Banks Vs Credit Unions 5 Things You May Not Know

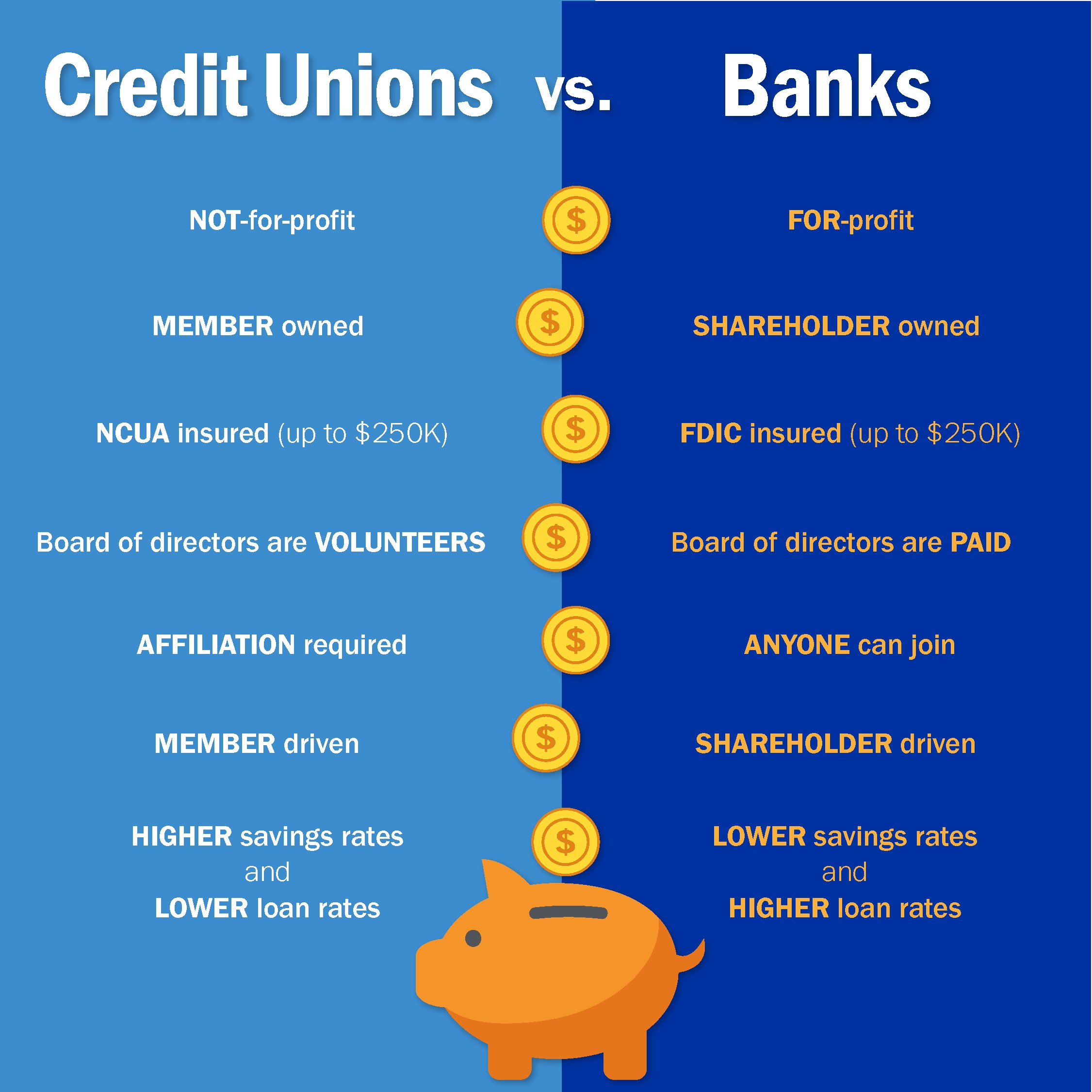

Banks Vs Credit Unions 5 Things You May Not Know Federal deposit insurance corp. (fdic) insures up to $250,000 per depositor, per insured bank, per account ownership category. (learn more about the fdic insurance limit.). While credit unions may have better mortgage rates than banks, there can be downsides to a mortgage with a credit union. for example, credit unions may not have as flexible prepayment terms as the banks. make sure to get clarification before signing on the dotted line.

