How To Get A Higher Credit Limit On Your Credit Card Improve Credit

How To Increase Your Credit Limit Score Lexington Law The number one downside of increasing your credit card limit is that you could start to spend more – due to the available credit – and therefore your credit card balance could increase. you owe more! that could mean you get into more debt, if you don’t manage it, which could have a negative impact on your credit score. A higher credit limit also increases your target credit utilization rate. for example, having a credit limit of $10,000 means you can spend between $1,500 and $3,000 at a rate of 15% to 30%. to.

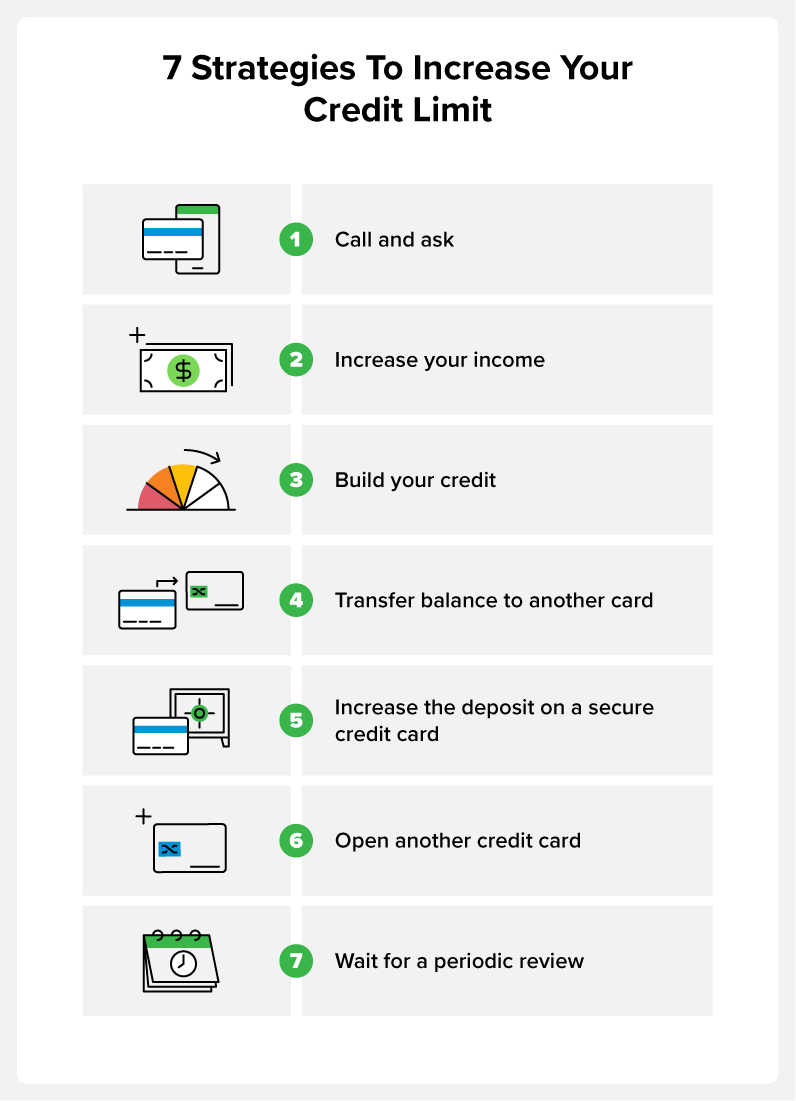

What Is The Average Credit Card Limit Credit Call your card issuer. call the number on the back of your card and ask a customer service representative whether you're eligible for a higher credit limit. the rep may ask the reason for your. Borrowing more than the authorized limit on a credit card may lower your credit score. try to use less than 30% of your available credit. it’s better to have a higher credit limit and use less of it each month. for example, suppose you have a credit card with a $5,000 limit and an average borrowing amount of $1,000. A good rule is to keep your credit utilization rate at 30% or lower. thus, if you have a $5,000 limit, this means carrying a $1,500 balance or less. if your credit limit was increased to $10,000. A credit limit is the maximum amount of money a person can spend when using a credit card. for example, if a credit card has a credit limit of $5,000, then the cardholder can make up to $5,000 in transactions on the card before they are unable to use it further. once the cardholder has reached the credit limit, they must pay down their balance.

