Credit Score In Canada What These 3 Digits Say About You

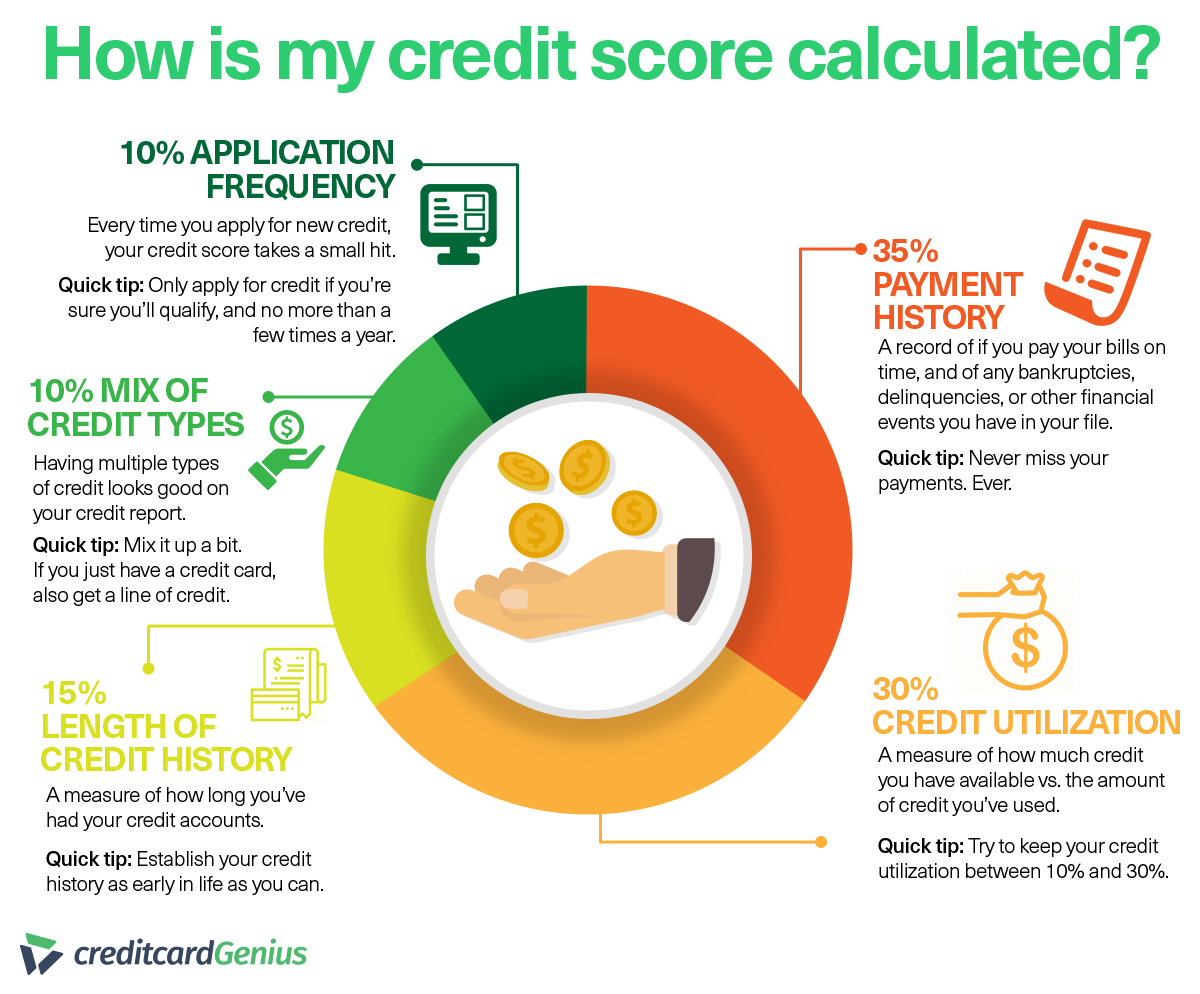

Credit Score In Canada What These 3 Digits Say About You Key takeaways. your credit score is a 3 digit rating of your financial trustworthiness on a scale of 300 – 900. a good credit score in canada (660 ) helps you qualify for better credit products, higher amounts of credit, and lower interest rates. credit bureaus use 5 factors to calculate your credit score: payment history, credit utilization. Credit scores in canada are three digit numbers that range from 300 900, and are rated from poor to excellent. be aware that these websites may send you credit card and loan offers based on.

Credit Score In Canada What These 3 Digits Say About You Your credit score. your credit score is a three digit number that comes from the information in your credit report. it shows how well you manage credit and how risky it would be for a lender to lend you money. your credit score is calculated using a formula based on your credit report. note that you:. Canada operates with a credit score range between 300 and 900. the lower your score, the less likely you are to be approved for a credit card or loan. if you do manage to qualify for a credit card. Edited by. beth buczynski. a credit score is a three digit number that is assigned to you based on your credit report. in canada, credit scores range from 300 to 900. credit scores are used by. Credit scores are generally described using the following ranges: 300 to 574: very poor. 575 to 659: below average or poor. 660 to 712: average or fair. 713 to 740: good or very good. 741 to 900.

Comments are closed.