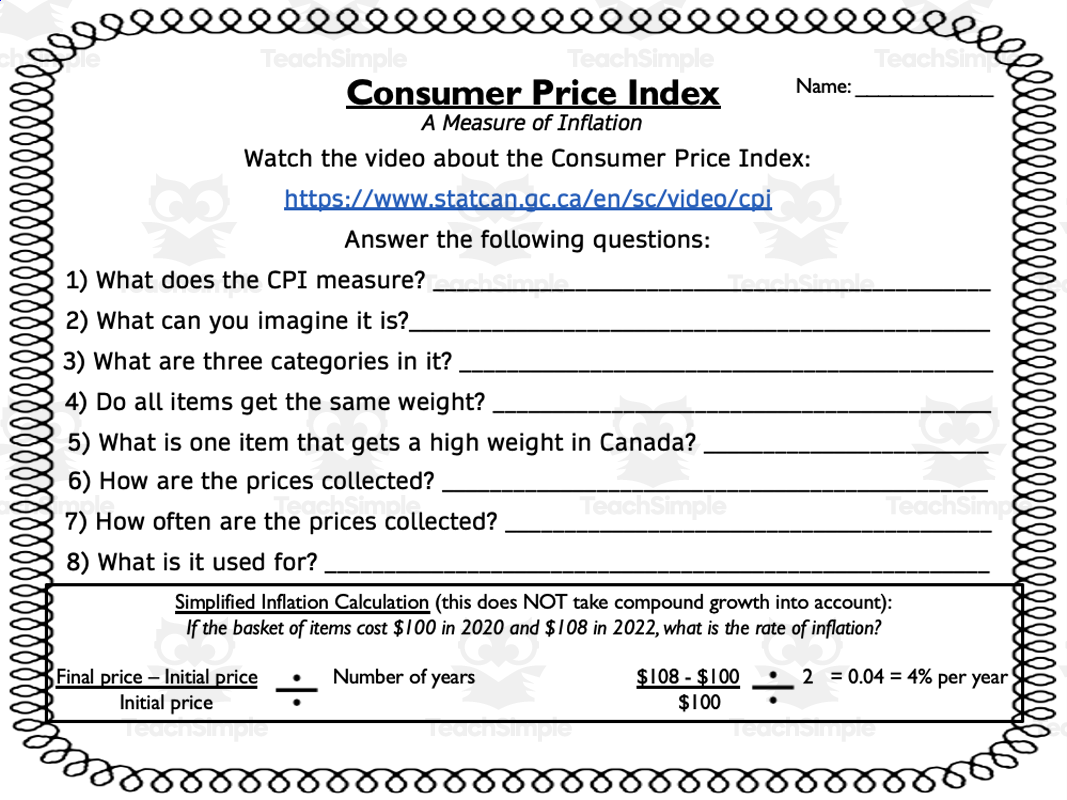

Consumer Price Index Cpi A Measure Of Inflation Financial Literacy

Consumer Price Index Cpi A Measure Of Inflation Financial Literacy Price index. a target low inflation rate is considered somewhere around. 2% 6%. inflationary price changes do not: account for the evolutionary advances of manufacturing and technology. inflation. a wide ranging rise in the price of goods and services over a period of time. monetary policy. The consumer price index is a widely quoted monthly reading of changes in the cost of living for american consumers. it is the key measure of inflation used by policymakers and investors to make.

Consumer Price Index Cpi A Measure Of Inflation Financial Literacy The consumer price index (cpi) measures the monthly change in prices paid by u.s. consumers. the bureau of labor statistics (bls) calculates the cpi as a weighted average of prices for a basket of. Consumer price data. the two most widely followed measures of consumer prices in the united states are the consumer price index (cpi) and the personal consumption expenditures (pce) price index. we discuss these indexes in detail below. in addition, our inflation 101 section provides explanations of many related concepts, such as aggregate and. The current cost of the basket is compared to its cost in the prior year, and then multiplied by 100 to determine the percentage. annual cpi = (value of basket in current year value of basket in. The consumer price index is calculated by measuring the price in one period for a fixed basket of consumer goods and services compared to previous periods. inflation is a rise in the general level.

Comments are closed.