How To Fill Out Form W4 2024 Single Head Of Household Married

How To Fill Out Form W4 2024 Single Head Of Household Married How to fill out form w4 2024 single, head of household, married filing joint dependentslearn how to fill out form w4 based on your specific income and fi. Step 2: account for multiple jobs. if you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding. for the highest paying job.

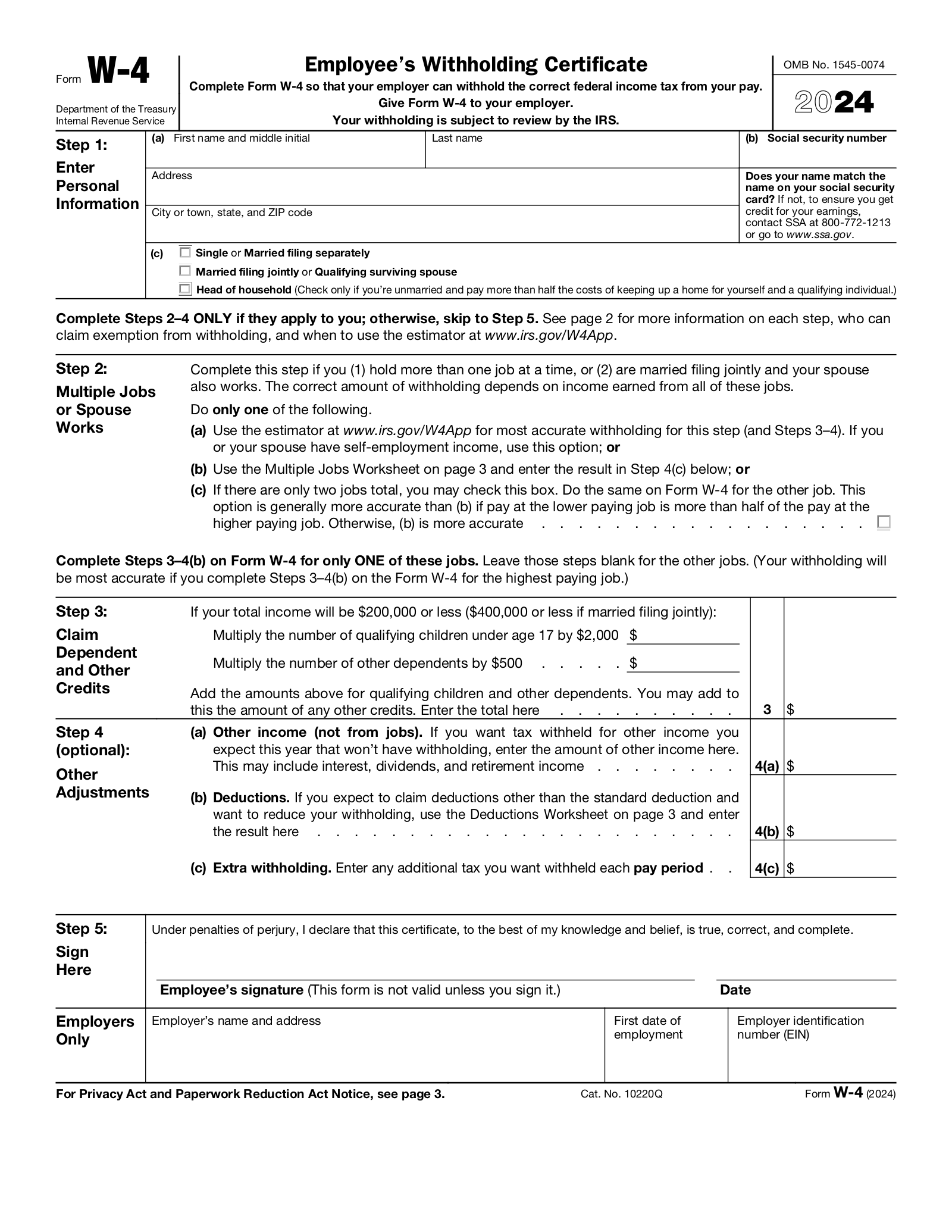

How To Fill Out An Irs W 4 Form 2024 Single Employee Head Complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. 2024. step 1: enter personal information. first name and middle initial. last name. (b) social security number. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Ensure you have the latest w 4 form from the irs website or your employer to report your income accurately. step 2: fill out separate forms for each job. complete a w 4 form for each employer if you have multiple jobs, as each employer needs to withhold taxes separately. step 3: review previous year's tax return. Step by step guide on how to accurately fill out the irs w 4 form, including tips for dealing with multiple jobs, claiming dependents, and utilizing deductio.

W4 Form 2024 Married Filing Jointly Nita Myrtle Ensure you have the latest w 4 form from the irs website or your employer to report your income accurately. step 2: fill out separate forms for each job. complete a w 4 form for each employer if you have multiple jobs, as each employer needs to withhold taxes separately. step 3: review previous year's tax return. Step by step guide on how to accurately fill out the irs w 4 form, including tips for dealing with multiple jobs, claiming dependents, and utilizing deductio. Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents. How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form.

Free Irs Form W4 2024 Pdf вђ Eforms Step 3: claim dependents and children. if you earn less than $200,000 per year as a single filer or less than $400,000 per year if married filing jointly, you can follow the steps on your w 4 form to include the $2,000 in credit for each dependent under 17 years of age and $500 for other dependents. How to fill out the w 4 form (2024) the redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form.

How To Fill In 2024 W 4 Form Step By Step Instructions

Comments are closed.