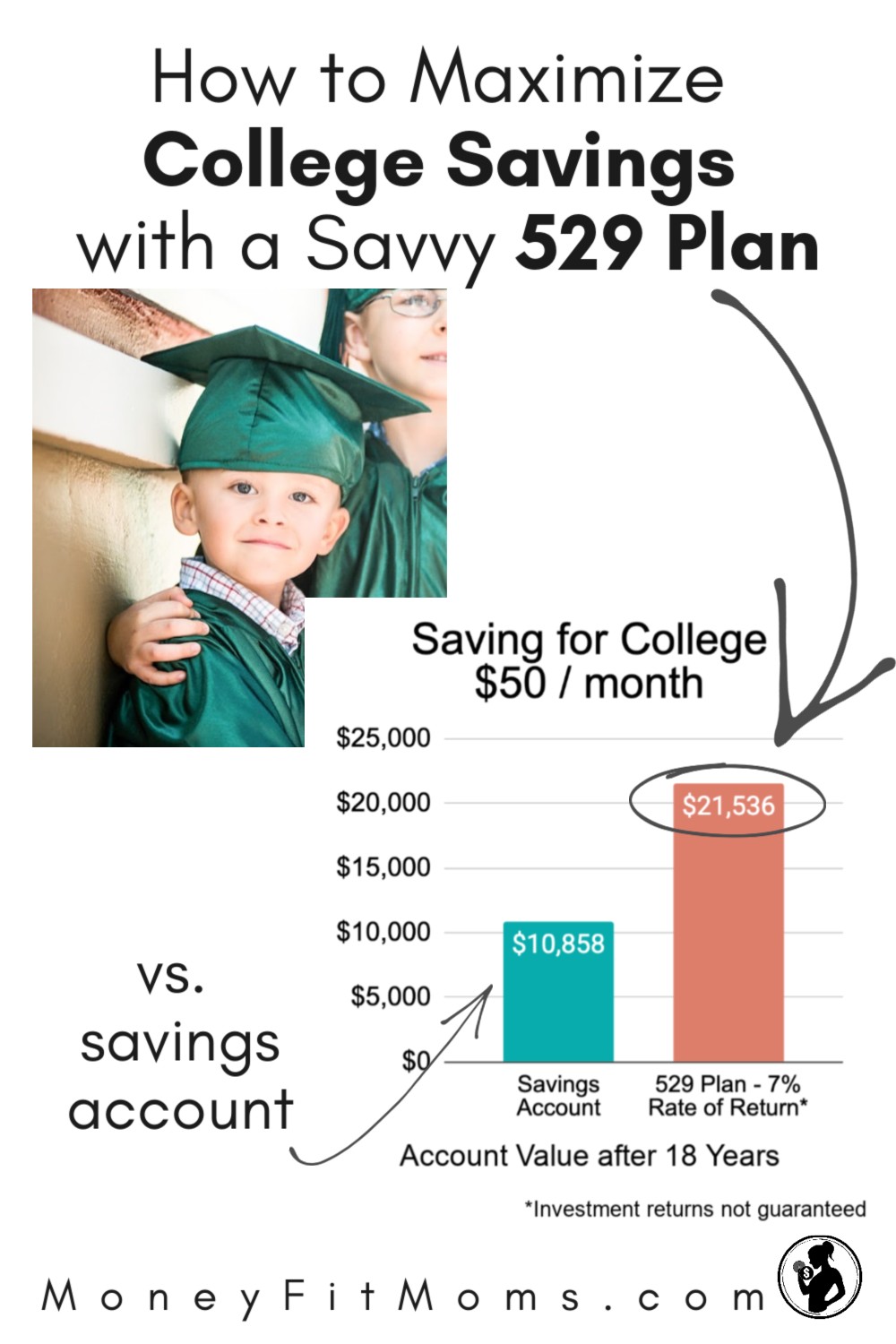

Saving For College How To Use 529 Plans Saving For College Change the beneficiary to a qualifying family member who will use the funds for college; save the funds for a future grandchild; the bottom line. your 529 plan is an excellent asset to your children’s college education. however, you must follow its scrupulous rules to maintain your savings and tax free benefits when you withdraw funds for school. An annual withdrawal limit of $10,000 is applied to 529 plans for k 12 tuition expenses. if you’re using 529 plan funds to pay student loan debt, there is a lifetime withdrawal limit of $10,000. Using a 529 college savings plan when saving for future education expenses can be an attractive option, as investments in the plan can grow tax free. in this guide, you'll find what you need to. A 529 plan is a tax advantaged vehicle to save for college and trade and vocational courses participating in u.s. department of education student aid programs. you can even apply 529 funds to.

What Is A 529 College Savings Plan And How It Can Solve The Student Using a 529 college savings plan when saving for future education expenses can be an attractive option, as investments in the plan can grow tax free. in this guide, you'll find what you need to. A 529 plan is a tax advantaged vehicle to save for college and trade and vocational courses participating in u.s. department of education student aid programs. you can even apply 529 funds to. 529 plans don’t have any time limits. if you have leftover money in your 529 college savings plan after you graduate, you can use that money to pay off all or part of your student loan debt. this change was introduced as part of the 2019 secure act, which applies to all 529 plan distributions made after december 31, 2018. See the best 529 plans, personalized for you. get started. learn about saving for college, 529 plans, financial aid, scholarships, fafsa and student loans. calculate college costs, loan payments, savings goals and sai.

Comments are closed.