Credit Unions Vs Banks Infographic Credit Unions Vs Ban

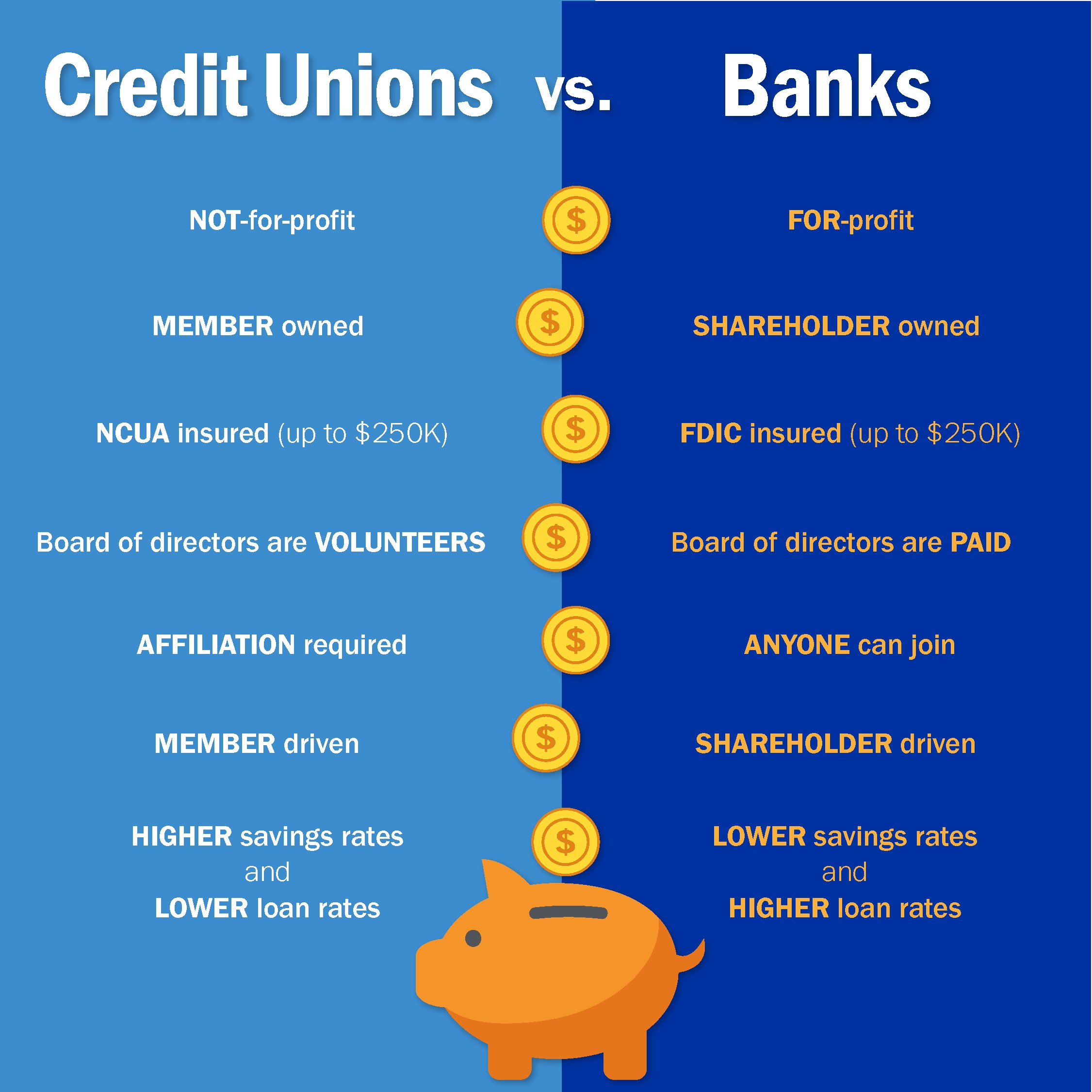

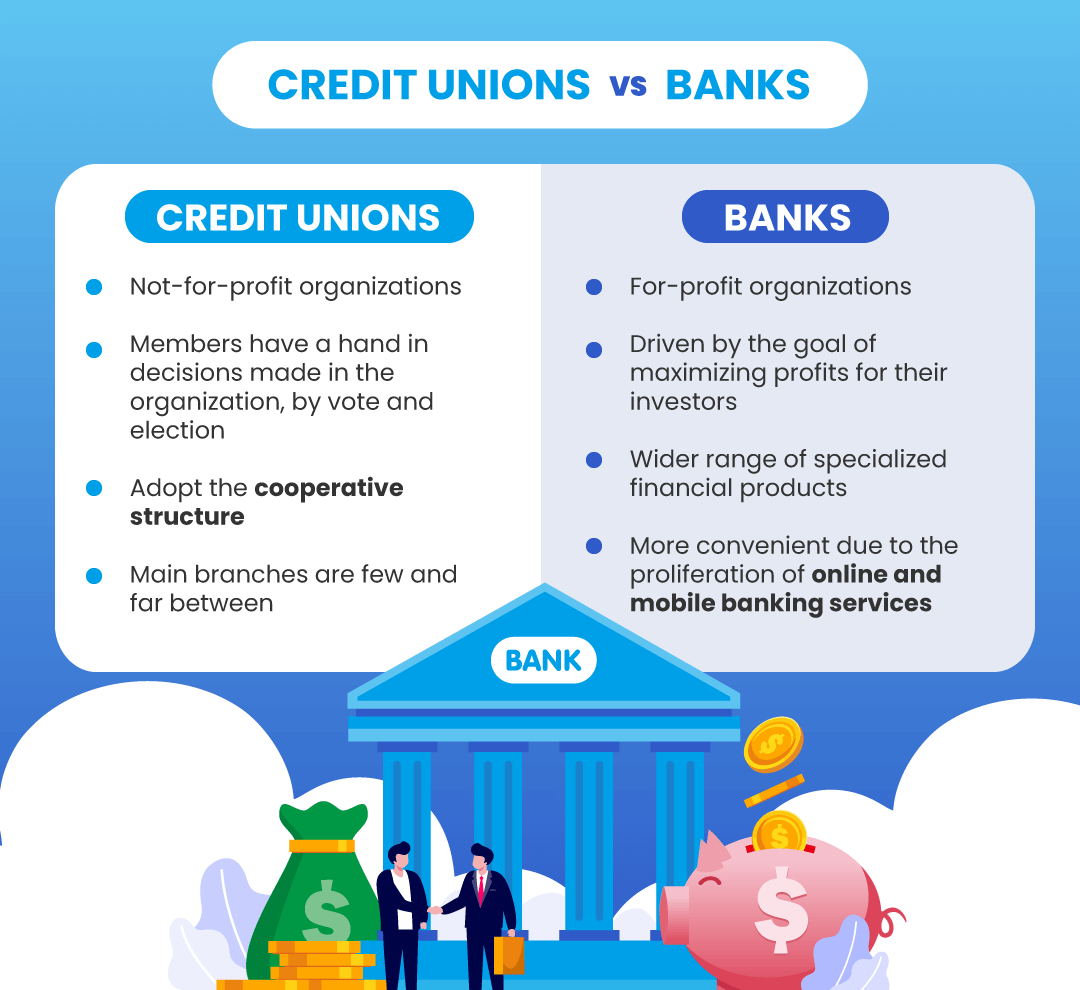

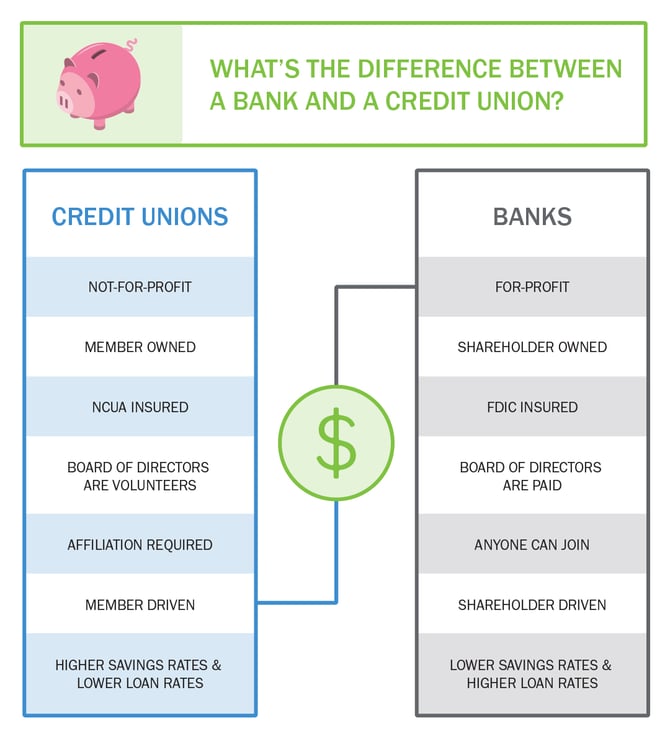

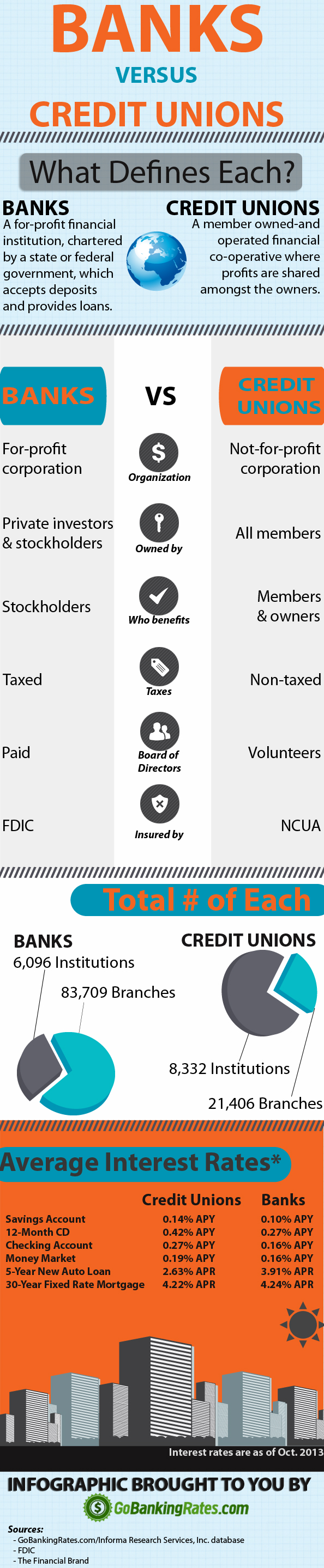

Credit Unions And Banks The Differences Which one is the right place for your money and your business? from maintaining accounts that keep your money safe and help it grow to providing loans and credit cards at the best rates and terms, where you bank matters. this infographic explains the key differences between credit unions and banks so you can decide what’s right for you. While all credit unions and banks may seem similar, there are some key differences to keep in mind when choosing between the two. here’s how banks and credit unions differ, and how they are the same. organizational structure: credit unions are financial cooperatives that are locally owned and controlled by their members.

