Budgeting Differentiating Between Needs And Wants For Smart Money

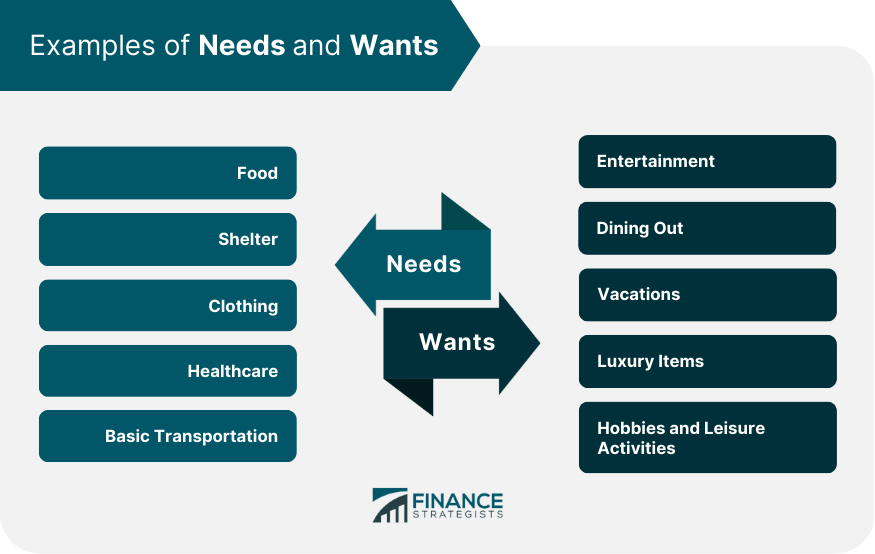

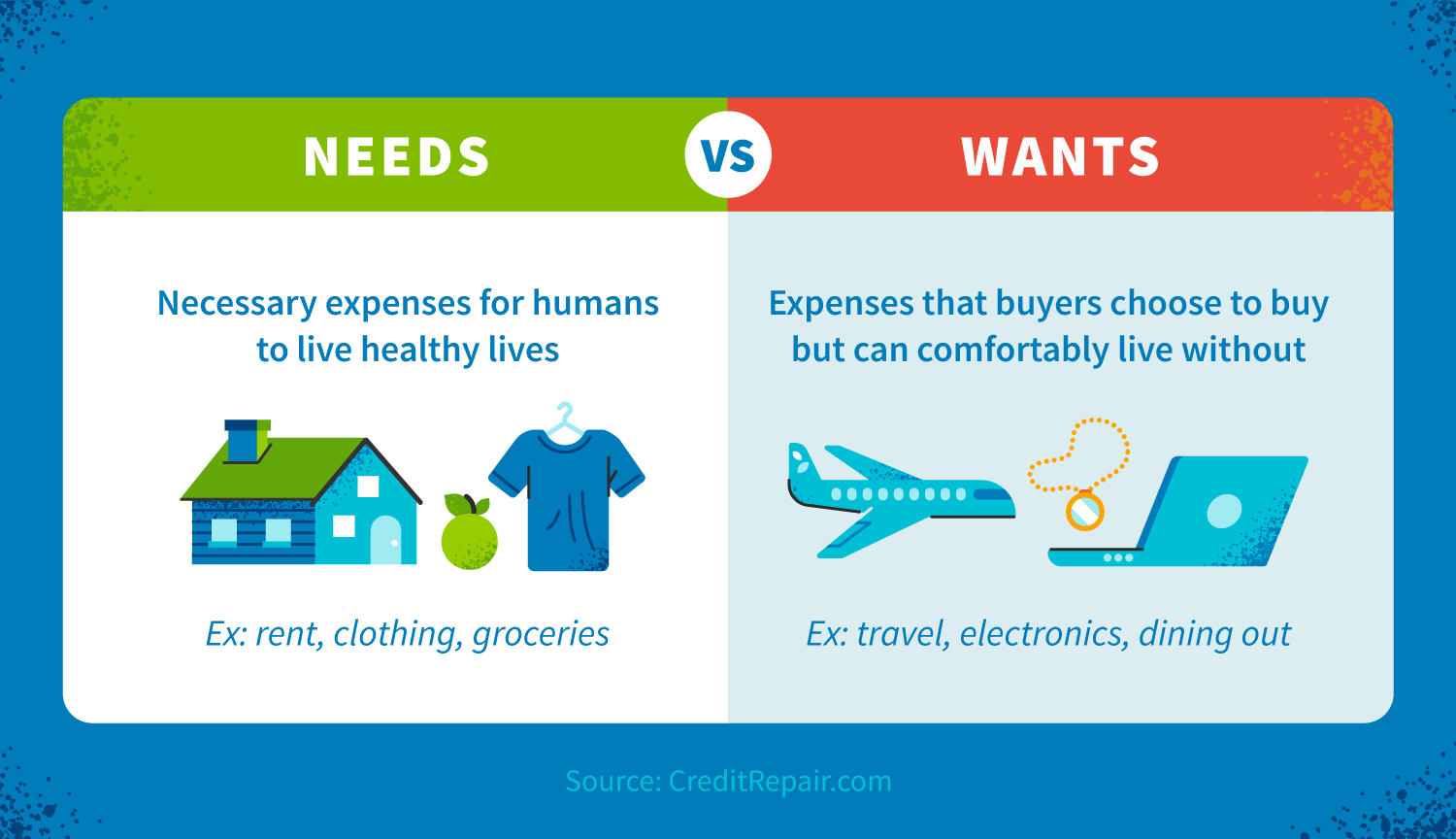

Budgeting Needs Vs Wants A How To Guide Budgeting needs and wants: identifying needs essentials for survival. when it comes to differentiating between needs and wants for smart money management, it is important to prioritize essentials for survival. these include housing and utilities, food and groceries, and transportation. Written by sam lipscomb, cepf®. when setting a budget, it’s important to differentiate between what you need and what you want. indeed, many budgeting systems ask you to assign percentages to your needs and wants. for instance, the 50 30 20 budget popularized by elizabeth warren recommends putting 50% of your budget to “needs” and 30% to.

Budgeting Needs Vs Wants Overview Practical Tips At nerdwallet, we recommend the 50 30 20 budget. if you distribute your monthly income in this fashion, you would spend 50% on needs, 30% on wants and 20% on savings and paying off debt. plug your. To differentiate between needs and wants in budgeting, you need to evaluate each expense and determine whether it is essential or non essential. needs are the expenses that you must pay for to survive and maintain a basic standard of living, while wants are the expenses that you can live without. you can use a needs vs. wants worksheet to help. Generally speaking, i would suggest that needs should take up at least 50% of your budget, while wants should take up no more than 30%. this will help ensure that you are able to meet your. If you don’t have enough money to cover everything, cut some spending (starting with wants!) or increase your income (hello, side hustle). hopefully all those needs vs. wants examples and explanations have cleared up any confusion between the two. now you can get your budget in priority order. and if you need a budget, check out everydollar!.

