How To Find Your Student Loan Servicer

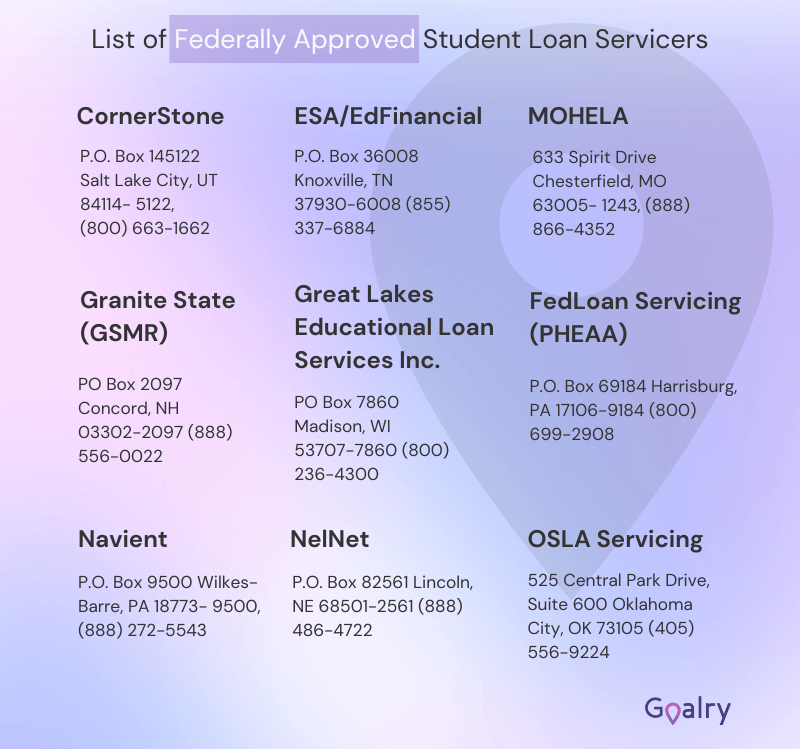

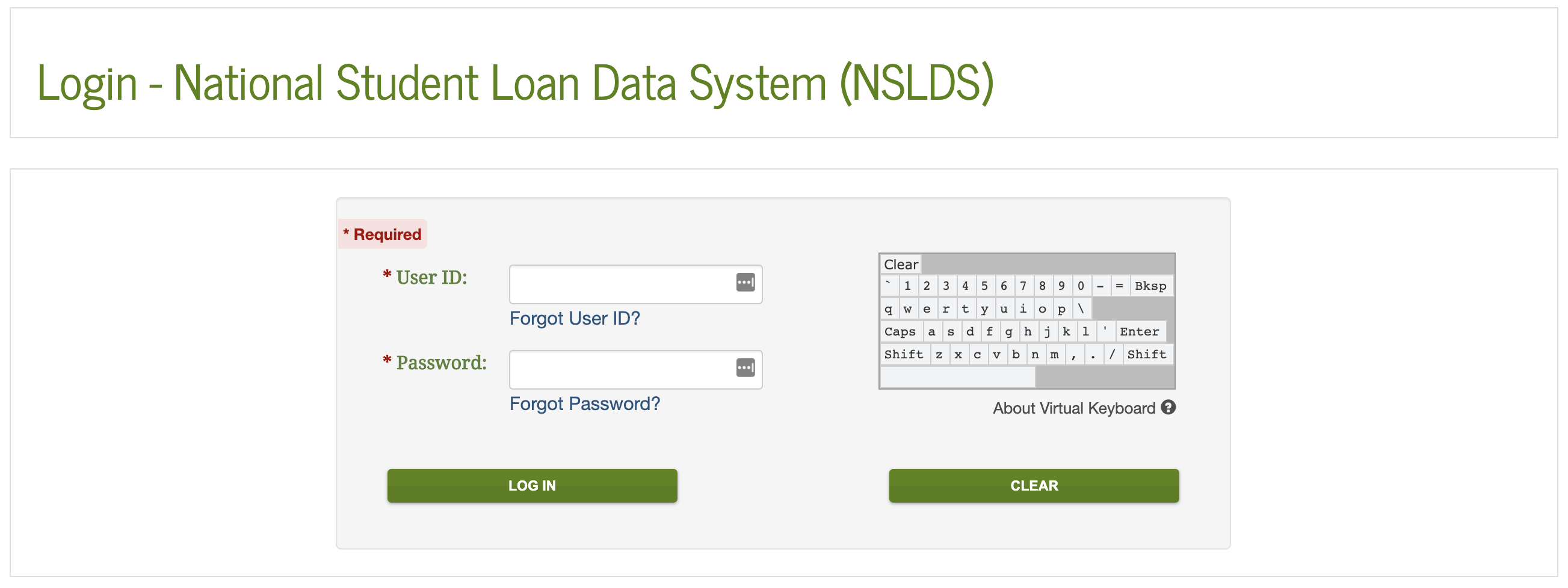

How To Find Your Student Loan Servicer Smart Tips Loanry When you start repaying your debt depends on the type of student loans you have, your lender, and other factors Learn more about starting loan repayments If you have federal student loans and are unsure of your servicer, visit StudentAidgov Log in to your account dashboard and find the “My Loan Servicers” section Alternatively, you can contact the

How To Find Your Student Loan Servicer Tuition Io President Joe Biden made student loan forgiveness a top priority during his term in office, but his efforts have not been without challenges Despite courts blocking several propo Navient is a student loan servicer — a company that acts as a middleman between borrowers and lenders It handles administrative tasks such as sending bills, collecting payments, enrolling borrowers Federal student loan borrowers need to start making payments in October, otherwise their credit score will take a serious hit NerdWallet Congratulations on your college graduation! Now, get ready for your next milestone: student loan repayment Most student loan borrowers get a six-month grace period after graduating or

How To Find Your Student Loan Servicer Smart Tips Loanry Federal student loan borrowers need to start making payments in October, otherwise their credit score will take a serious hit NerdWallet Congratulations on your college graduation! Now, get ready for your next milestone: student loan repayment Most student loan borrowers get a six-month grace period after graduating or The Consumer Financial Protection Bureau reached a $120 million settlement with Navient that may lead to compensation for hundreds of thousands of borrowers The political battle over education debt will continue no matter who wins the White House, so if you’re waiting for relief, it’s best to