How To Lower Property Taxes In Nj Staybite11

How To Lower Property Taxes In Nj Staybite11 The new jersey globe was the first to report on the deal. how much? eligible residents aged 65 and older would receive a benefit up to a maximum of $6,500 per year, beginning in 2026. (the. Walk through the home with the tax assessor during the evaluation process. make sure to point out the properties, good and bad, for the fairest possible valuation for your home. keep in mind that you do not have to allow the tax assessor into your home. however, if you do not permit access to the interior, an assessor assumes you’ve made.

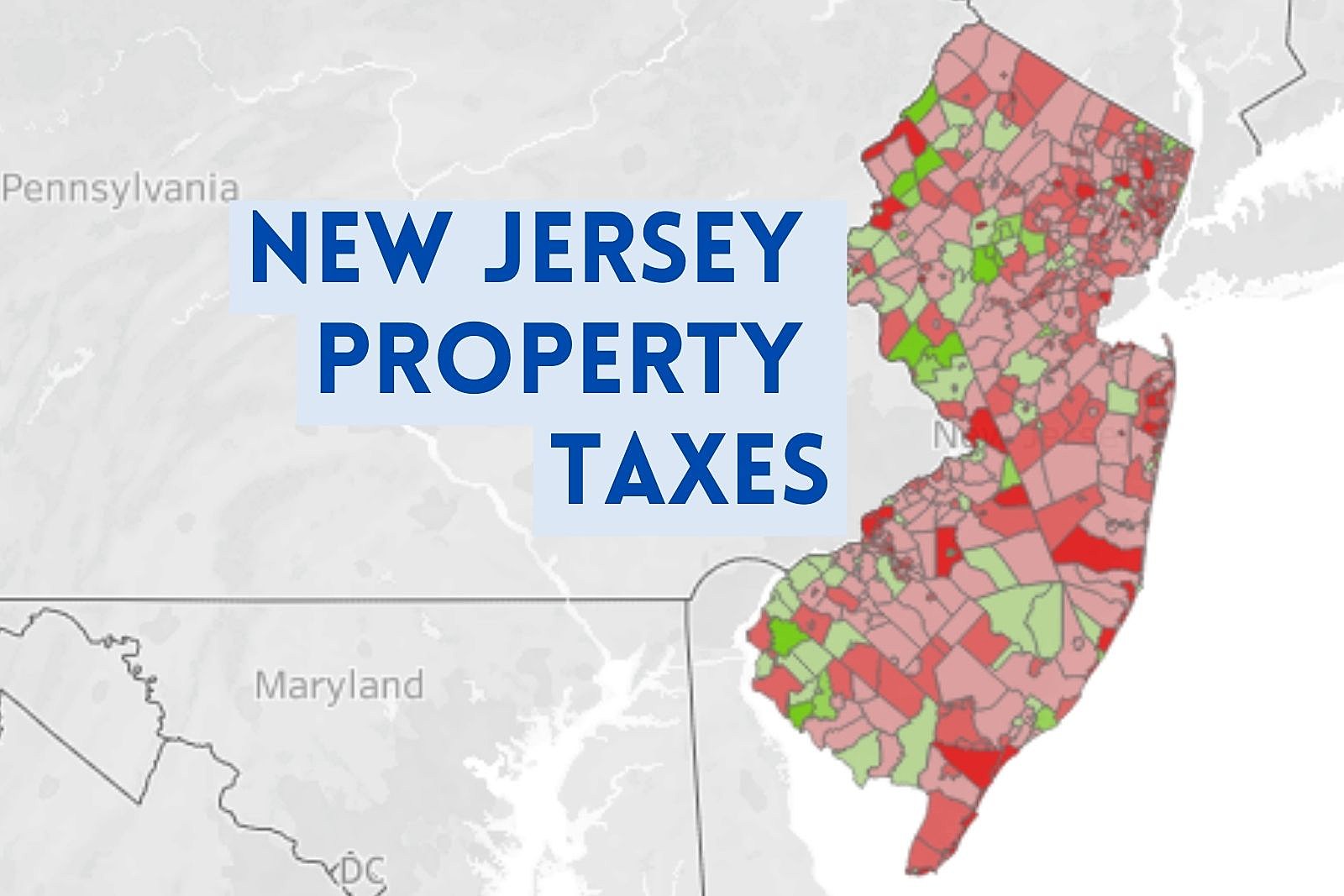

How To Lower Property Taxes In Nj Staybite11 A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older, up to a maximum of $6,500 annually. right now, senior homeowners making up to $500,000 annually would be eligible for the promised benefits. the cost of stay nj could eventually rise to. About the stay nj property tax credit program. governor phil murphy signed the stay nj act (p.l. 2023, ch. 75) into law in july of 2023, authorizing the creation of the stay nj task force. the task force is charged with putting forth recommendations on how to implement the new stay nj property tax relief program, restructure and consolidate the. Basic homestead rebate or credit. many new jersey homeowners are entitled to a rebate or credit that's a percentage of the first $10,000 in property tax that they paid last year. the percentage depends on the owner's annual income (the higher your income, the lower the percentage). if your annual income exceeds $250,000, you will not qualify. New jersey property tax reassessments: a detailed guide for homeowners. according to the latest data from the tax foundation, the average property tax bill in new jersey is $9,279 per year. this is the highest average property tax bill in the nation. in 2022, new jersey homeowners paid an average of 2.3% of their household income in property taxes.

How To Lower Property Taxes In Nj Staybite11 Basic homestead rebate or credit. many new jersey homeowners are entitled to a rebate or credit that's a percentage of the first $10,000 in property tax that they paid last year. the percentage depends on the owner's annual income (the higher your income, the lower the percentage). if your annual income exceeds $250,000, you will not qualify. New jersey property tax reassessments: a detailed guide for homeowners. according to the latest data from the tax foundation, the average property tax bill in new jersey is $9,279 per year. this is the highest average property tax bill in the nation. in 2022, new jersey homeowners paid an average of 2.3% of their household income in property taxes. The homeowner’s maximum stay nj benefit would be $5,000, or 50% of the tax bill. the homeowner also qualifies for a $1,750 anchor benefit and a $1,000 senior freeze benefit, which add up to. Though you might not think so, mistakes are common. if you find them, the township or city must correct them. 2. don't build. any structural changes to a home or property will increase your tax.

Comments are closed.