How To Fill Out The New 2020 W 4 Form Very Detailed Examples

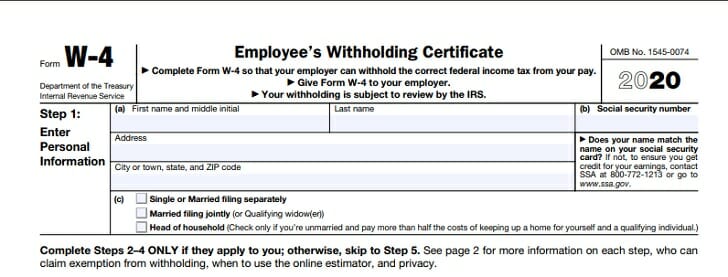

How To Fill Out The New 2020 W 4 Form Very Detailed Examples 2020 W How to fill out 2020 w 4 form by paper or using the irs w 4 app. (this video is loaded with detail to help you learn how the 2020 w 4 works) (2020 w 4 explai. The 2020 w 4 does not have a specific labeled spot to record this. an employee who qualifies for exemption, steps 1 (a), 1 (b), which is their name, address, and social security number, and step 5 (signature). beneath section 4 (c) and above the line that begins step 5. it should be noted that these employees will need to submit a new form w 4.

How To Fill Out The W 4 Form New For 2020 Smartasset The old form w 4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. step 2 of the redesigned form w 4 lists three different options you should choose from to make the necessary withholding adjustments. note that, to be accurate, you should furnish a 2020 form w 4 for all of these jobs. A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax. As with the prior version of the form, the new w 4 allows you to claim exempt status if you meet certain requirements. in 2019 and years prior, form w 4 only required you to input: the number of allowances you were claiming. any additional amount you wanted to be withheld from your paycheck. to calculate the number of allowances, you could use. Learn about the changes made to the w 4, including whether you can still claim 1 or 0. the balance is part of the dotdash meredith publishing family. the irs significantly updated the w 4 form to make it easier to fill out and give you more control over your withholding. learn how to complete it.

How To Fill Out The Updated 2020 W 4 Form Youtube As with the prior version of the form, the new w 4 allows you to claim exempt status if you meet certain requirements. in 2019 and years prior, form w 4 only required you to input: the number of allowances you were claiming. any additional amount you wanted to be withheld from your paycheck. to calculate the number of allowances, you could use. Learn about the changes made to the w 4, including whether you can still claim 1 or 0. the balance is part of the dotdash meredith publishing family. the irs significantly updated the w 4 form to make it easier to fill out and give you more control over your withholding. learn how to complete it. Complete steps 3–4(b) on form w 4 for only one of these jobs. leave those steps blank for the other jobs. (your withholding will be most accurate if you complete steps 3–4(b) on the form w 4 for the highest paying job.) step 3: claim dependents. if your income will be $200,000 or less ($400,000 or less if married filing jointly):. The current form no longer focuses on personal and dependent exemptions as they have been suspended through 2025 tax years. form w 4 takes you through 5 quick steps that gather the information needed to estimate more accurate withholding. step 1. here you enter your personal information.

Comments are closed.