How Does Refinancing A Mortgage Work

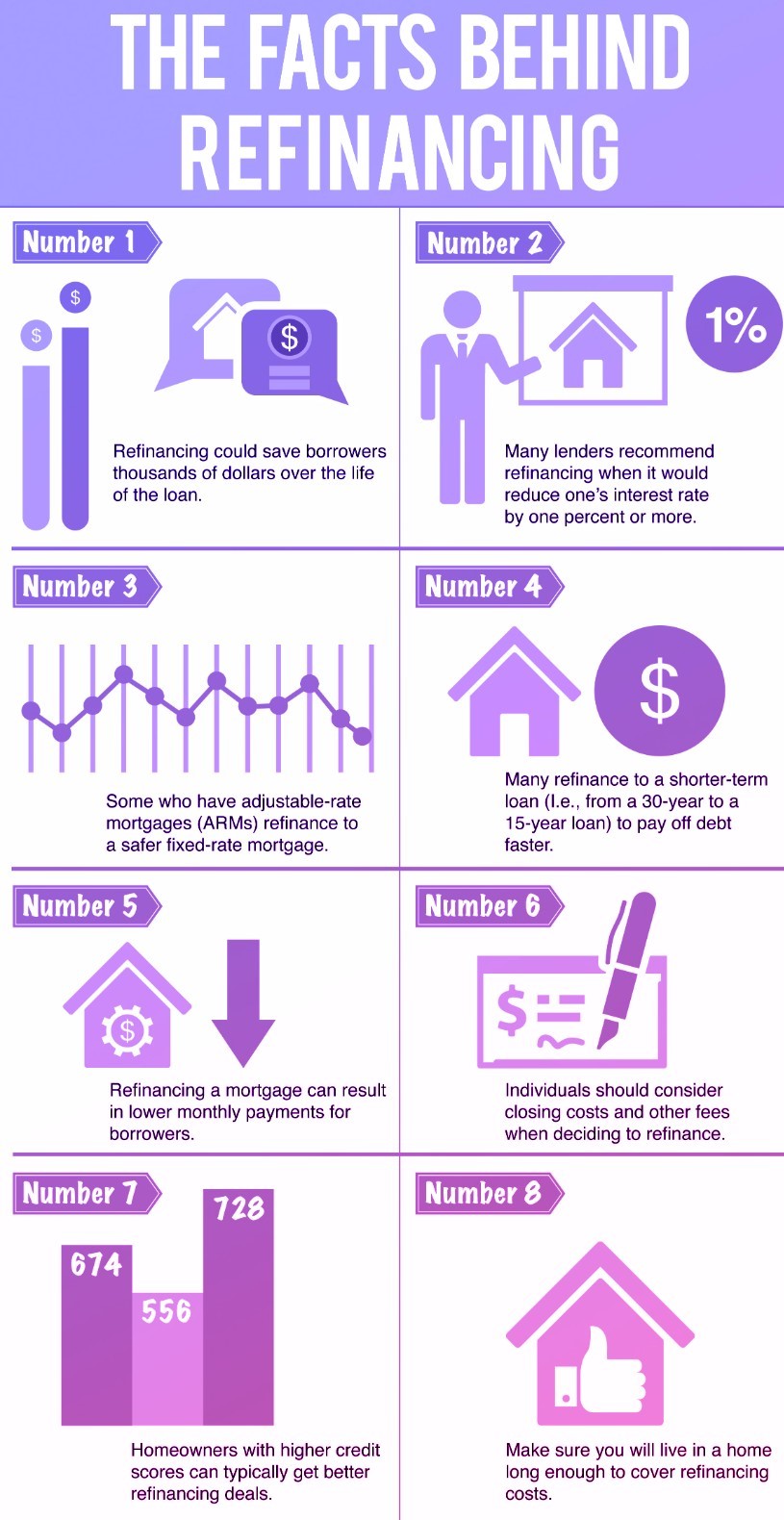

How Does Mortgage Refinancing Work Learn the steps and benefits of refinancing your mortgage, from choosing a refinance type to closing on your new loan. compare different refinance options, interest rates, lenders and costs to find the best deal for you. Learn how to replace your current mortgage with a new one, adjusting the rate, term or both. compare different types of refinancing, such as cash out, no closing cost, reverse and debt consolidation, and their pros and cons.

Mortgage Refinance Everything You Need To Know About It Loanry Refinancing is when you pay off an existing loan with a new loan, often to lower your interest rate, monthly payment or equity. learn about the different types of refinance loans, how to prepare, shop and close your refinance, and how much it costs. Typically, they cost 2% to 6% of your outstanding principal balance. for example: if you still owe $200,000 on your home, expect to pay $4,000 to $12,000 in refinance fees. costs vary by lender. Yes. some common reasons include a lower than expected appraisal value, a change in your credit score or a loan program switch. 4. prepare your home for an appraisal. unless you’re eligible for an appraisal waiver, a licensed real estate appraiser will need to inspect your home to estimate the value. Application fee: $75 to $500. origination fee: 0.5% to 1.5% of your loan amount. credit check fee: about $25. title services: $400 to $900. depending on your lender, you might have the option of a.

Mortgage Refinance Guide When How To Refinance Mint Yes. some common reasons include a lower than expected appraisal value, a change in your credit score or a loan program switch. 4. prepare your home for an appraisal. unless you’re eligible for an appraisal waiver, a licensed real estate appraiser will need to inspect your home to estimate the value. Application fee: $75 to $500. origination fee: 0.5% to 1.5% of your loan amount. credit check fee: about $25. title services: $400 to $900. depending on your lender, you might have the option of a. Learn how to refinance your home loan in five steps, from deciding on the loan type and term to closing on your new loan. find out what documents you need, how to shop for the best rate, and how to lock your interest rate. Apply for the new mortgage. when you've chosen the lender you want to do business with, you can start the application process. applying for refinancing may remind you of what you had to go through.

Comments are closed.