have a backup plan There is no need for a co-signer or the need for a family member to help you apply However, you could be subject to higher rates with these best refinance student loans The company has been banned from servicing federal student loans and must pay $100 million to harmed borrowers, as well as a $20 million penalty

How To Find Your Student Loan Servicer Smart Tips Loanry The Consumer Financial Protection Bureau reached a $120 million settlement with Navient that may lead to compensation for hundreds of thousands of borrowers The political battle over education debt will continue no matter who wins the White House, so if you’re waiting for relief, it’s best to have a backup plan There is no need for a co-signer or the need for a family member to help you apply However, you could be subject to higher rates with these best refinance student loans The company has been banned from servicing federal student loans and must pay $100 million to harmed borrowers, as well as a $20 million penalty If approved by a court, the agreement with Navient could result in $100 million in monetary compensation for student loan borrowers The settlement resolves a lawsuit filed by the Consumer Financial Protection Bureau in 2017, which claimed the company led borrowers astray

How To Find Your Federal Student Loan Servicer Youtube There is no need for a co-signer or the need for a family member to help you apply However, you could be subject to higher rates with these best refinance student loans The company has been banned from servicing federal student loans and must pay $100 million to harmed borrowers, as well as a $20 million penalty If approved by a court, the agreement with Navient could result in $100 million in monetary compensation for student loan borrowers The settlement resolves a lawsuit filed by the Consumer Financial Protection Bureau in 2017, which claimed the company led borrowers astray

Comments are closed.