Fill Form W 4 2024 Online Simplify Tax Withholding Pdfliner

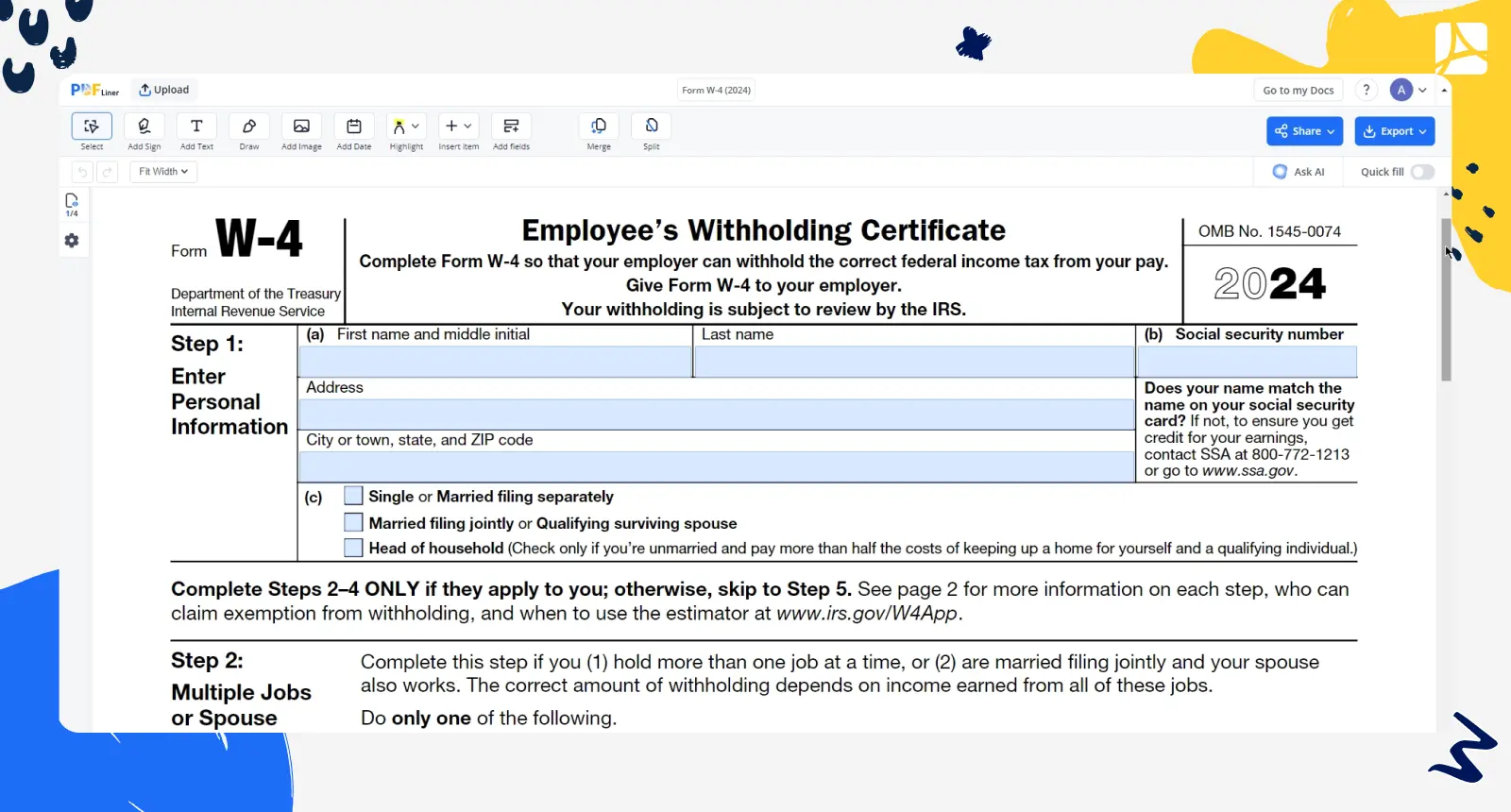

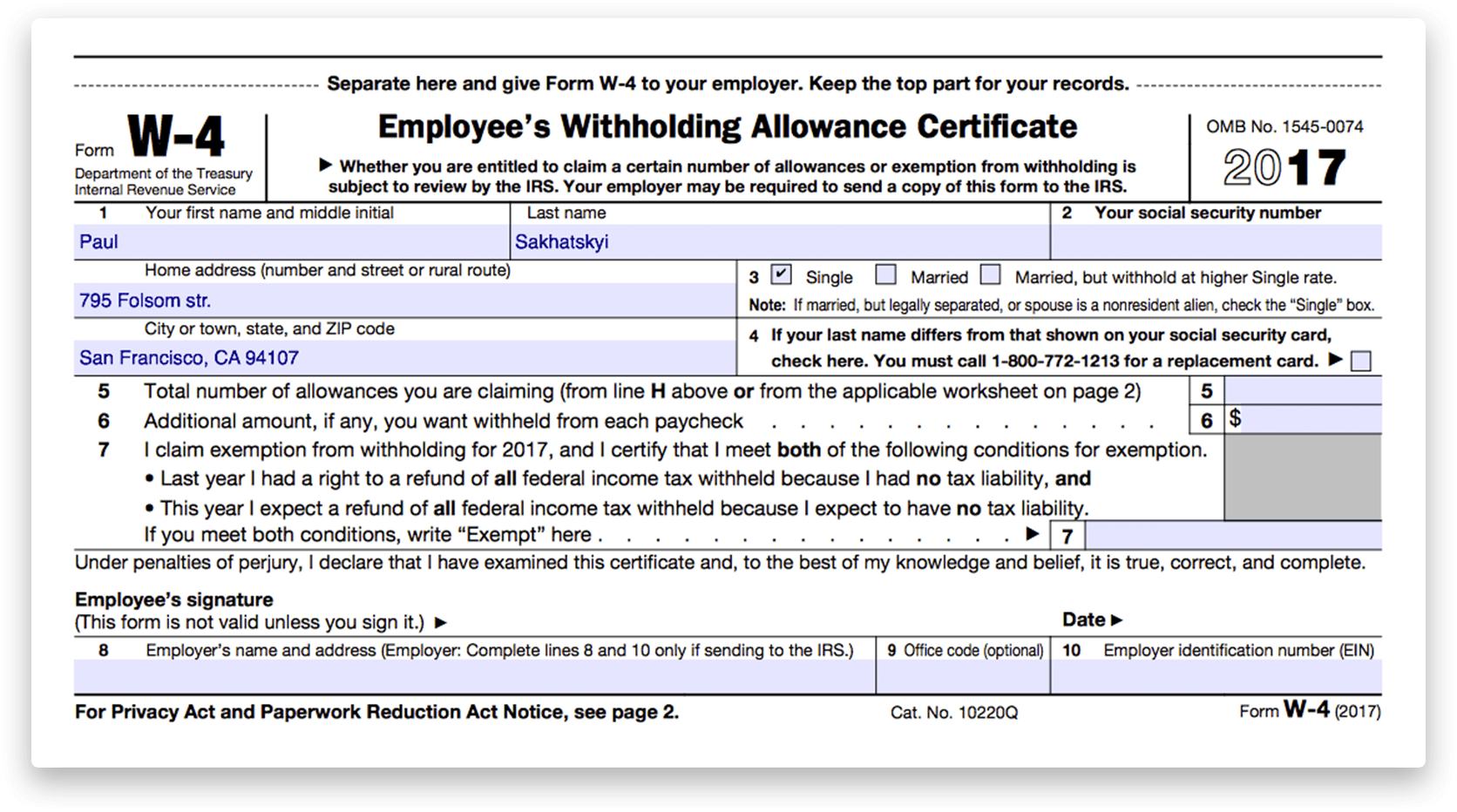

Fill Form W 4 2024 Online Simplify Tax Withholding Pdfliner How to fill out irs form w 4 2024. step 1: take a look at the sample w 4 forms. step 2: open the document with pdfliner by clicking the fill this form button. step 3: follow these guidelines that will lead you through the procedure: answer a few questions to fill out the allowances section. 2024 form w 4. form. w 4. department of the treasury internal revenue service. employee’s withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay. give form w 4 to your employer. your withholding is subject to review by the irs. omb no. 1545 0074.

