Does Refinancing Your Mortgage Impact Credit Scores Equifax

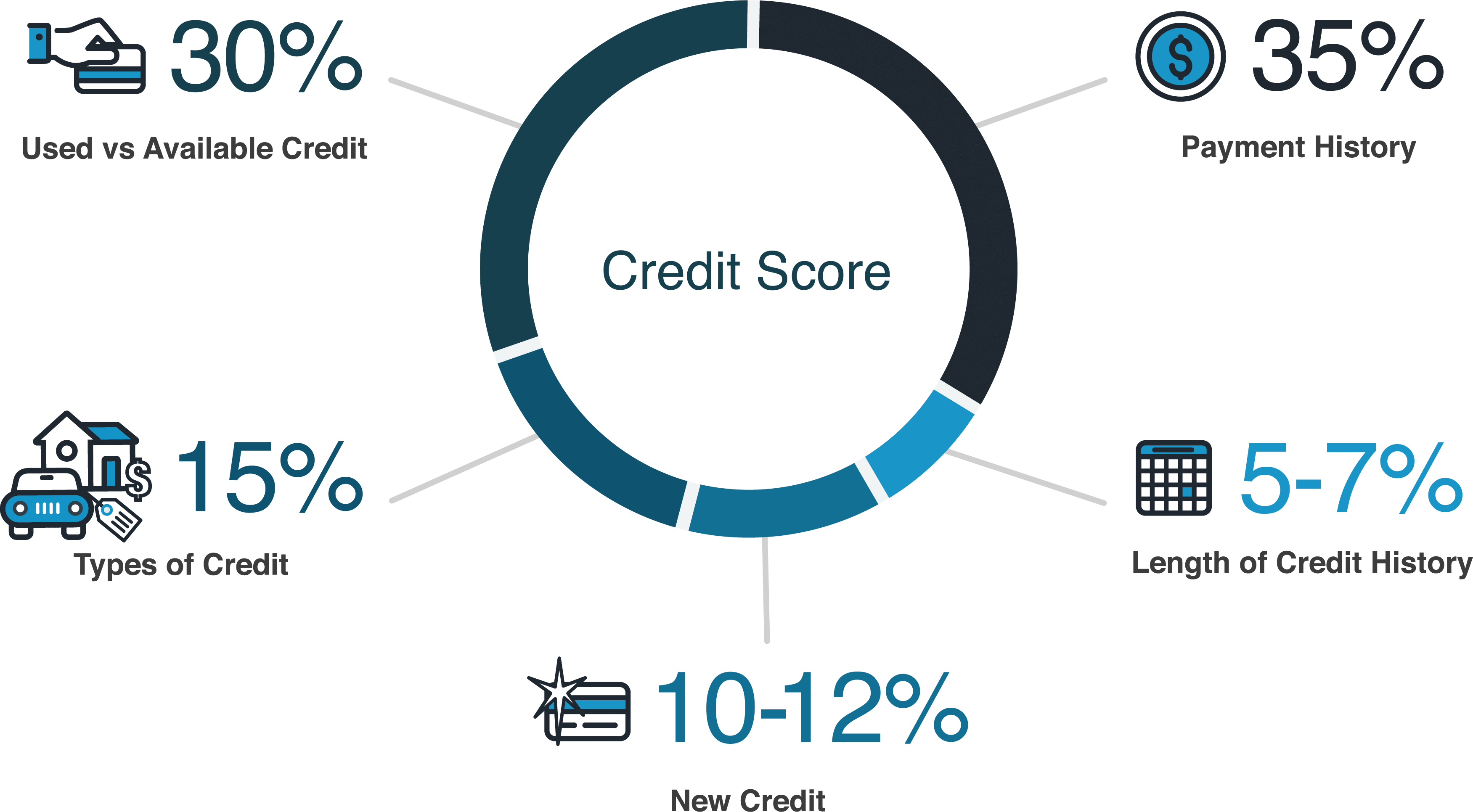

What Affects Credit Scores Infographic Equifaxв However, keep in mind that, despite the benefits of an adjusted loan, a mortgage refinance could have a negative impact on your credit scores. here are three things to know about your credit reports before you begin the refinancing process: 1. a refinance can appear on your credit reports as a new loan. Understanding your credit – your credit scores and credit history are among the factors that may determine your loan terms, including interest rate. it's also important to maintain responsible credit behaviors (e.g. paying your bills on time, using a low percentage of available credit, paying off debts) before you start the refinance process.

Does Refinancing Mortgage Affect Credit Score Mortgageinfoguide Top factors that affect your credit scores. whether you’re interested in building, maintaining or improving your credit, knowing how your scores are calculated and what may have the biggest impact can help you on your journey to financial well being. we worked with fairstone, which offers personal loans and mortgage refinancing to customers. To nab the lowest rate, you’ll need to keep a strong credit score — which actually becomes more challenging after you refinance. that’s because a refi can cause your credit score to drop. With equifax complete tm premier, we monitor your credit report and score to help you spot signs of fraud. and if your identity is stolen, we'll help you recover. understanding credit scores is not as difficult as you may think. this guide from equifax canada tells you five things you need to know about credit scores. We worked with fairstone, which offers personal loans and mortgage refinancing to customers with fair to good credit, to create this quick guide to help you focus on what matters most to your creditworthiness.

How Does Refinancing Affect Your Credit Score Rocket Mortgage With equifax complete tm premier, we monitor your credit report and score to help you spot signs of fraud. and if your identity is stolen, we'll help you recover. understanding credit scores is not as difficult as you may think. this guide from equifax canada tells you five things you need to know about credit scores. We worked with fairstone, which offers personal loans and mortgage refinancing to customers with fair to good credit, to create this quick guide to help you focus on what matters most to your creditworthiness. Keep in mind, however, that refinancing a mortgage does come with closing costs, including an origination fee, appraisal costs, title insurance and credit reporting fees. these costs often add up. You could see a credit score ding when refinancing your mortgage. all 3 of your credit scores may fall temporarily due to a mortgage refinance application; but the impact is usually quite minimal, perhaps only 5 10 points for most consumers; and the effects are often fleeting, with score reversals happening in a month or so.

Comments are closed.