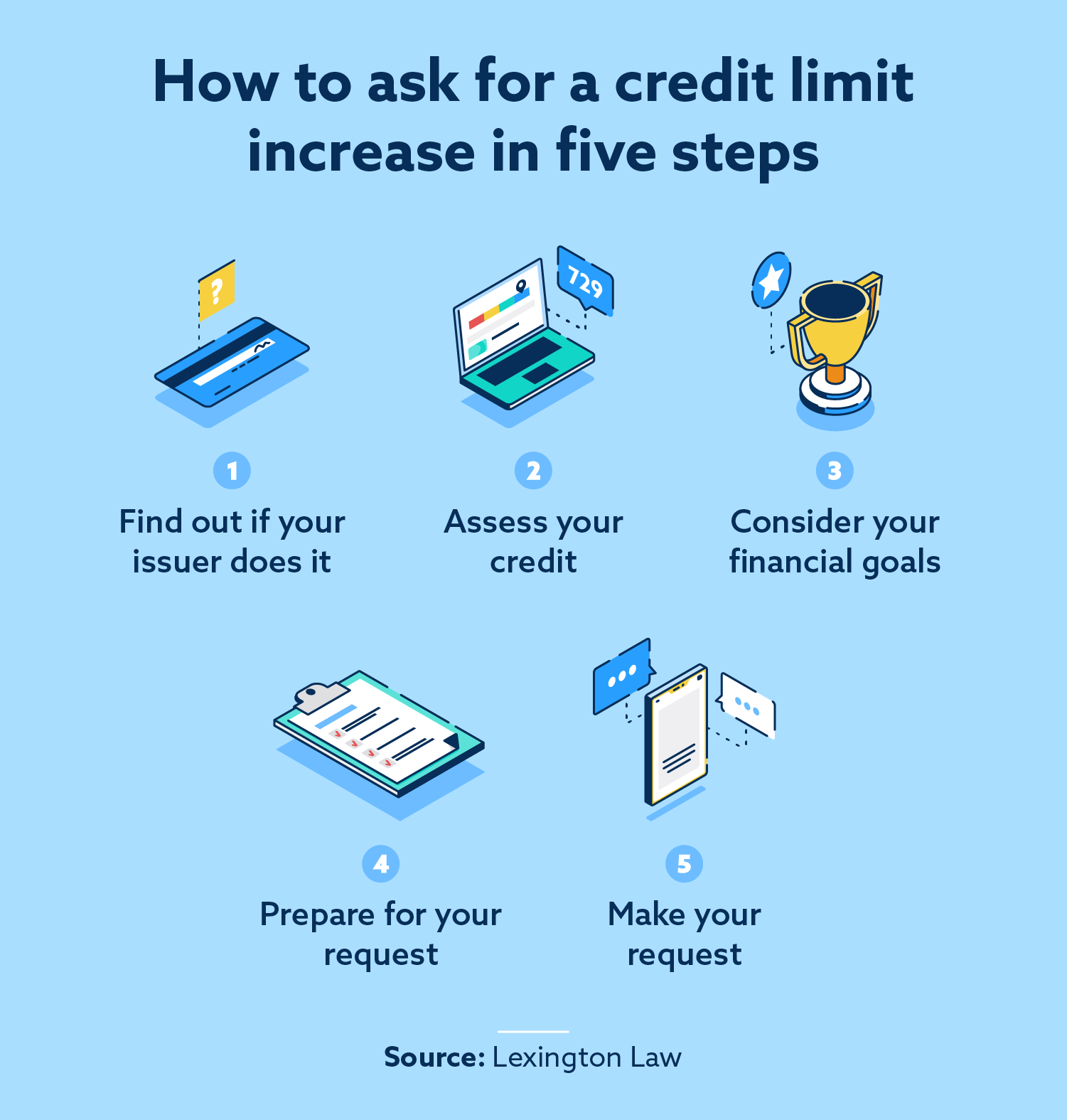

What Is Credit Limit How To Increase Credit Card Limit Paytm Blo A good rule is to keep your credit utilization rate at 30% or lower. thus, if you have a $5,000 limit, this means carrying a $1,500 balance or less. if your credit limit was increased to $10,000. A credit limit is the maximum amount of money a person can spend when using a credit card. for example, if a credit card has a credit limit of $5,000, then the cardholder can make up to $5,000 in transactions on the card before they are unable to use it further. once the cardholder has reached the credit limit, they must pay down their balance. On time payments, longer credit history and paying down other debts will all improve your credit. making timely mortgage payments, paying off other debt or reducing the principal on your car loan. Request online. many card issuers make it easy to ask for a credit limit increase. all you have to do is log into your account online and navigate to the card services page. here, you may find an.

Comments are closed.