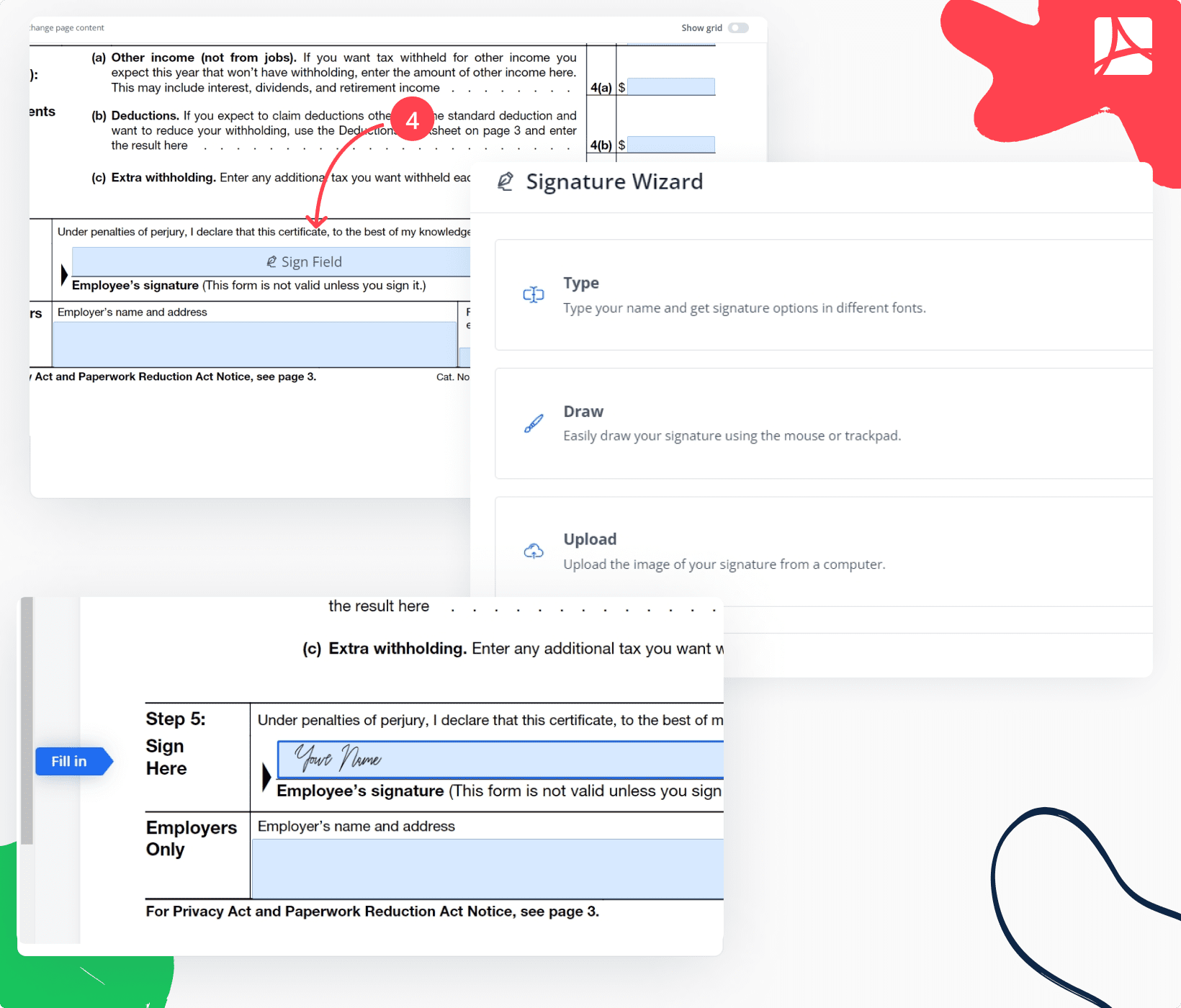

Fill Form W 4 2024 Online Simplify Tax Withholding Pdfliner Form versions. 2022 fillable form w 4sp for 2022 tax year fill out form. 2023 fillable form w 4sp for 2023 tax year fill out form. fill this form. fillable blank form w 4 (sp) fill out and sign the document in a few minutes with pdfliner download printable pdf template or edit online . Create pdf w 9 form (2024) w 2 form 2024 irs form w 9 (2018) form 1099 misc (2024) qualified dividends and capital gain tax worksheet 2023 social security benefits worksheet (2023) 1040 form virginia schedule osc form w 4 (2024) form 1099 g (2021) form 1099 nec (2024) kentucky form 740 (2023) form 1095 a form w 2 (2022) missouri form 5086 secure power of attorney form 941 pennsylvania form. Step 3: make a new signature. there are four ways you can make a signature. you can write your name at the top of the window that will appear, and the editor will create a handwriting copy. if you want, you can also draw a signature (choose “draw”). there is also a possibility to upload a photo of your handwritten signature from a computer. A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax.

2024 W 4 Form Pdf Jeanne Maudie Step 3: make a new signature. there are four ways you can make a signature. you can write your name at the top of the window that will appear, and the editor will create a handwriting copy. if you want, you can also draw a signature (choose “draw”). there is also a possibility to upload a photo of your handwritten signature from a computer. A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

Comments are closed.