An Introduction To Stablecoins вђ Everything Explained The Chart Guru

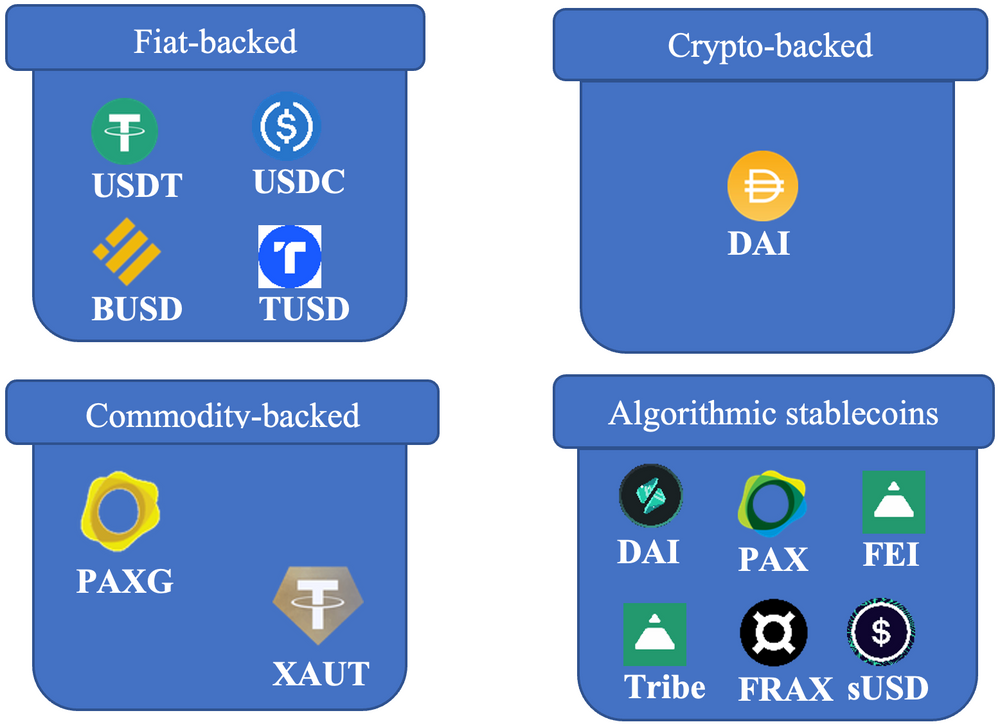

An Introduction To Stablecoins вђ Everything Explained The Chart Gu Stablecoins are designed to have a stable financial value. they are mostly pegged to a fiat currency, like the us dollar. some benefits include stability, transparency, efficiency, accessibility, and decentralization. there are several types of stablecoins: collateralized, algorithmic, hybrid, and more. The most popular stablecoins today are cryptocurrencies whose value are pegged to a unit of another local fiat currency most commonly the us dollar. these tokens are fully backed 1:1 by their underlying assets. there are also stablecoins which are pegged to other currencies like the euro, pound or korean won as well as commodities like gold.

An Introduction To Stablecoins A “ stablecoin ” is a type of cryptocurrency whose value is pegged to another asset class, such as a fiat currency or gold, to stabilize its price. here's why stablecoins are useful to crypto. Stablecoins are a class of cryptocurrencies that attempt to offer investors price stability either by being backed by specific assets or using algorithms to adjust their supply based on demand. You can think of an algorithmic stablecoin as a bucket of water left outside with a water level marked on the inside. to keep the water inside the bucket at exactly the same level, you set up a. A stablecoin is a cryptocurrency whose value is pegged to the price of another asset, hence the term “stable.”. for example, if functioning correctly a stablecoin pegged to the u.s. dollar.

An Introduction To Stablecoins вђ Global X Etfs You can think of an algorithmic stablecoin as a bucket of water left outside with a water level marked on the inside. to keep the water inside the bucket at exactly the same level, you set up a. A stablecoin is a cryptocurrency whose value is pegged to the price of another asset, hence the term “stable.”. for example, if functioning correctly a stablecoin pegged to the u.s. dollar. Stablecoins have exploded in popularity since the start of the decade, helping to fuel the cryptocurrency industry’s growth and push new use cases for digital assets. many pundits believe that it is the ubiquity and versatility of stablecoins that is in fact driving the ascent of assets like bitcoin, as it allows investors to convert fiat to their equivalent value in digital assets, earn. Stablecoins are cryptocurrencies whose values are tied to those of real word assets such as the u.s. dollar. they were developed in part as a response to the price volatility experienced by.

Comments are closed.