How To Swing Trade Stocks Examples Tips Cmc Markets

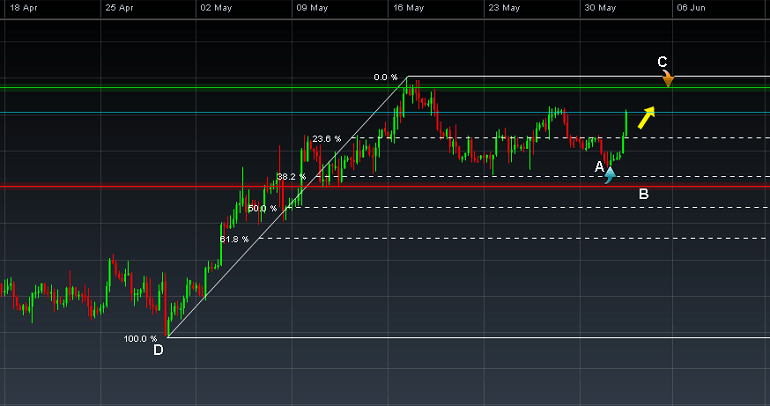

How To Swing Trade Stocks Examples Tips Cmc Markets The three most important points on the chart used in this example include the trade entry point (a), exit level (c) and stop loss (b). any swing trading system should include these three key elements. guide to diagram: a – trade entry point. b – stop loss. c – price forecast (exit level). Swing trading example. source: cmc markets. guide to diagram: a – trade entry point. b – stop loss. c – price forecast (exit level) d – fibonacci technical analysis. there are numerous strategies you can use to swing trade stocks. in this example we've shown a swing trade based on trading signals produced using a fibonacci retracement.

How To Swing Trade Stocks Examples Tips Cmc Markets A swing trading strategy involves traders ‘buying’ a security when they suspect that the market will rise, or ‘selling’ an asset when they suspect that the price will fall. swing traders can take advantage of the market’s fluctuations as the price swings back and forth, from an overbought to oversold state. Discover how to swing trade stocks in our trading guide that includes 5 swing trading strategies that can enhance your trading knowledge. find out more here. This will be the settings we use for all the coming backtests in the article. swing trading strategy backtest. 2. double seven. this is another swing trading strategy that uses mean reversion. the strategy rules are as follows: enter when the market is above its 200 day moving average and performs a new 7 day low. How to find stocks to swing trade. the first thing you want to do is see if there are any upcoming events, such as earnings. you can do this by going on the company website, or earningswhispers. next, you want to see if there are any news events. generally, a catalyst will help stocks move.

Swing Trading Strategies Tips Indicators Cmc Markets This will be the settings we use for all the coming backtests in the article. swing trading strategy backtest. 2. double seven. this is another swing trading strategy that uses mean reversion. the strategy rules are as follows: enter when the market is above its 200 day moving average and performs a new 7 day low. How to find stocks to swing trade. the first thing you want to do is see if there are any upcoming events, such as earnings. you can do this by going on the company website, or earningswhispers. next, you want to see if there are any news events. generally, a catalyst will help stocks move. My analysis, research, and testing stems from 25 years of trading experience and my certification with the international federation of technical analysts. the five important swing trading strategies are trend following, support and resistance, breakouts, momentum, and reversals. automating the identification, testing, and execution of these. Quick introduction. a swing trader seeks to capture gains by holding an instrument anywhere from overnight to several weeks. the primary objective is to profit from price oscillations or ‘swings’ that occur as assets fluctuate between support and resistance levels or within well defined technical patterns.

Comments are closed.