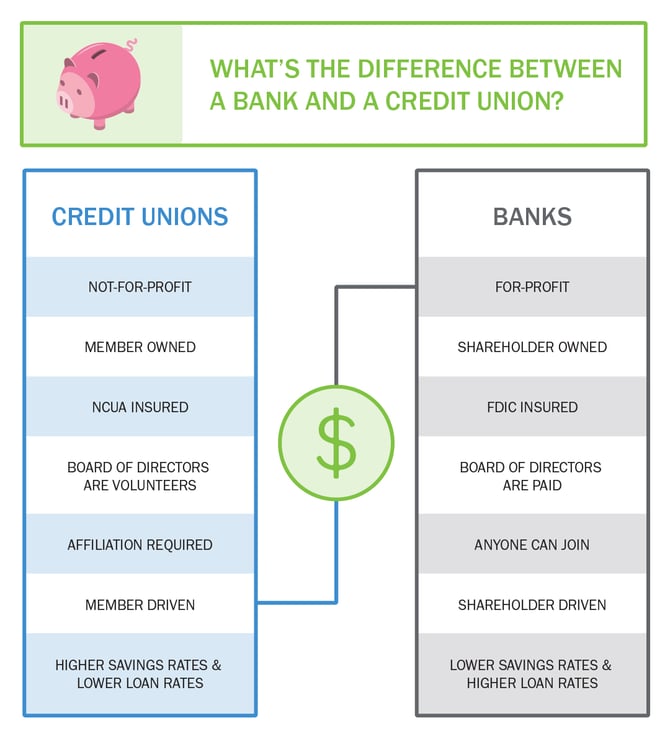

Credit Unions Vs Banks Things You May Not Know Key takeaways. the biggest difference between banks and credit unions is that banks are for profit while credit unions are not. banks tend to offer a larger menu of financial products and services, while credit unions focus on quality over quantity. banks tend to charge more and higher fees than credit unions, but credit unions require a. A credit union is very similar to a bank, in that it offers many of the same financial services. but credit unions have one big difference from banks. "credit unions are the non profit version of. Banks vs. credit unions: how they operate. a credit union is a not for profit financial institution owned cooperatively by its members. a bank, on the other hand, is a for profit company that is. Pros of credit unions. lower fees: credit union products may come at a lower price than what banks offer and some credit unions even waive certain fees on bank accounts and credit cards.

Credit Unions And Banks The Differences Banks vs. credit unions: how they operate. a credit union is a not for profit financial institution owned cooperatively by its members. a bank, on the other hand, is a for profit company that is. Pros of credit unions. lower fees: credit union products may come at a lower price than what banks offer and some credit unions even waive certain fees on bank accounts and credit cards. The key difference between banks and credit unions lies in their profit structure. banks are privately run or owned by shareholders and their main operational goal is to maximize profits. conversely, credit unions are cooperatives that are owned by their members and operate as not for profit organizations. banks want to maximize shareholder. The main difference between a bank and a credit union is that one is for profit and the other is not for profit. traditional banks offer more accessibility, technology, and convenience. but because they have a high amount of overhead and a focus on making as much profit as possible, interest rates on loans may be higher.

Credit Unions Vs Banks Things You May Not Know The key difference between banks and credit unions lies in their profit structure. banks are privately run or owned by shareholders and their main operational goal is to maximize profits. conversely, credit unions are cooperatives that are owned by their members and operate as not for profit organizations. banks want to maximize shareholder. The main difference between a bank and a credit union is that one is for profit and the other is not for profit. traditional banks offer more accessibility, technology, and convenience. but because they have a high amount of overhead and a focus on making as much profit as possible, interest rates on loans may be higher.

Comments are closed.