How To Determine Deductions On W4

How To Determine Deductions On W4 The tax withholding estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. we don't save or record the information you enter in the estimator. for details on how to protect yourself from scams, see tax scams consumer alerts. check your w 4 tax withholding with the irs tax. Step 2: account for multiple jobs. if you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding. for the highest paying job.

:max_bytes(150000):strip_icc()/Deductions-Worksheet-3ac3d23a5f51472e98e676fcc3f88fcf.jpg)

How To Determine Deductions On W4 Take these steps to fill out your new w 4. 1. download and print a blank 2024 w 4 form. 2. fill in the fields using the info from the calculator. 3. give it to your employer as soon as possible. print a blank w 4. Adjust your withholdings with our w 4 refund calculator. your w 4 directly affects your paycheck amount and potential tax refund. use our w 4 tax withholding estimator to change your withholdings at any time and find the best fit for you. we’ll even help fill out your w 4 form (s). calculate my w 4. The amount withheld depends on: the amount of income earned and. three types of information an employee gives to their employer on form w–4, employee's withholding allowance certificate: filing status: either the single rate or the lower married rate. number of withholding allowances claimed: each allowance claimed reduces the amount withheld. Prior to 2020, a withholding allowance was a number on your w 4 form that your employer used to determine how much federal and state income tax to withhold from your paycheck. the more allowances you claimed on your form w 4, the less income tax would be withheld from each paycheck. beginning in 2020, the irs completely reworked form w 4 to.

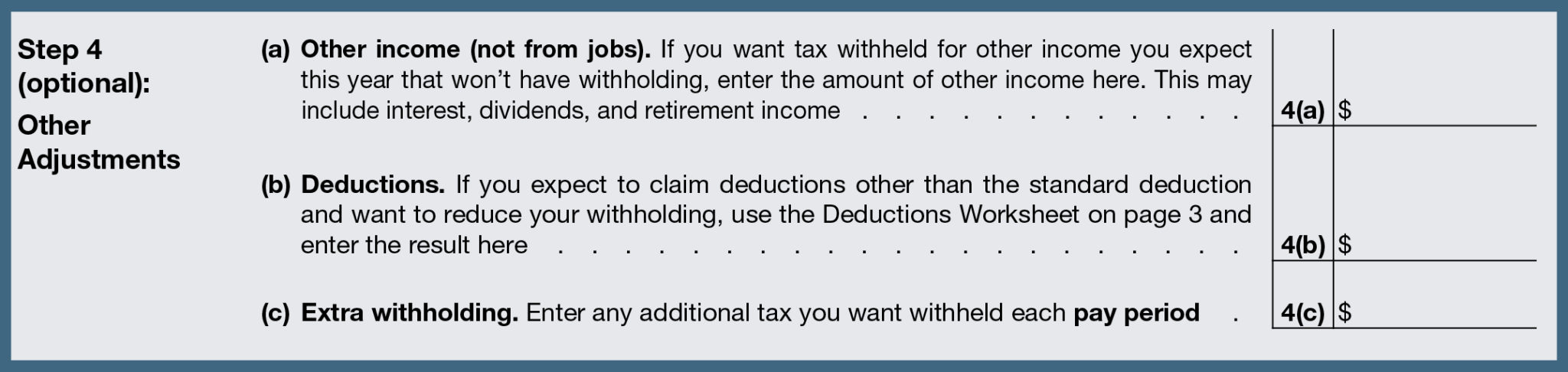

How To Determine Deductions On W4 The amount withheld depends on: the amount of income earned and. three types of information an employee gives to their employer on form w–4, employee's withholding allowance certificate: filing status: either the single rate or the lower married rate. number of withholding allowances claimed: each allowance claimed reduces the amount withheld. Prior to 2020, a withholding allowance was a number on your w 4 form that your employer used to determine how much federal and state income tax to withhold from your paycheck. the more allowances you claimed on your form w 4, the less income tax would be withheld from each paycheck. beginning in 2020, the irs completely reworked form w 4 to. Also, the form w 4 instructions say that when an individual or couple holds multiple jobs at once, the amounts needed on steps 3, 4(a), 4(b), and 4(c) should go on the w 4 associated with the highest paying job; the w 4s for all other jobs should have zeros (or blank) for these four steps, which will result in the standard amount of withholding. Line 4b on w4: you can account for tax credits and deductions. the w 4 form allows you to adjust your withholding to account for certain tax credits and deductions. there are lines on the w 4 form.

Comments are closed.