Credit Union Vs Bank What Are The Differences Azeus Convene Cons. customer service: banks tend to get lower marks for customer service than credit unions, though it’s more of a problem at big banks than smaller ones. lower savings rates: because banks. Key takeaways. the biggest difference between banks and credit unions is that banks are for profit while credit unions are not. banks tend to offer a larger menu of financial products and services, while credit unions focus on quality over quantity. banks tend to charge more and higher fees than credit unions, but credit unions require a. Better rates on savings accounts and loans: credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want. higher interest rates on bank. The main difference between a credit union and a bank is that credit unions are not for profit, whereas banks are for profit enterprises. knowing about the other differences will affect which home.

Banks Vs Credit Unions 5 Things You May Not Know Better rates on savings accounts and loans: credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want. higher interest rates on bank. The main difference between a credit union and a bank is that credit unions are not for profit, whereas banks are for profit enterprises. knowing about the other differences will affect which home. Average credit union vs. bank fees ; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151. The main difference between a bank and a credit union is that one is for profit and the other is not for profit. traditional banks offer more accessibility, technology, and convenience. but because they have a high amount of overhead and a focus on making as much profit as possible, interest rates on loans may be higher.

Credit Unions Vs Banks Things You May Not Know Average credit union vs. bank fees ; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151. The main difference between a bank and a credit union is that one is for profit and the other is not for profit. traditional banks offer more accessibility, technology, and convenience. but because they have a high amount of overhead and a focus on making as much profit as possible, interest rates on loans may be higher.

Banks Vs Credit Unions What S The Difference Gobankingrates

Comments are closed.