How To Fill Out Irs Form W4 Married Filing Jointly 2023

How To Fill Out Irs Form W4 Married Filing Jointly 2023 Youtube Senior tax advisor. to fill out a w 4 when married filing jointly and both spouses work, both spouses fill out form w 4, both spouses check box 2 (c) in step 2, one spouse with the highest income claims any dependents in step 3, and each spouse fills out step 4 based on personal income. once complete, each spouse submits the w 4 to their employer. Step 4 of form w4 lets you withhold tax from other income you’ll earn during the year, such as interest, retirement, or dividends. you can enter the full amount of such income in the 4 (a) field. the standard deduction for 2023 for taxpayers with married filing jointly filing status is $27,700. enter this amount in the 4 (b) field and proceed.

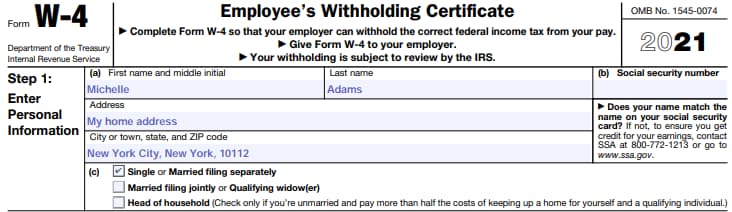

How To Fill Out W 4 Form Married Filing Jointly 2023 2023 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074. Step 2: account for multiple jobs. if you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding. for the highest paying job. To withhold the maximum amount on your w 4, fill in step 4 (a) with the amount of other income. if you make $10,000 this year from other income sources, you are in the 22% tax bracket, and you are paid bimonthly, then you should put $92 on line 4 (a) (10,000 * 0.22 24 = 91.67). Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

Comments are closed.