Gold And Silver Overlay Usd Chart 100 Years Gold

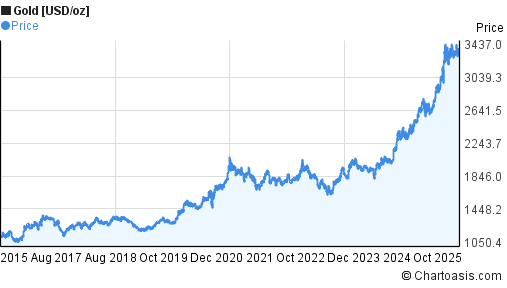

Gold And Silver Overlay Usd Chart 100 Years Gold Will Go To 2 500 The current month is updated on an hourly basis with today's latest value. the current price of gold as of september 18, 2024 is $2,573.75 per ounce. historical chart. 10 year daily chart. by year. by president. by fed chair. by recession. show recessions log scale inflation adjusted. Palladium prices historical chart. this chart compares gold prices and silver prices back to 1915. each series shown is a nominal value to demonstrate the comparison in actual investment returns between each over various periods of time.

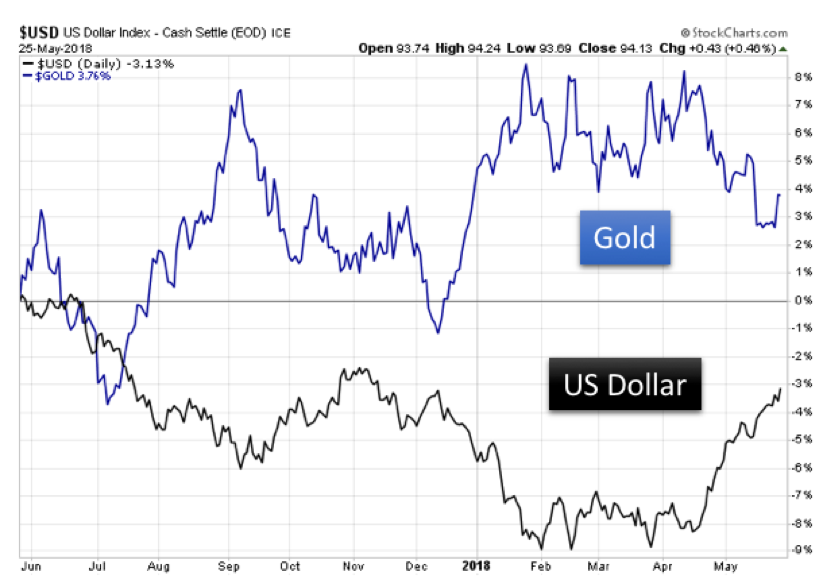

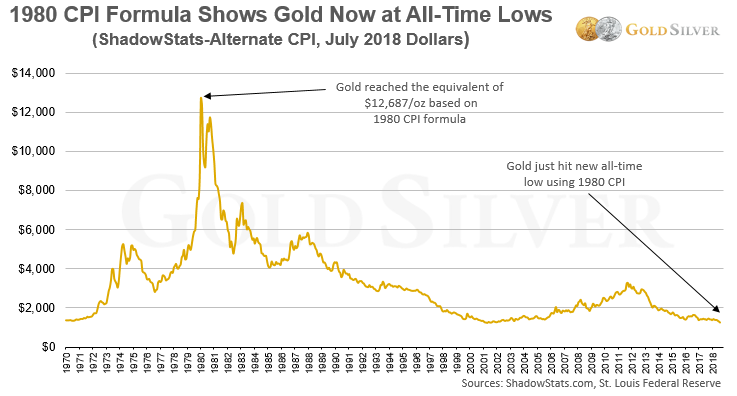

The U S Dollar Vs Gold Seeking Alpha Gold to silver ratio 100 year historical chart. this interactive chart tracks the current and historical ratio of gold prices to silver prices. historical data goes back to 1915. backlinks from other sites are the lifeblood of our site and our primary source of new traffic. if you use our chart images on your site or blog, we ask that you. 1862 16. 1872 16.3. 1874 16.6. the gold to silver spot ratio is a straightforward though relative measurement. it represents the number of silver ounces worth 1 ounce of gold. since the prices of gold and silver can change, the spot ratio indicates the relative worth of these two metals. we grabbed the underlying data for our. Global gold investments. 9440 santa monica blvd suite 301. beverly hills,ca 90210. p 1 888 700 4148. e info@iragoldproof . corporate. office. 3773 howard hughes pkwy ste 500s. las vegas,nv 89169. Gold price chart 100 years – update: june 2024. an even longer historical gold price chart is the one below: the gold price chart over 300 years. this is the longest historical gold price wit some relevance at present day (read: in our modern economic and monetary system). the same conclusions apply as the ones derived from the 100 year gold.

Gold And Silver Overlay Usd Chart 100 Years Gold Will Go To 2 500 Global gold investments. 9440 santa monica blvd suite 301. beverly hills,ca 90210. p 1 888 700 4148. e info@iragoldproof . corporate. office. 3773 howard hughes pkwy ste 500s. las vegas,nv 89169. Gold price chart 100 years – update: june 2024. an even longer historical gold price chart is the one below: the gold price chart over 300 years. this is the longest historical gold price wit some relevance at present day (read: in our modern economic and monetary system). the same conclusions apply as the ones derived from the 100 year gold. The chart at the top of the page allows you to view historical gold prices going back over 40 years. you can view these gold prices in varying currencies as well, seeing how it has performed over a long period of time. depending on the currencies being used, you may find a better long term value. Historical prices of gold and silver. the price of gold today is determined by supply and demand as it is traded through large global markets of physical metals (from raw ore to refined bars and coins), and even contracts for future delivery at a specific price. in the us, a market determined price is a relatively recent phenomenon.

Gold And Silver Overlay Usd Chart 100 Years 1 Year о The chart at the top of the page allows you to view historical gold prices going back over 40 years. you can view these gold prices in varying currencies as well, seeing how it has performed over a long period of time. depending on the currencies being used, you may find a better long term value. Historical prices of gold and silver. the price of gold today is determined by supply and demand as it is traded through large global markets of physical metals (from raw ore to refined bars and coins), and even contracts for future delivery at a specific price. in the us, a market determined price is a relatively recent phenomenon.

Comments are closed.