Needs Vs Wants Must Know Differences Creditrepair Generally speaking, i would suggest that needs should take up at least 50% of your budget, while wants should take up no more than 30%. this will help ensure that you are able to meet your. If you don’t have enough money to cover everything, cut some spending (starting with wants!) or increase your income (hello, side hustle). hopefully all those needs vs. wants examples and explanations have cleared up any confusion between the two. now you can get your budget in priority order. and if you need a budget, check out everydollar!. The 50 30 20 rule is a simple guideline for managing your finances: allocate 50% of your income to essential needs. dedicate 30% of your income to wants and discretionary spending. set aside 20% of your income for savings, investments, and debt repayment. this rule can be adjusted according to your personal circumstances and priorities, but it. Really.) learning to differentiate needs from wants helps you make smarter money decisions, use your resources wisely, and avoid unnecessary spending. it's all about creating a balanced budget that covers the essentials but still leaves room for some of life’s greatest pleasures. so, let's figure out needs vs wants.

Budgeting Differentiating Between Needs And Wants For Smart Money The 50 30 20 rule is a simple guideline for managing your finances: allocate 50% of your income to essential needs. dedicate 30% of your income to wants and discretionary spending. set aside 20% of your income for savings, investments, and debt repayment. this rule can be adjusted according to your personal circumstances and priorities, but it. Really.) learning to differentiate needs from wants helps you make smarter money decisions, use your resources wisely, and avoid unnecessary spending. it's all about creating a balanced budget that covers the essentials but still leaves room for some of life’s greatest pleasures. so, let's figure out needs vs wants.

Comments are closed.