Budgeting A Key To Smart Money Management

Smart Money Management Tips A Comprehensive Guide To Financial Success See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. Fidelity research shows that sticking to the 50 15 5 budget can help you maintain financial stability now—and down the road. 6. cut yourself some slack. a budget is supposed to make you aware of your spending habits—not make you miserable. avoid shooting for unrealistic spending limits or monthly savings goals.

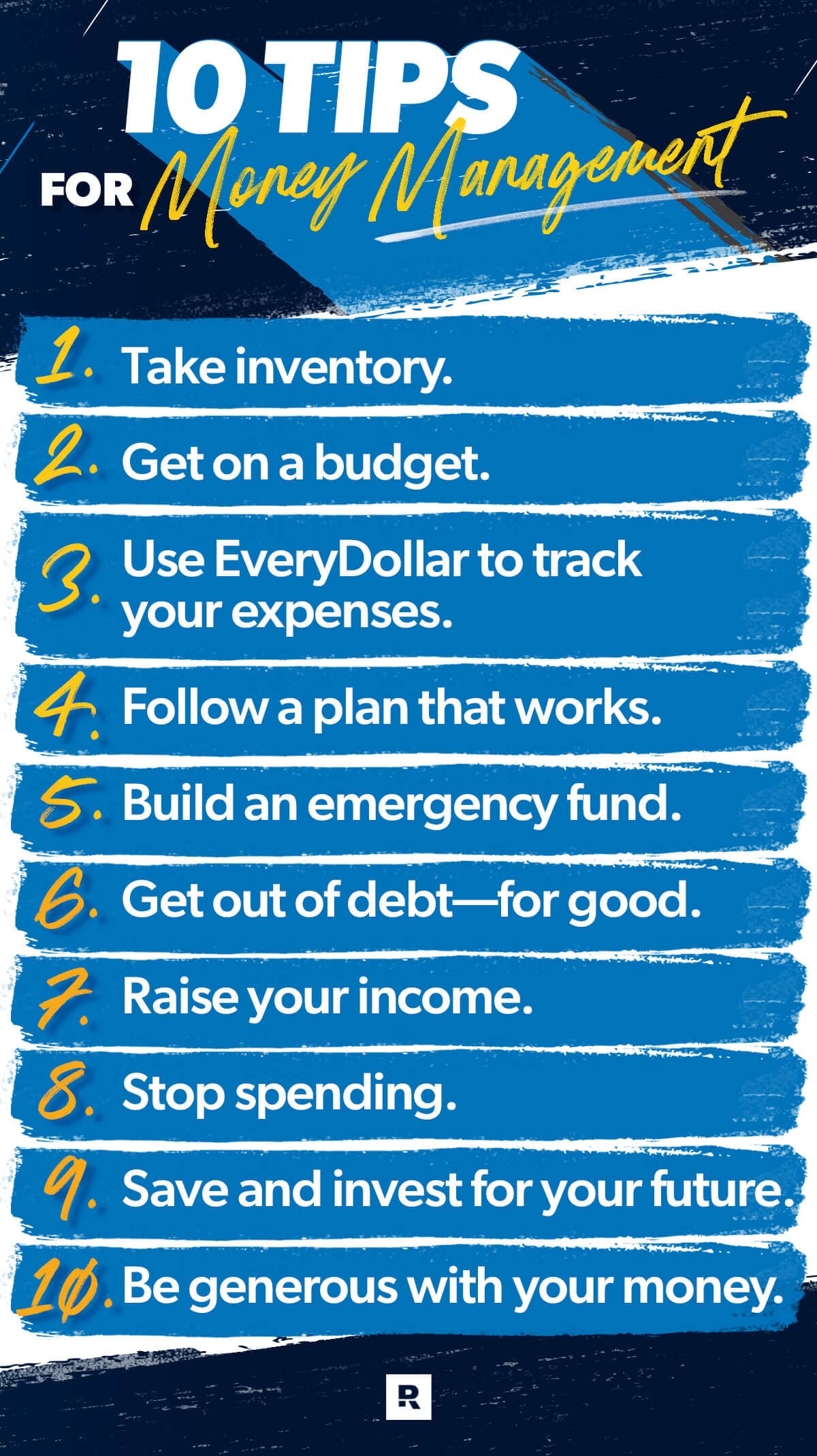

Financial And Budgeting Apps The Key To Smart Money Management 1. take financial inventory. the first step to managing money is knowing what you’re dealing with. that’s right, it’s time to be brave and look in the financial mirror. start by logging in to any financial accounts you have (bank accounts, credit card accounts, student loan accounts). When budgeting with a partner, discuss the details together to ensure you’re on the same page. 2. use empowering language. the term “budget” can be off putting. “people resist it because. 1. set goals. one great place to start your budgeting process: set goals to give yourself something concrete to work toward. your financial goals could be long term, like saving for a house, college education or retirement. they could also be short term, like putting money aside for a dream vacation. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money.

Budget And Money Management 1. set goals. one great place to start your budgeting process: set goals to give yourself something concrete to work toward. your financial goals could be long term, like saving for a house, college education or retirement. they could also be short term, like putting money aside for a dream vacation. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. 15 budgeting tips. 1. budget to zero before the month begins. this means before the month even starts, you’re making a plan and giving every dollar a name. this is what we call a zero based budget. now that doesn’t mean you have zero dollars in your bank account. (leave a buffer of a few hundred dollars.). The money smart for adults instructor led curriculum provides participants with practical knowledge, skills building opportunities, and resources they can use to manage their finances with confidence. instructors can use it to deliver unbiased, relevant, and accurate financial education whether they are new to training or experienced trainers.

Comments are closed.